random discretionary trading "alpha"

aka, something you can use as a framework to think about what a market is doing, when it might change and why you could potentially make money off of it:

Fair value (a thread)

aka, something you can use as a framework to think about what a market is doing, when it might change and why you could potentially make money off of it:

Fair value (a thread)

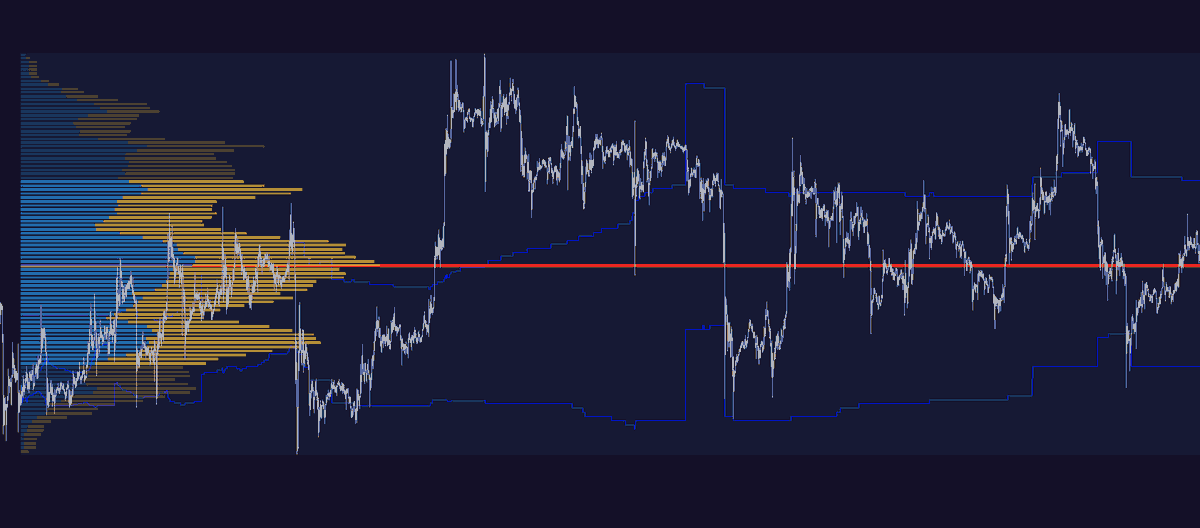

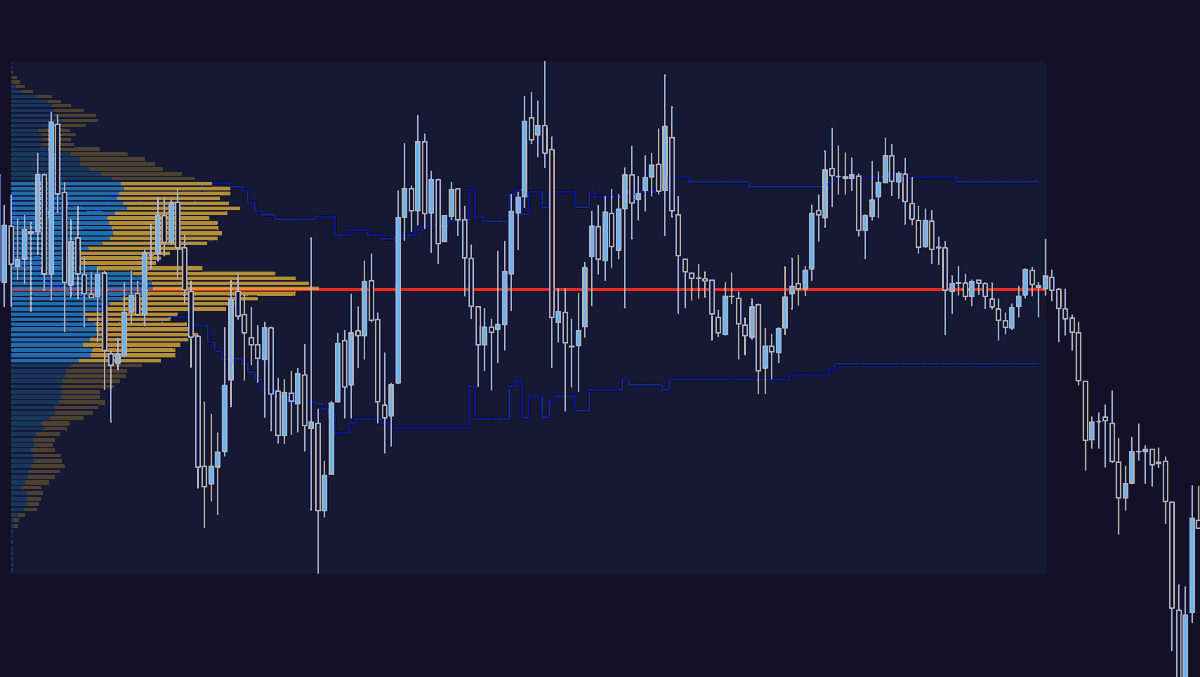

Clearly, this thing is ranging. This means it is not moving up or down on net, it is bouncing around a particular area.

