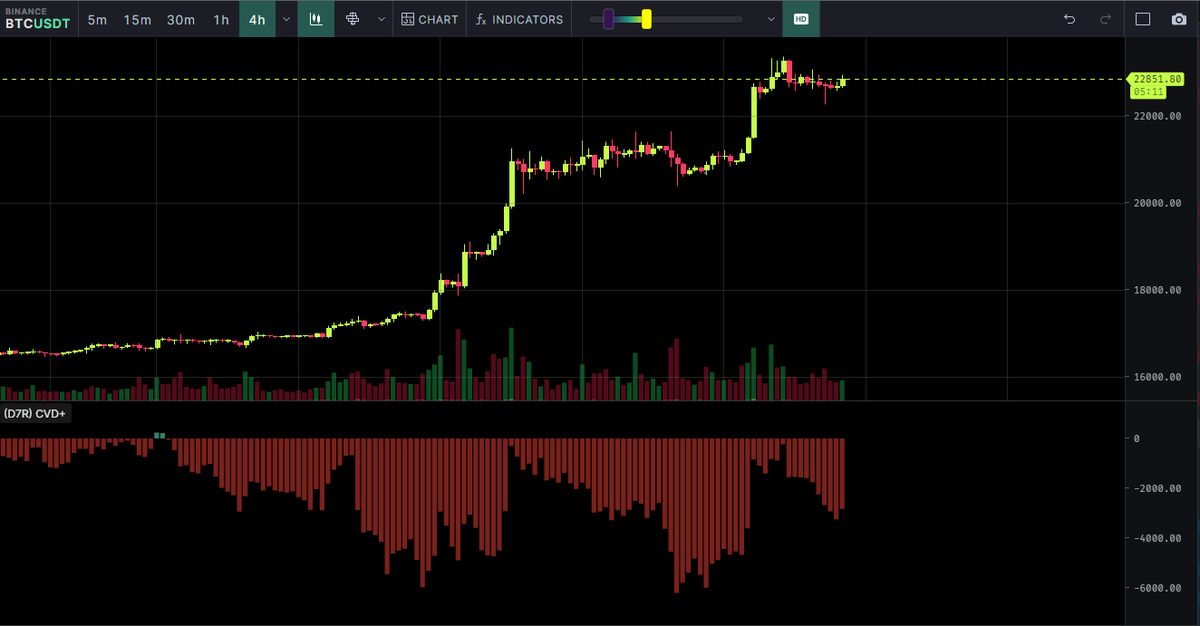

When CVD is positive, it means that buying volume is greater than selling volume. This is a bullish signal and suggests that the price of the crypto is likely to rise.

When negative, it means that selling volume is greater than buying volume. This is often a bearish sign.

2/6

When negative, it means that selling volume is greater than buying volume. This is often a bearish sign.

2/6

2. If you see CVD very one sided and with that, open interest going up it can indicate a lot of crowding into that side of the trade.

Be careful if this happens, especially if the spot pair is showing the opposite as it could mean a squeeze is on the table.

4/6

Be careful if this happens, especially if the spot pair is showing the opposite as it could mean a squeeze is on the table.

4/6

CVD can also be used to identify key support and resistance levels. If buying volume is strong at a certain price level, it suggests that buyers are willing to step in at that level, which can act as support.

5/6

5/6

When used correctly, CVD can be a valuable tool to give insight into what is happening and where. I mostly use it in combination with open interest and funding rates to identify potential long or short crowding.

6/6

6/6

Loading suggestions...