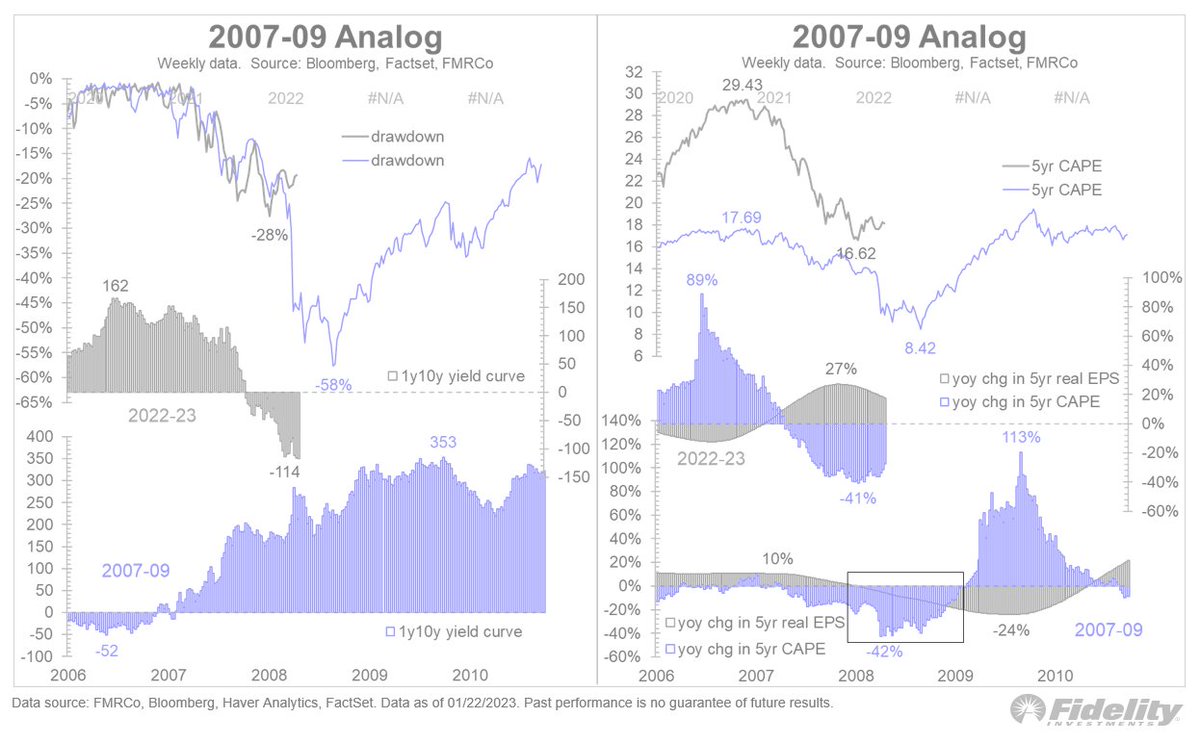

This was a double whammy of declining earnings and contracting multiples, both happening concurrently. This is highlighted in the box at the bottom right. It is literally the worst-case outcome, and it produced a 57% decline. /2

The price analog is a little scary to say the least, and hopefully the similarities end here. If they don’t, earnings would have to fall off a cliff right about now. /3