Why would it do that?

I don't give a shit, who cares.

All that matters is that this asset currently likes trading around a certain price area.

Why would it do that?

I don't give a shit, who cares.

All that matters is that this asset currently likes trading around a certain price area.

That price (denoted by a red line here) is called the point of control, or POC

Now think about it

if an asset is trading within a specific price range

and we can see the price level at which the most volume is traded in that range

it stands to reason...

Now think about it

if an asset is trading within a specific price range

and we can see the price level at which the most volume is traded in that range

it stands to reason...

...that the highest-volume area on the chart is most likely the price at which the highest number of participants agree that this thing is fairly valued

fair value of an asset is where the largest number of people agree to trade it, whether they are buying or selling

fair value of an asset is where the largest number of people agree to trade it, whether they are buying or selling

If the price goes above that fair value (the POC), sellers are getting a good deal.

They can sell rich (above the fair value) and will drive the price down

Buyers are getting a good deal anywhere below the fair value line

so who decides where that fair value is to begin with?

They can sell rich (above the fair value) and will drive the price down

Buyers are getting a good deal anywhere below the fair value line

so who decides where that fair value is to begin with?

Unsurprisingly, the market itself does.

That fair value point will always be determined by discovering the equilibrium price between buyers and sellers

fair value is always set at the point at which both sides of the market believe they are getting a good price to trade

That fair value point will always be determined by discovering the equilibrium price between buyers and sellers

fair value is always set at the point at which both sides of the market believe they are getting a good price to trade

understanding this gives us an opportunity as discretionary traders

it should already seem obvious, but if we know the fair value for the market is price x

...we should probably sell the asset any time it is trading above price x right?

it should already seem obvious, but if we know the fair value for the market is price x

...we should probably sell the asset any time it is trading above price x right?

conversely, we ought to be buying any time the asset trades below price x

often, we can simply buy and sell the asset back to the fair value price

but if the fair value price is known, why does the asset not just... trade at that price all the time?

often, we can simply buy and sell the asset back to the fair value price

but if the fair value price is known, why does the asset not just... trade at that price all the time?

idk, have you ever tried to get 10 people to agree on something?

what about 100

or a million

or however many of you fucking idiots are out there trading DogeShitPerpCumInuMoon coin

point is, good luck trying to get everyone to always agree on the same price for something

what about 100

or a million

or however many of you fucking idiots are out there trading DogeShitPerpCumInuMoon coin

point is, good luck trying to get everyone to always agree on the same price for something

Fair value is always a giant question mark

in some tradfi market assets, there's actually something close to a definitive mathematical answer for fair value

those assets don't move much and the people trading them are way smarter than me or anyone reading this fucking thread

in some tradfi market assets, there's actually something close to a definitive mathematical answer for fair value

those assets don't move much and the people trading them are way smarter than me or anyone reading this fucking thread

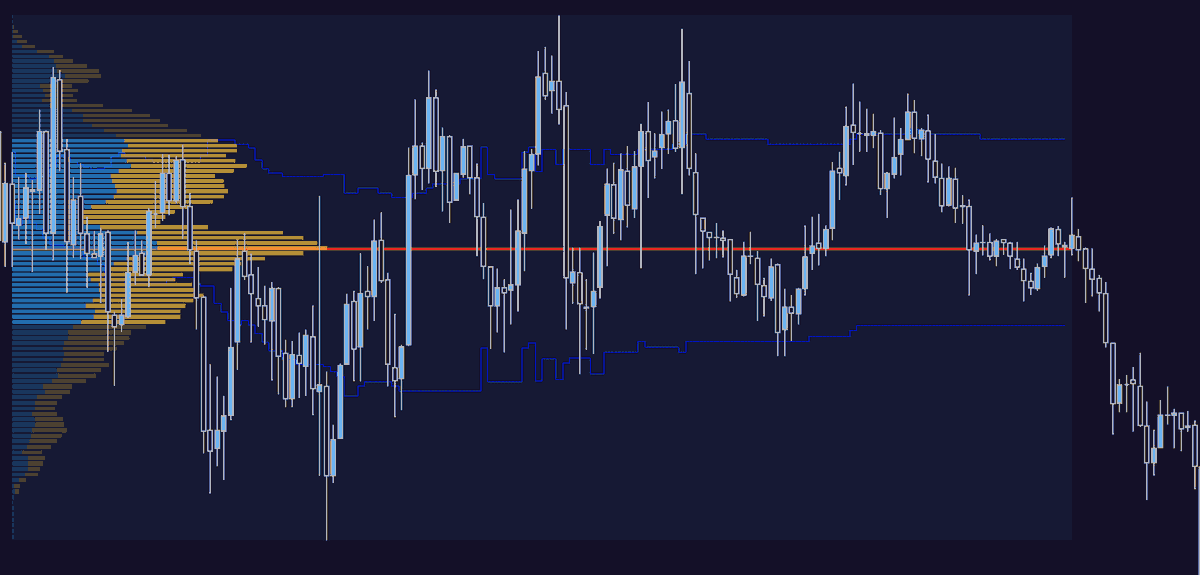

but in the more nebulous markets, fair value is always in flux

which means that buyers and sellers are always trying to push price away from the established fair value price

