1/ Capital efficiency remains one of DeFi's biggest challenges

Especially on AMMs where a large chunk of stablecoins liquidity sits unused.

Here's how you can maximize your liquidity by auctioning it to the highest bidder ↓🧵

Especially on AMMs where a large chunk of stablecoins liquidity sits unused.

Here's how you can maximize your liquidity by auctioning it to the highest bidder ↓🧵

2/ @ArchimedesFi is a premier lending and borrowing marketplace offering up to 10x leverage on overcollaterized stablecoins.

Essentially, they're aimed at promoting capital efficiency and helping provide quality leverage opportunities.

Essentially, they're aimed at promoting capital efficiency and helping provide quality leverage opportunities.

3/ Initially, they raised a pre-seed round of $2.4 million.

And recently, they raised an additional $4.9M in a seed round led by Hack VC - making it a total of $7.3M

cryptodataspace.com

And recently, they raised an additional $4.9M in a seed round led by Hack VC - making it a total of $7.3M

cryptodataspace.com

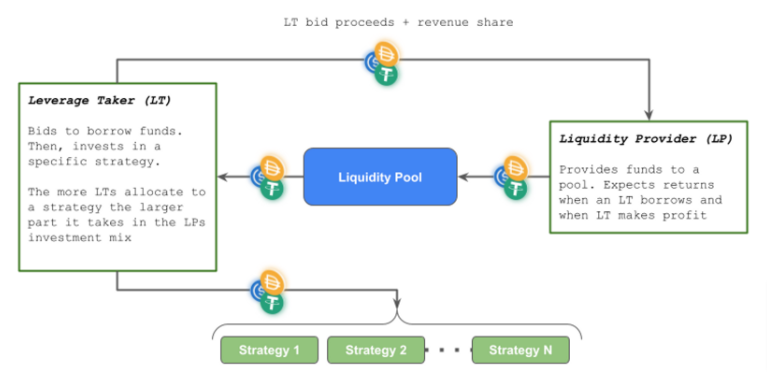

4/ Archimedes has two main categories of users:

• LPs (lenders): users offering their assets for a passive, low-risk APY.

• Leverage Takers - LTs (borrowers): investors looking to maximize the APY of their assets.

• LPs (lenders): users offering their assets for a passive, low-risk APY.

• Leverage Takers - LTs (borrowers): investors looking to maximize the APY of their assets.

5/ Here's how it works!

Instead of rallying around experts to fix the issue of Real Yields for LPs, Archimedes "asks the market" via auctioning liquidity.

This method places the market above individuals, enabling the platform to provide liquidity to LTs.

Instead of rallying around experts to fix the issue of Real Yields for LPs, Archimedes "asks the market" via auctioning liquidity.

This method places the market above individuals, enabling the platform to provide liquidity to LTs.

7/ LPs will mainly have a stake in the profits generated by the LTs.

This strategy is awesome because:

• LPs get Real Yields from real activities and not from token emissions.

• LPs invest in a diversified portfolio that is market-determinant

This strategy is awesome because:

• LPs get Real Yields from real activities and not from token emissions.

• LPs invest in a diversified portfolio that is market-determinant

8/ Bringing it together, LTs can earn 10X yield using the @OriginProtocol $OUSD strategy.

While LPs earn passively from trading, leverage, origination, and performance fees. Also, from $ARCH incentives.

While LPs earn passively from trading, leverage, origination, and performance fees. Also, from $ARCH incentives.

9/ Archimedes recently launched IvUSD/3crv stablecoin pool on @CurveFinance to enable users to earn top-of-market APY and real yields.

Here's a step-by-step guide:

Here's a step-by-step guide:

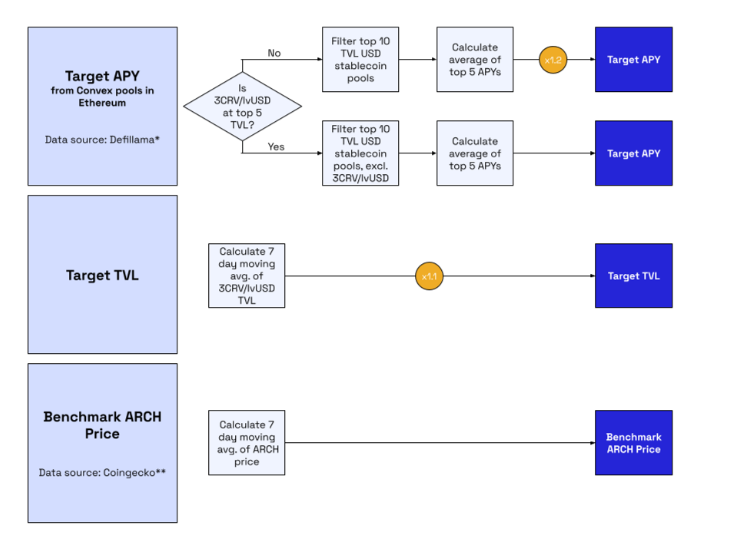

11/ It does this by calculating the ARCH emission volume every two weeks based on the $ARCH price and a target APY based on top pools and market APYs.

The dynamic emission prevents the over-inflation of the token supply and protects the value of the token and protocol.

The dynamic emission prevents the over-inflation of the token supply and protects the value of the token and protocol.

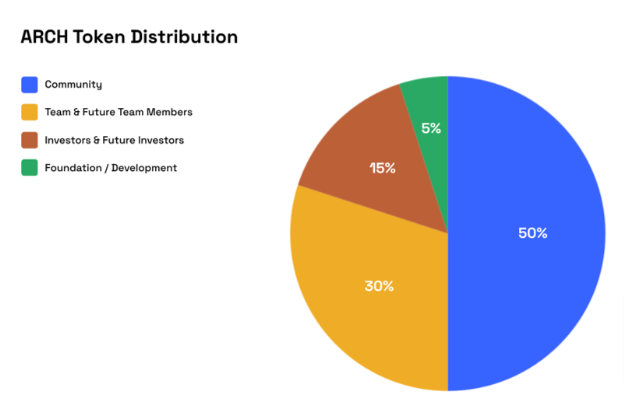

13/ Also, $ARCH is the de facto token for leverage takers.

It is used for making bids in the auction via the first price interactions, in an attempt to get a more favorable ratio of ARCH to lvUSD leverage.

It is used for making bids in the auction via the first price interactions, in an attempt to get a more favorable ratio of ARCH to lvUSD leverage.

14/ Security

Archimedes has been audited by @HalbornSecurity, including other minor audits.

Even so, it's still exposed to smart contract risks, which are the dominant risks of all DeFi protocols.

Archimedes has been audited by @HalbornSecurity, including other minor audits.

Even so, it's still exposed to smart contract risks, which are the dominant risks of all DeFi protocols.

15/ Overall, Archimedes is a promising project.

I particularly like the concept of dynamic emissions and how they're redefining capital efficiency and real yields.

Go check them out: @ArchimedesFi

I particularly like the concept of dynamic emissions and how they're redefining capital efficiency and real yields.

Go check them out: @ArchimedesFi

16/ That's all for today.

Disclaimer: Nothing in this thread constitutes financial advice. Always DYOR.

Follow me @ViktorDefi for more threads on narratives and low-cap gems.

Disclaimer: Nothing in this thread constitutes financial advice. Always DYOR.

Follow me @ViktorDefi for more threads on narratives and low-cap gems.

One more thing. Kindly Retweet.

Loading suggestions...