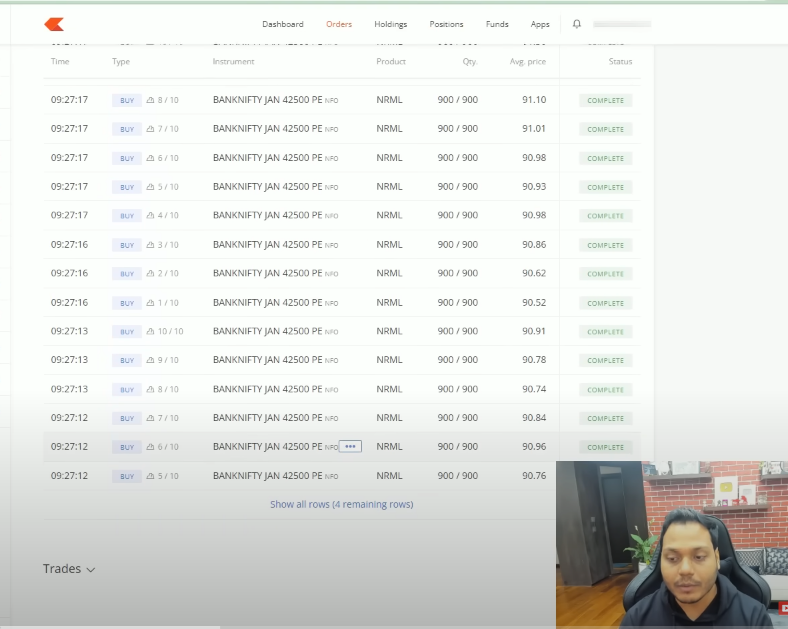

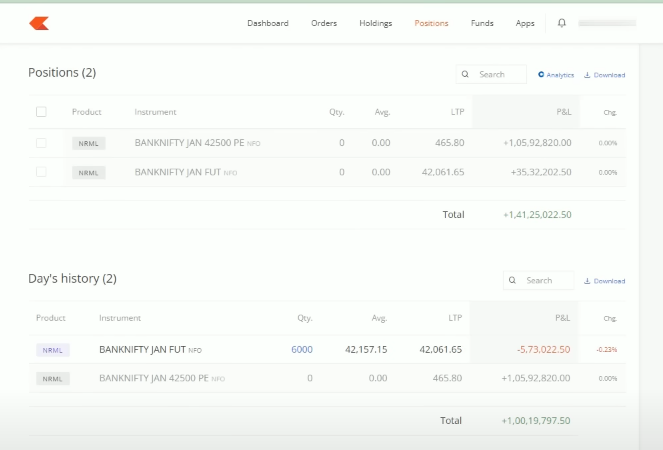

Subhasish Pani earned +1,41,25,022 profit in Option Buying on Expiry day yesterday.

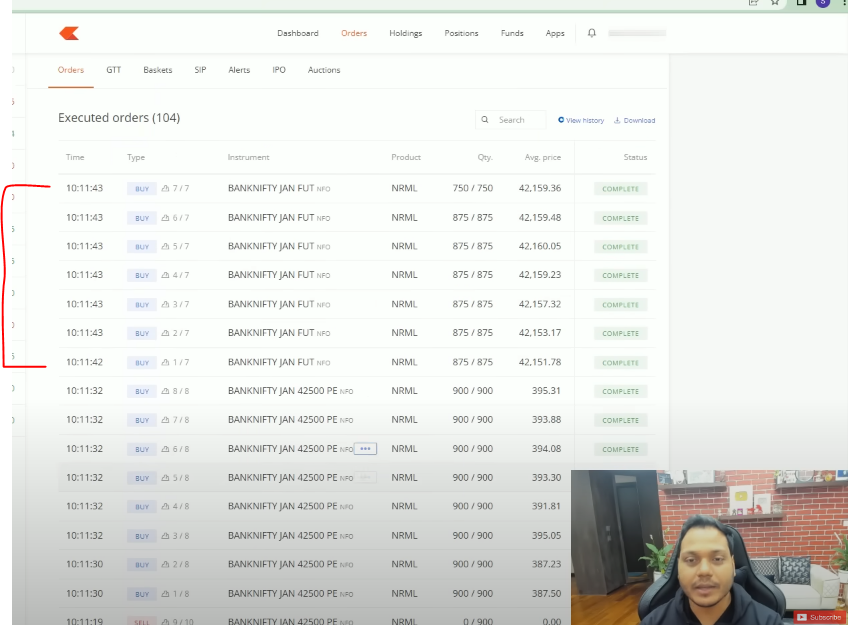

He captured the down move in both futures and options.

