There are 3 main reasons why people are getting the axe:

1) Cost reduction (plain and simple)

2) Different economic reality than expected back in Covid days

3) The AI wars

These all work in order. So, let’s start with the first one.

1) Cost reduction (plain and simple)

2) Different economic reality than expected back in Covid days

3) The AI wars

These all work in order. So, let’s start with the first one.

1/ Cost reduction

Any decision related to cutting costs has more to do with the income statement (aka P&L) than the balance sheet.

The majority, at least.

A common argument people have is that tech companies have a lot of cash. So, they shouldn't be firing people.

Any decision related to cutting costs has more to do with the income statement (aka P&L) than the balance sheet.

The majority, at least.

A common argument people have is that tech companies have a lot of cash. So, they shouldn't be firing people.

As much as this is true, the cash balance in the balance sheet is a combination of different sources and it might not indicate that the business is doing well, operationally speaking.

They might have a lot of cash because they borrowed a lot or had a one-off sale.

They might have a lot of cash because they borrowed a lot or had a one-off sale.

The amount of cash a company has reflects the macro and microeconomic context that these companies were living in in the past.

That past was a lot more favorable than what we're currently going through.

That past was a lot more favorable than what we're currently going through.

Using that as an anchor point, you can expect that in the current business context (i.e. potential recession, war with Ukraine) business activity will be weaker overall.

Which would probably result in a reduced cash position for all these companies.

RED FLAG.

Which would probably result in a reduced cash position for all these companies.

RED FLAG.

A better indicator to tell you if the company is in a pickle to stay competitive and profitable is the income statement (or P&L).

Let’s take a look at Microsoft, as an example.

Let’s take a look at Microsoft, as an example.

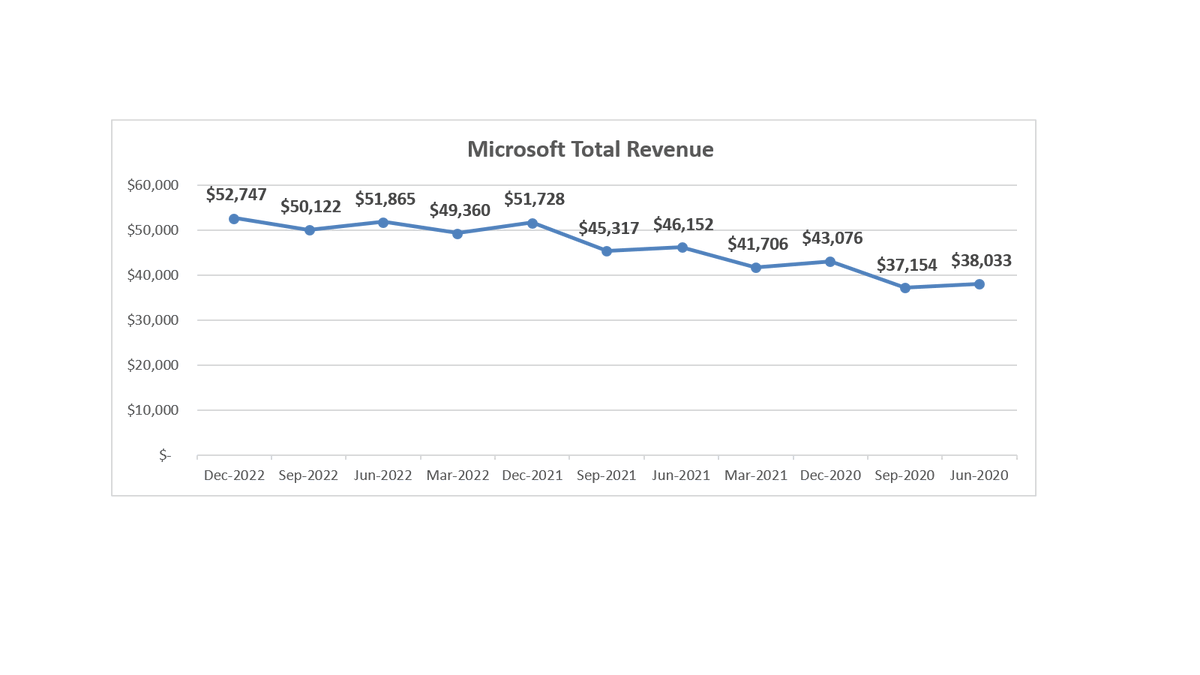

As of December 2022, Microsoft had:

$16 billion in cash.

