1.

Disclaimer:

Take note that this is my personal plan, because it fits with my attitude and goals as I don't want to day trade and I prefer a more “passive” approach.

Everyone needs to deliver a personal setup.

We’re all different.

So let's start.

Disclaimer:

Take note that this is my personal plan, because it fits with my attitude and goals as I don't want to day trade and I prefer a more “passive” approach.

Everyone needs to deliver a personal setup.

We’re all different.

So let's start.

3.

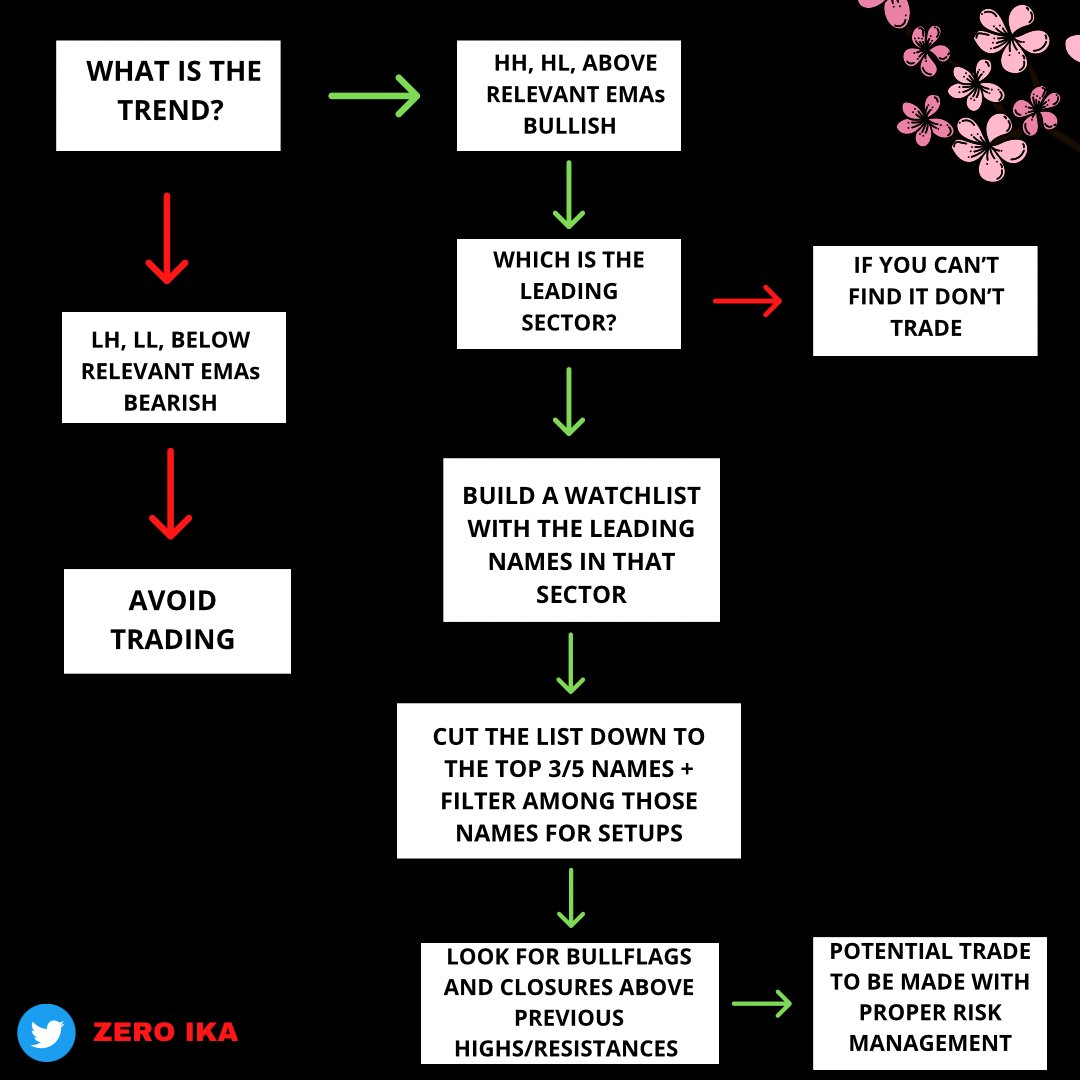

▫️What is the trend?