Here's a breakdown of how he earned this profit: 🧵

Collaborated with @niki_poojary

He captured the down move in both futures and options.

Here's a breakdown of how he earned this profit: 🧵

Collaborated with @niki_poojary

2/ Hints

He was giving hints from 1-2 months for Option Buyers regarding when they should buy options at a low IV.

The current market scenario was one where the premiums were too low.

According to him, one should plan for a buying trade during such scenarios and target big.

He was giving hints from 1-2 months for Option Buyers regarding when they should buy options at a low IV.

The current market scenario was one where the premiums were too low.

According to him, one should plan for a buying trade during such scenarios and target big.

3/ Gap down sharp selling

Prefers 12 o clock momentum usually whenever there is a gap-down scenario.

Already the market above 42700 buyers weren't strong enough. So on Thursday in a gap-down scenario, he was expecting a big downfall.

Prefers 12 o clock momentum usually whenever there is a gap-down scenario.

Already the market above 42700 buyers weren't strong enough. So on Thursday in a gap-down scenario, he was expecting a big downfall.

8/ IV less (premium are damm cheap)

Option buying premiums are low for the last 10 expiries and in many of them, we have seen very good momentum on expiries.

If premiums are cheap and a big movement comes, its the best thing for option buyers so they should be prepared.

Option buying premiums are low for the last 10 expiries and in many of them, we have seen very good momentum on expiries.

If premiums are cheap and a big movement comes, its the best thing for option buyers so they should be prepared.

9/ Option sellers will be scared

He says a buyer should plan a good R:R trade for buying either when Option Sellers are scared (due to low premiums) or stuck (in round number strikes).

When premiums are low, sellers are easily trapped as there is very less scope to adjustments.

He says a buyer should plan a good R:R trade for buying either when Option Sellers are scared (due to low premiums) or stuck (in round number strikes).

When premiums are low, sellers are easily trapped as there is very less scope to adjustments.

10/ Market should increase premiums before budget

Usually, before an event what happens is there is an increase in volatility and premiums shoot up on both sides to compensate for the risk associated with the BUDGET.

This time the premiums had not increased.

Perfect scenario!

Usually, before an event what happens is there is an increase in volatility and premiums shoot up on both sides to compensate for the risk associated with the BUDGET.

This time the premiums had not increased.

Perfect scenario!

11/ Drawdown recovery

In January, he is just coming out of a drawdown.

No one likes to always be in a drawdown, and one should risk profits made already to make more going ahead.

So from a month or two he might have been flat, so he risked less.

In January, he is just coming out of a drawdown.

No one likes to always be in a drawdown, and one should risk profits made already to make more going ahead.

So from a month or two he might have been flat, so he risked less.

12/ Risk to Reward was great

He hates an R:R of 1:1 & usually prefers it to be 1:6 and 1:10.

Today he got out at 1:3 approx.

Only in scalping does he trade with low R:R.

He hates an R:R of 1:1 & usually prefers it to be 1:6 and 1:10.

Today he got out at 1:3 approx.

Only in scalping does he trade with low R:R.

We are finally on Youtube!!

We have a free Youtube Channel where we cover our analysis of the markets.

If interested feel free to join using this link: youtu.be

We have a free Youtube Channel where we cover our analysis of the markets.

If interested feel free to join using this link: youtu.be

We also have a free telegram channel.

Link to join: t.me

Link to join: t.me

That's a wrap!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

If you enjoyed this thread:

1. Follow us

@Adityatodmal & @niki_poojary

for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!

Loading suggestions...