$53 billion in revenue.

$20 billion in operating income.

Great. Now, let’s put those numbers into perspective.

$16 billion in cash.

$53 billion in revenue.

$20 billion in operating income.

Great. Now, let’s put those numbers into perspective.

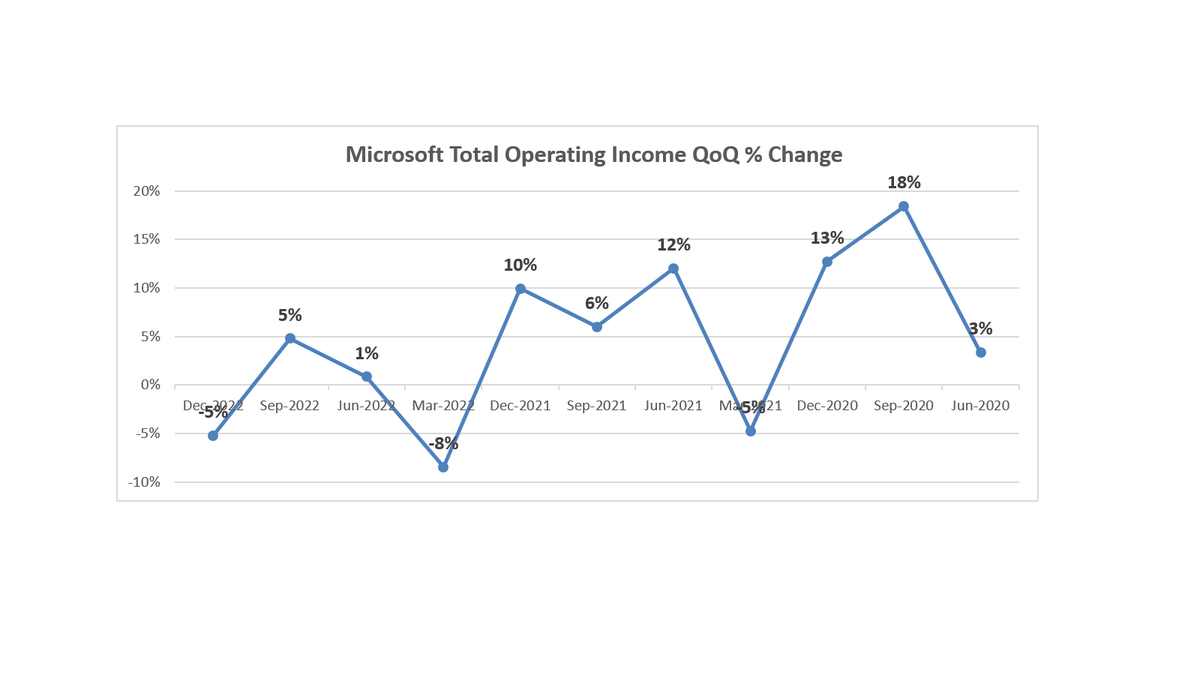

Now, let’s look at operating income.

This is revenue minus costs to operate the business.

That includes the cost of making products, selling them, and any other cost related to running a business like accounting, HR, and marketing.

This is revenue minus costs to operate the business.

That includes the cost of making products, selling them, and any other cost related to running a business like accounting, HR, and marketing.

