The U.S. debt ceiling has caused tons of controversy in politics and finance in recent weeks.

However, you might not understand what it actually is.

Here’s a simple breakdown of the debt ceiling:

However, you might not understand what it actually is.

Here’s a simple breakdown of the debt ceiling:

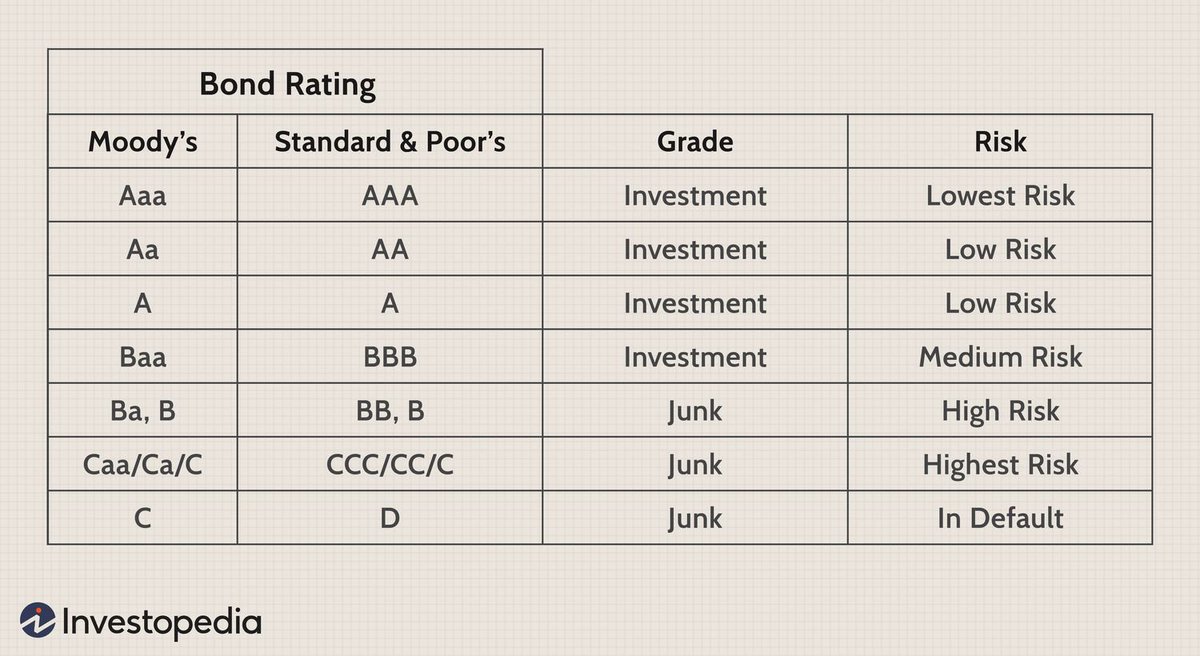

2/ Countries have the same ratings just like businesses do.

The USA had a AAA rating until 2011 when they almost defaulted on their debt.

The reason we almost defaulted?

Enter the debt ceiling.

The USA had a AAA rating until 2011 when they almost defaulted on their debt.

The reason we almost defaulted?

Enter the debt ceiling.

3/ The USA has a weird thing called the debt ceiling.

This is a limit on the amount of debt that the country can take on.

If our debt hits that limit, the USA might not be able to pay their investors which would be catastrophic

This is a limit on the amount of debt that the country can take on.

If our debt hits that limit, the USA might not be able to pay their investors which would be catastrophic

5/ Since 2011, Congress and the president have had to raise the debt ceiling 8 times which is unprecedented

The debt ceiling debate has almost become an annual task.

The debt ceiling debate has almost become an annual task.

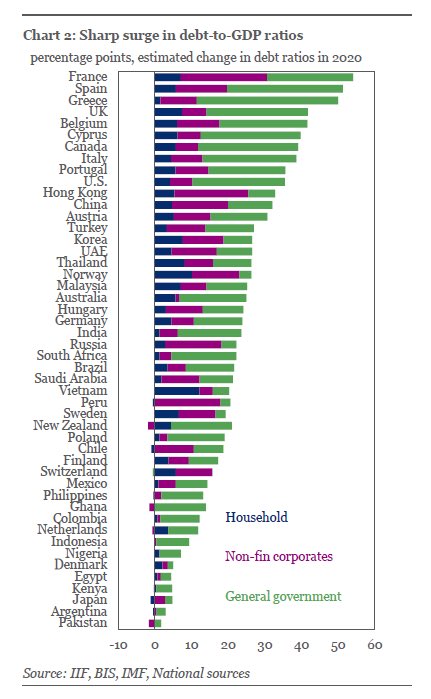

7/ The best way to look at the debt is not to look at it as a number.

It should be looked at in comparison to the size of the economy (GDP)

The USA takes on more debt whenever it spends a lot more.

This could be because of wars or investments during recessions.

It should be looked at in comparison to the size of the economy (GDP)

The USA takes on more debt whenever it spends a lot more.

This could be because of wars or investments during recessions.

9/ Unfortunately, they approve the budget that spends more money then it actually brings in.

The treasury has to makeup th difference by taking on debt.

They do this by selling bonds.

The treasury has to makeup th difference by taking on debt.

They do this by selling bonds.

10/ Bonds can vary but they usually work like this:

You buy a $1,000 30 year bond that gives you 2% of a locked in interest rate.

Each year, the treasury will send you $20 or 2% of your capital.

After 30 years, you will get your money back from the government.

You buy a $1,000 30 year bond that gives you 2% of a locked in interest rate.

Each year, the treasury will send you $20 or 2% of your capital.

After 30 years, you will get your money back from the government.

11/ It is a win-win for you and the government.

The USA gets money to fund the government while you get a risk-free profit.

35% of the total US debt is owned by bond investors.

The USA gets money to fund the government while you get a risk-free profit.

35% of the total US debt is owned by bond investors.

12/ The biggest problem with the debt ceiling is that if we hit the debt ceiling then the treasury can no longer sell bonds.

In fact, they might not even be able to pay federal employees, social programs, or the interest owed to investors which is a default.

In fact, they might not even be able to pay federal employees, social programs, or the interest owed to investors which is a default.

13/ If we hit the debt ceiling, it will likely lower our countries credit rating to A which means interest rates will go up on their own.

This will make mortgages, cars, and any type of loans much more expensive for the average person.

This will make mortgages, cars, and any type of loans much more expensive for the average person.

14/ We are one of 2 countries that has a debt ceiling.

Norway is the other country but their debt ceiling is so high that it won’t ever be reached.

Some people believe that the best thing to do is repeal the debt ceiling but others thing that would lead to even more spending

Norway is the other country but their debt ceiling is so high that it won’t ever be reached.

Some people believe that the best thing to do is repeal the debt ceiling but others thing that would lead to even more spending

Thank you for reading!

If you enjoyed this twitter thread:

-RT my first tweet

-Follow me @investmattallen

-Subscribe to my newsletter

I tweet things like this everyday to help people create generational wealth

If you enjoyed this twitter thread:

-RT my first tweet

-Follow me @investmattallen

-Subscribe to my newsletter

I tweet things like this everyday to help people create generational wealth

Every Wednesday, I discuss complex ideas about money, investing, and finance in a simple way.

Typically a 5-minute read and free, it’s a no brainer :)

Sign up:

mattallenletter.com

Typically a 5-minute read and free, it’s a no brainer :)

Sign up:

mattallenletter.com

Loading suggestions...