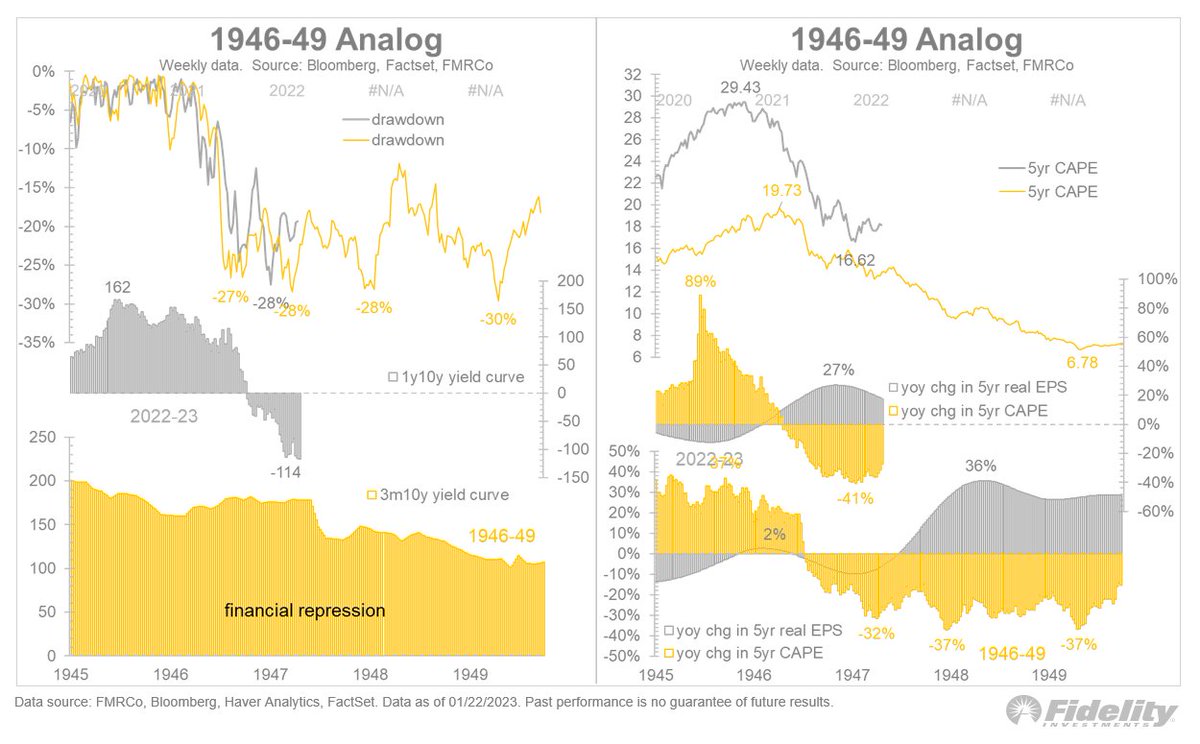

As good as the 1946-49 price analog has been, an imminent acceleration in earnings growth offset by more derating seems like an unlikely outcome for this cycle. /5