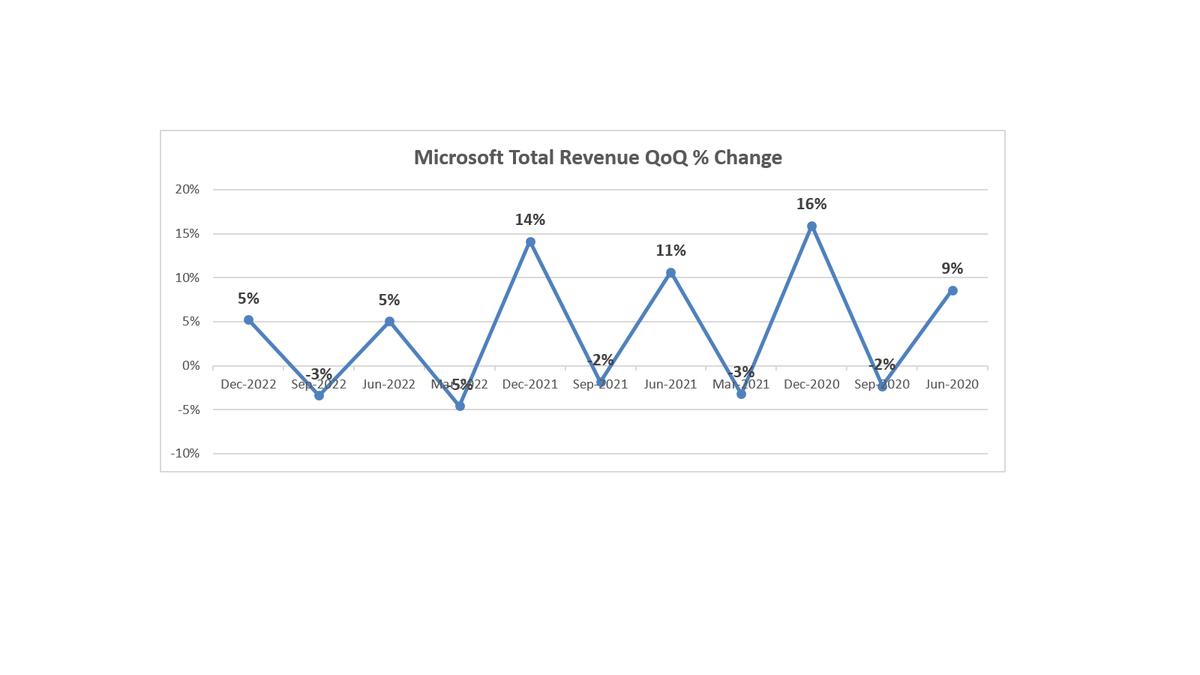

OK, so now we know that costs need to be reduced.

Why is revenue shrinking?

Well, to use the words from executives … these companies hired and planned for a different reality.

What does that mean? Well ...

Why is revenue shrinking?

Well, to use the words from executives … these companies hired and planned for a different reality.

What does that mean? Well ...

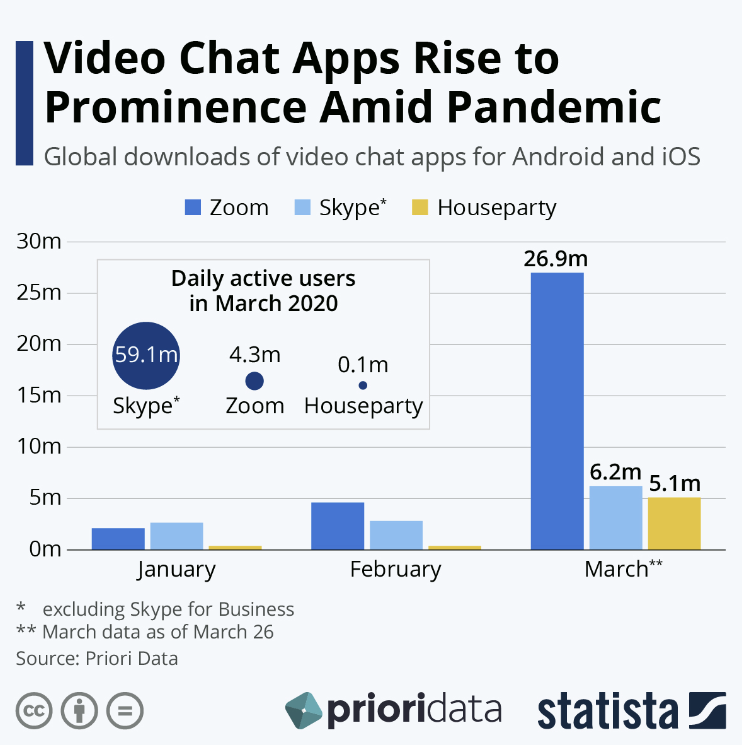

When Covid and lockdowns started, one of the first things needed to keep the world running was a way to communicate with each other from home.

