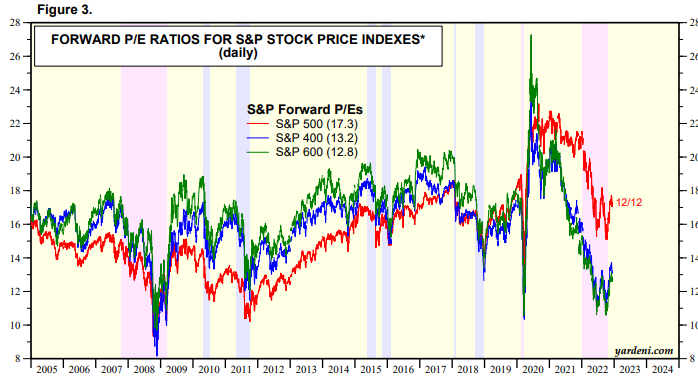

Next days will give us more insight, but a day like today, where inflation comes in lower and we sell off shows me that the narrative could be shifting from a focus on inflation to the incoming recession/EPS crunch.

I do not want to speak too quickly either, because despite the seemingly negative action, we have consistently put in higher highs and lows so far since mid october.

The issues stems from good news becoming neutral.

The issues stems from good news becoming neutral.

If lower inflation and pivot linked easing can not give us a bid, we do not have a catalyst left.

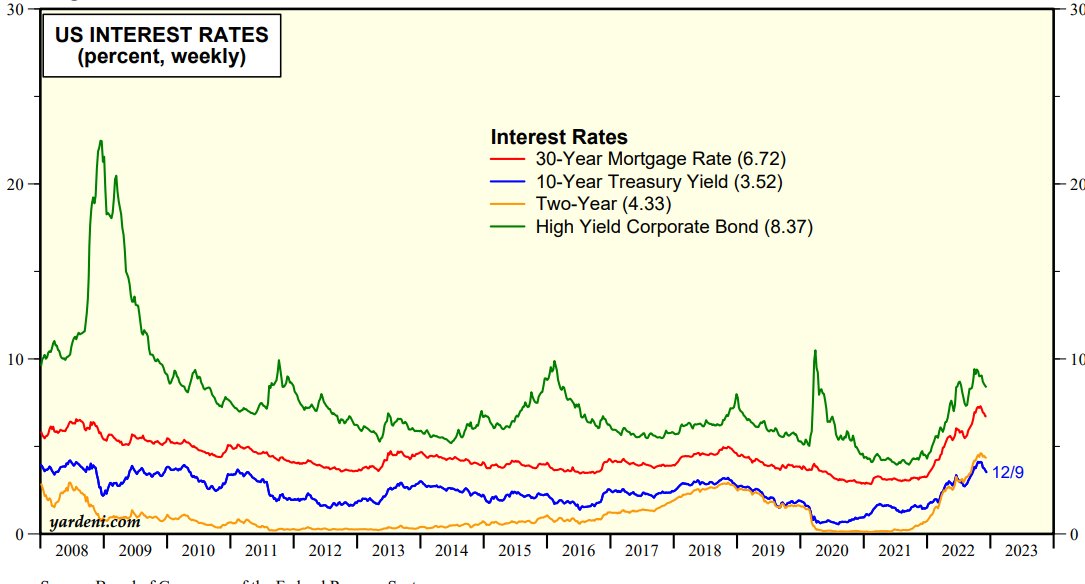

However I will say that the inflation easing will lead to lower bond yields and thus will allow for risk assets to stabilize no matter what.

However I will say that the inflation easing will lead to lower bond yields and thus will allow for risk assets to stabilize no matter what.

Loading suggestions...