Before entering any trades we should make an analysis evaluating the trend.

Since I'm not a short guy, I only look for bullish/long setups. (Trend rider)

If I find a setup that I don't like it's simple...

I don't force the trade and I wait.

▫️What is the trend?

Before entering any trades we should make an analysis evaluating the trend.

Since I'm not a short guy, I only look for bullish/long setups. (Trend rider)

If I find a setup that I don't like it's simple...

I don't force the trade and I wait.

4.

▫️Bearish posture.

Identifying a bearish posture: LH + LL + price below the relevant EMAs.

LH + LL is a well-known pattern that indicates a bearish trend.

Your goal is to find out in the chart this pattern..but how to?

▫️Bearish posture.

Identifying a bearish posture: LH + LL + price below the relevant EMAs.

LH + LL is a well-known pattern that indicates a bearish trend.

Your goal is to find out in the chart this pattern..but how to?

6.

The yellow line represents the 9-EMA where, as you can see, the price traded below it supporting the bearish case by the LH + LL pattern.

The whole point of this chart is to wait and don't trade considering the bearish conditions.

The yellow line represents the 9-EMA where, as you can see, the price traded below it supporting the bearish case by the LH + LL pattern.

The whole point of this chart is to wait and don't trade considering the bearish conditions.

7.

▫️Bullish posture.

To identify a bullish posture: HH + HL + price above relevant EMAs.

Contrary to LH + LL, HH + HL is a pattern that helps to catch a bullish trend.

The predominant EMA remains the 9 one on the daily but 21 EMA also works well.

▫️Bullish posture.

To identify a bullish posture: HH + HL + price above relevant EMAs.

Contrary to LH + LL, HH + HL is a pattern that helps to catch a bullish trend.

The predominant EMA remains the 9 one on the daily but 21 EMA also works well.

9.

As you can see it rode the 9-EMA, had a deviation below that has been bought up and then it reclaimed the EMA to continue the trend.

The low was still higher than the previous one.

That's an example of a bullish trend and what I look for to start.

As you can see it rode the 9-EMA, had a deviation below that has been bought up and then it reclaimed the EMA to continue the trend.

The low was still higher than the previous one.

That's an example of a bullish trend and what I look for to start.

10.

▫️Which is the leading sector?

Leaders generally make the largest moves in bullish market phases but there have been instances where they even lead when the rest of the market was down.

Past examples include: Metaverse, DeFi, Gaming, AI and are the ideal candidates to trade

▫️Which is the leading sector?

Leaders generally make the largest moves in bullish market phases but there have been instances where they even lead when the rest of the market was down.

Past examples include: Metaverse, DeFi, Gaming, AI and are the ideal candidates to trade

11.

▫️If you can find it don't trade it.

As the leading sector shows strength in terms of price action, it’s easier to trade.

If you don't find it or there is none, don't trade and wait.

Also, if the charts are already parabolic forget about them and move on.

▫️If you can find it don't trade it.

As the leading sector shows strength in terms of price action, it’s easier to trade.

If you don't find it or there is none, don't trade and wait.

Also, if the charts are already parabolic forget about them and move on.

12.

▫️Build a watchlist with the names of the sector.

Building watchlists help your mind to have a clearer and more organized outlook on the market.

It's a practice that I do very often if not every time I need to set up a trade/position.

▫️Build a watchlist with the names of the sector.

Building watchlists help your mind to have a clearer and more organized outlook on the market.

It's a practice that I do very often if not every time I need to set up a trade/position.

13.

The path is simple:

• Find the leading sector.

• Open @tradingview.

• Click on top left and rename a watchlist (Gaming for example).

• Add names: $GALA $UOS $MANA $SAND $ALICE

• Add the benchmarks to help you gauge the strength of the market. $BTC + $ETH + $DXY

The path is simple:

• Find the leading sector.

• Open @tradingview.

• Click on top left and rename a watchlist (Gaming for example).