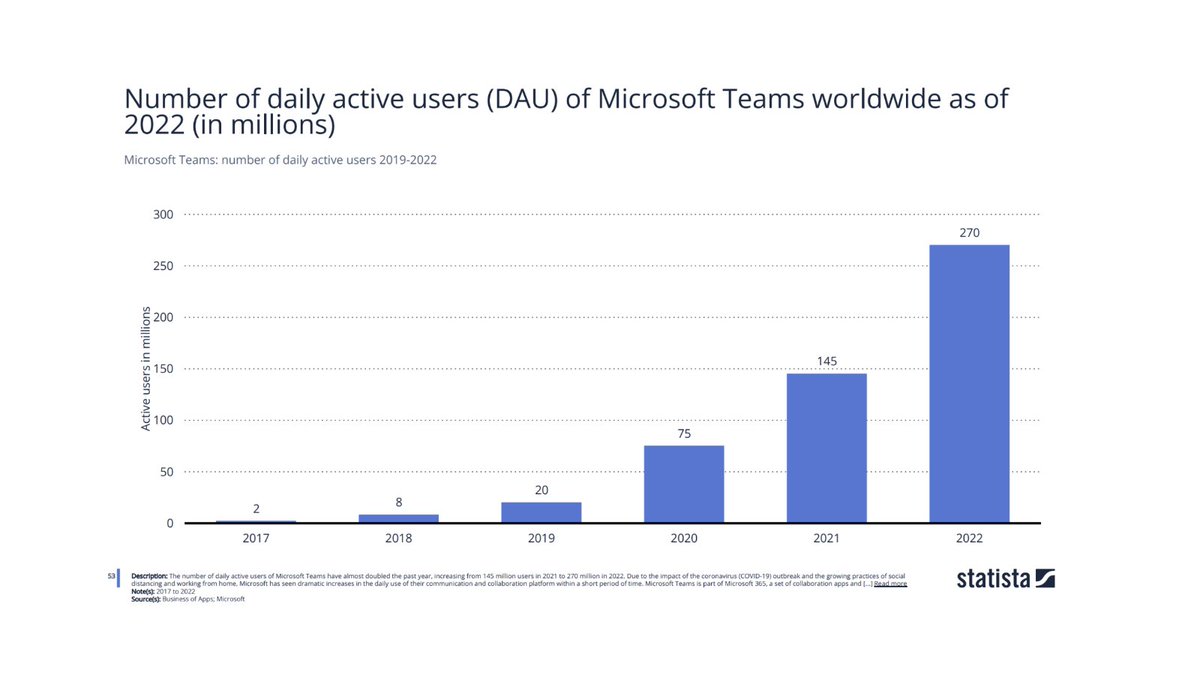

Applications such as Zoom and Teams became adopted at lightning speed.

Applications such as Zoom and Teams became adopted at lightning speed.

This is the other reality these execs are talking about.

They thought that the pandemic would accelerate the digital transformation of enterprises, even after the pandemic was over.

They thought they could sustain the pace at which they were selling their products.

They thought that the pandemic would accelerate the digital transformation of enterprises, even after the pandemic was over.

They thought they could sustain the pace at which they were selling their products.

But this is not the case.

People are returning to office.

Productivity suites like Office 365 are no longer needed with all its features.

And the migration to the cloud will be delayed because companies rather save some coin to endure the upcoming recession.

People are returning to office.

Productivity suites like Office 365 are no longer needed with all its features.

And the migration to the cloud will be delayed because companies rather save some coin to endure the upcoming recession.