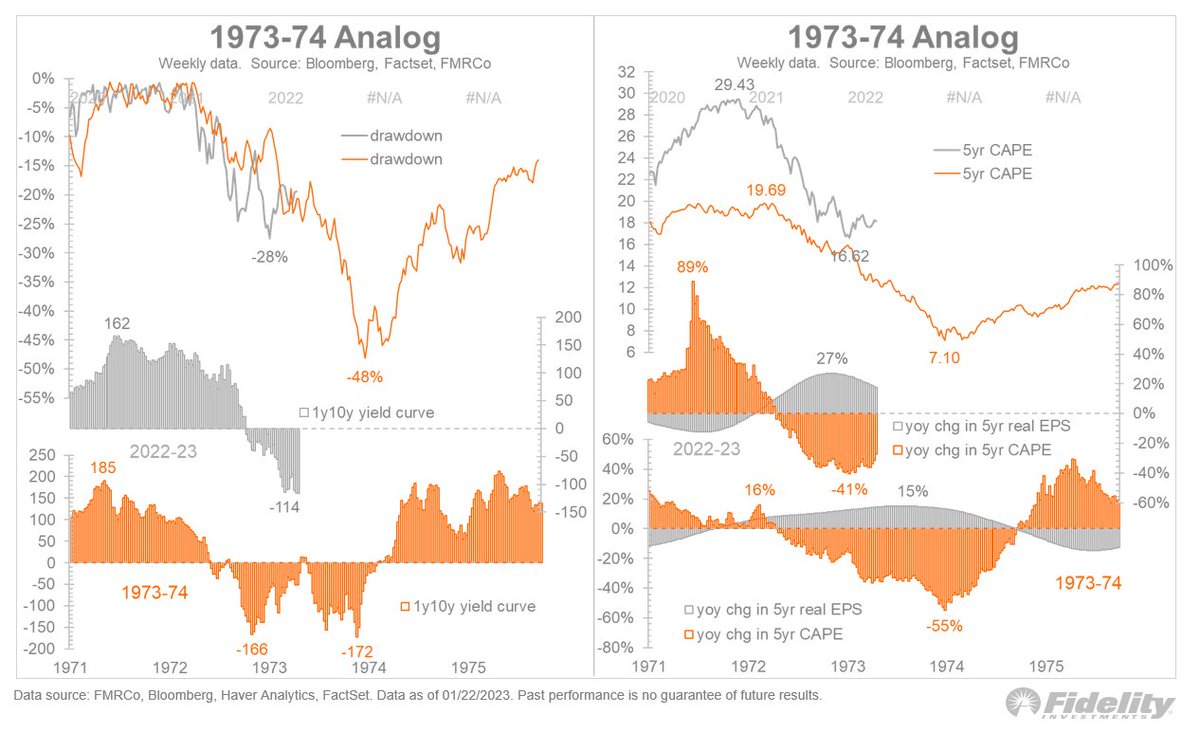

Then the Fed stopped tightening, the market bottomed, and earnings peaked. Sound familiar? Last year’s decline was "only" 28% (compared 47% then), but the unusual timing of earnings peaking at the bottom raises the possibility that 2022 could end up being a mini-1974. /7