• Add names: $GALA $UOS $MANA $SAND $ALICE

• Add the benchmarks to help you gauge the strength of the market. $BTC + $ETH + $DXY

15.

▫️Cut the list down to the top 3/5 names and filter for the best setups.

If your list contains 10/15 names it will be more difficult for you to find setups.

It will only create more confusion in your mind.

Cut the list down to the strongest names.

▫️Cut the list down to the top 3/5 names and filter for the best setups.

If your list contains 10/15 names it will be more difficult for you to find setups.

It will only create more confusion in your mind.

Cut the list down to the strongest names.

16.

Filter the charts as I told you in the previous posts:

• Look for HH + HL and price above the 9/21 EMA.

• Look for accumulation zones. (Be careful between distribution and accumulation!)

Most important once again: don’t force trades.

Filter the charts as I told you in the previous posts:

• Look for HH + HL and price above the 9/21 EMA.

• Look for accumulation zones. (Be careful between distribution and accumulation!)

Most important once again: don’t force trades.

17.

▫️Look for bull flags & closures above past high/resistances.

So that's the easiest way to scan potential trades.

As you know there are plenty of patterns/indicators/ways but this is something very easy and profitable if you do it well.

▫️Look for bull flags & closures above past high/resistances.

So that's the easiest way to scan potential trades.

As you know there are plenty of patterns/indicators/ways but this is something very easy and profitable if you do it well.

19.

Take note that the retracement period (the flag) shouldn't be too heavy (sign of a weak trend).

The breakout from the flag should be made of a strong candle to validate it.

Place a stop loss below the lowest low made by the price after the breakout of the trendline.

Take note that the retracement period (the flag) shouldn't be too heavy (sign of a weak trend).

The breakout from the flag should be made of a strong candle to validate it.

Place a stop loss below the lowest low made by the price after the breakout of the trendline.

20.

• Close above previous highs/resistances.

When $BTC broke the old 2017 20k high in 2020, this led to a move to 60k+ over time.

The same has applied to many major altcoins.

The more tests at an old resistance, the higher the probability of a breakout.

• Close above previous highs/resistances.

When $BTC broke the old 2017 20k high in 2020, this led to a move to 60k+ over time.

The same has applied to many major altcoins.

The more tests at an old resistance, the higher the probability of a breakout.

22.

▫️Potential trade to be made with proper risk management.

Risk management is the key to all positions and trades if we want to succeed.

Don't know how to do it?

Here is a guide I made.👇

▫️Potential trade to be made with proper risk management.

Risk management is the key to all positions and trades if we want to succeed.

Don't know how to do it?

Here is a guide I made.👇

23.

The key takeaway here is one.

Besides risk management, find your way.

This is the strategy I use the most but there are plenty of strategies that work well depending on time horizons, risk, targets and especially your attitude.

The key takeaway here is one.

Besides risk management, find your way.

This is the strategy I use the most but there are plenty of strategies that work well depending on time horizons, risk, targets and especially your attitude.

24.

If you want to grow more follow these quality accounts:

• @CryptoGirlNova

• @crypthoem

• @BlocksNThoughts

• @Teaching_Crypto

• @i_am_jackis

• @chirocrypto

• @rektdiomedes

• @crypthoem

• @i_am_jackis

• @TheDeFinvestor

• @MercyDeGreat

If you want to grow more follow these quality accounts:

• @CryptoGirlNova

• @crypthoem

• @BlocksNThoughts

• @Teaching_Crypto

• @i_am_jackis

• @chirocrypto

• @rektdiomedes

• @crypthoem

• @i_am_jackis

• @TheDeFinvestor

• @MercyDeGreat

25.

That’s it.

• Did you find value in my thread? Follow me @IamZeroIka for more crypto insights.

• If you think your friends will benefit from what I wrote, jump on the first tweet and RT it!

Thanks for reading, Zero.

That’s it.

• Did you find value in my thread? Follow me @IamZeroIka for more crypto insights.

• If you think your friends will benefit from what I wrote, jump on the first tweet and RT it!

Thanks for reading, Zero.

Loading suggestions...