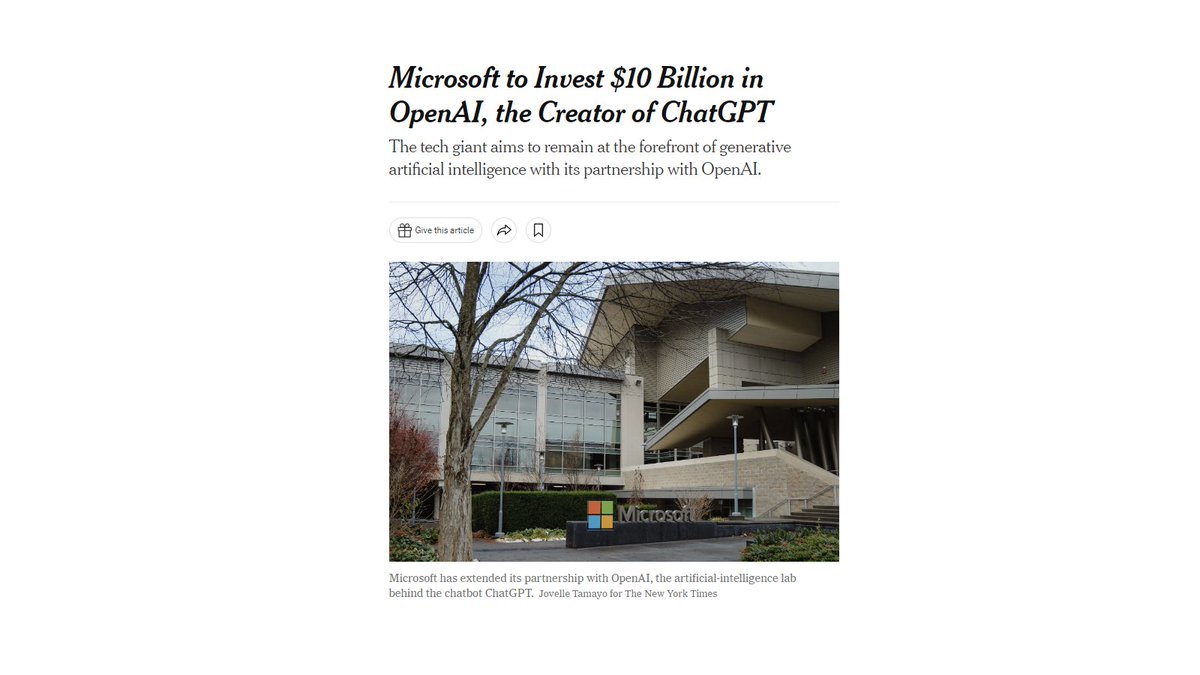

But it’s available for bets in areas that will yield a massive return on investment.

Best bet right now is artificial intelligence.

An area that has the potential to disrupt entire industries as we know them.

And a lot of companies are salivating about the opportunity.

Best bet right now is artificial intelligence.

An area that has the potential to disrupt entire industries as we know them.

And a lot of companies are salivating about the opportunity.

ChatGPT got 100 million users in a couple of months.

Imagine what it will look like 10 years from now.

The money that is being saved by firing disposable employees (or in more corporate-finance-lingo, non-revenue generating headcount) will be used to fund more lucrative bets.

Imagine what it will look like 10 years from now.

The money that is being saved by firing disposable employees (or in more corporate-finance-lingo, non-revenue generating headcount) will be used to fund more lucrative bets.

So, there you have it folks.

I hope you enjoyed reading this thread.

If you learned something valuable today:

1. Follow me @theantonioreza for more

2. Comment with what your thoughts are

2. RT the first tweet so more people can learn

I hope you enjoyed reading this thread.

If you learned something valuable today:

1. Follow me @theantonioreza for more

2. Comment with what your thoughts are

2. RT the first tweet so more people can learn

If you want to learn more about accounting and finance, consider downloading my FREE guide.

theantonioreza.com

theantonioreza.com

Loading suggestions...