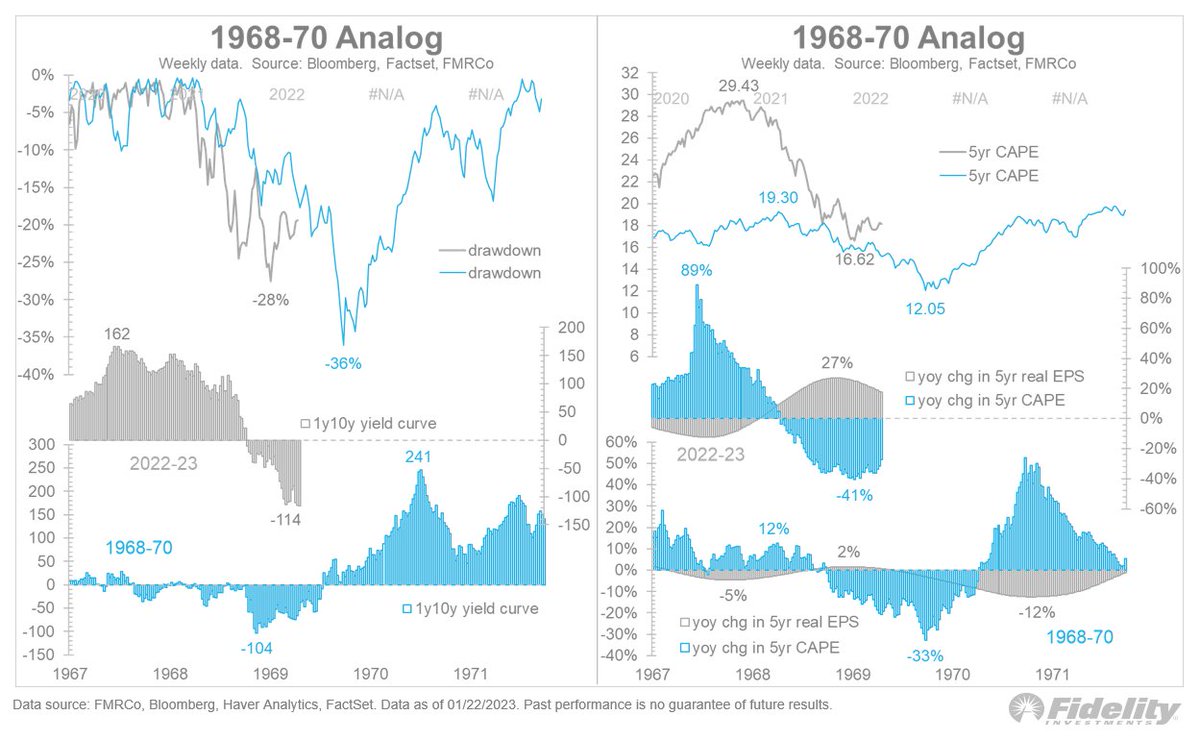

There was a 36% drawdown in 1968-70, ultimately led by a concurrent decline in both EPS and valuation. It was basically a smaller version of 1974. /9

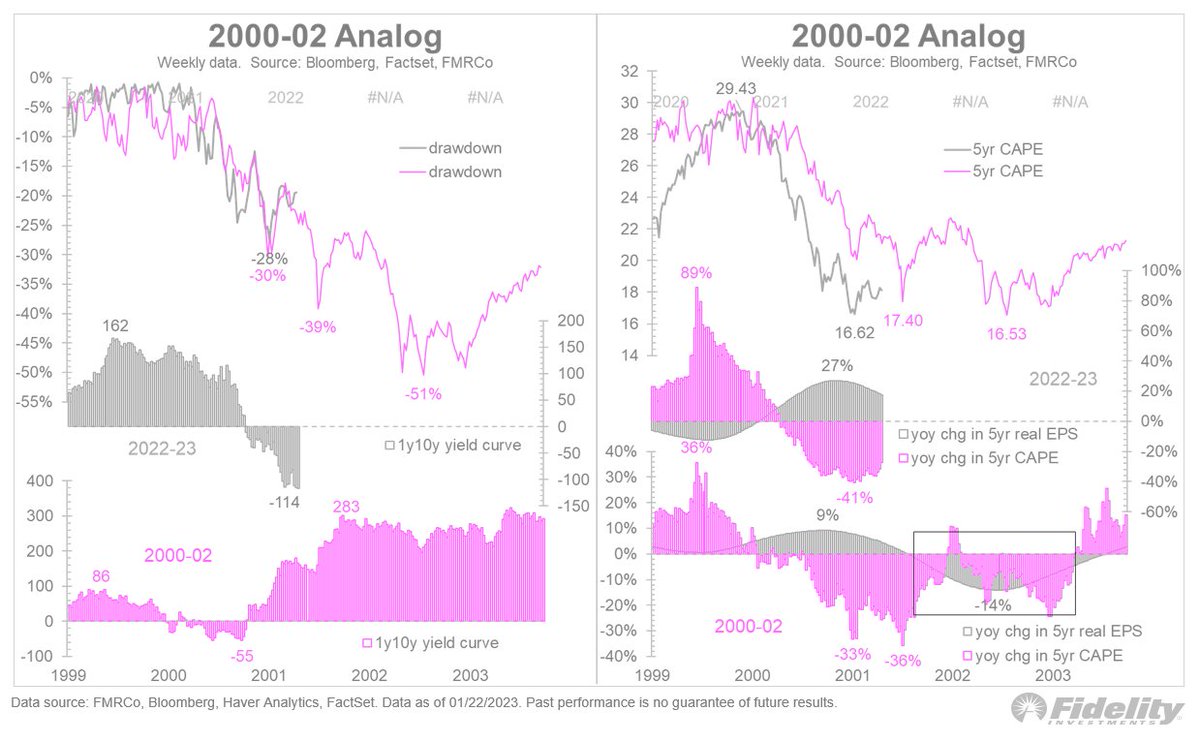

That too was a “super-bear” cycle that produced a simultaneous drawdown in both earnings and valuation. And the current point in the cycle is where the P/E drawdown was nearing its worst point (on a rate of change basis), while earnings rolled over hard. /11

The good news for the current cycle is that the P/E ratio at the October low already reached the worst levels reached in 2001 and 2002. /END

Loading suggestions...