and we get to tell them they are wrong

which means that buyers and sellers are always trying to push price away from the established fair value price

and we get to tell them they are wrong

obviously, this means that the previous fair value... isn't any more

there aren't as many people who see price as "cheap", as there are people who see it as "expensive"

why? again, who fucking cares, we're traders not mind readers.

all we need to know is that value has moved

there aren't as many people who see price as "cheap", as there are people who see it as "expensive"

why? again, who fucking cares, we're traders not mind readers.

all we need to know is that value has moved

If we can see that fair value has moved, or is moving, that's useful information

do we know what the new fair value is? Of course not ya dingus, but neither does anybody else.

so we can just trade with the side of the market which seems to be winning at the moment

do we know what the new fair value is? Of course not ya dingus, but neither does anybody else.

so we can just trade with the side of the market which seems to be winning at the moment

Eventually the market will figure its shit out and everyone will get back to agreeing on price (more or less)

and we can get back to telling them when they're bidding above or selling below whatever that new fair value price happens to be

and we can get back to telling them when they're bidding above or selling below whatever that new fair value price happens to be

Now, before I finish off with a few concrete trading tips, it's important to remember a few things

- we aren't predicting jack shit

- we aren't deciding on fair price (and neither is anyone else in particular)

- we make money off people who fight the market

- so don't be one

- we aren't predicting jack shit

- we aren't deciding on fair price (and neither is anyone else in particular)

- we make money off people who fight the market

- so don't be one

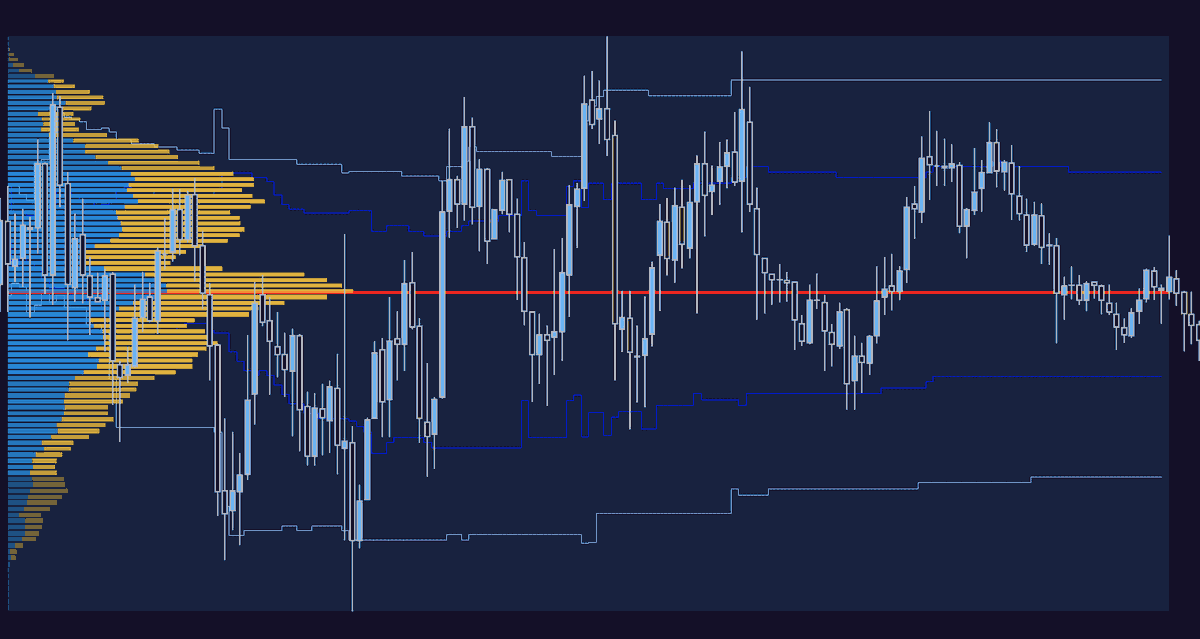

I usually stagger sells between the top two bands and target the POC.

I usually bid between the bottom two bands, same target.

If price moves much outside of them, chances are good that that fair value I'm targeting... probably isn't any more.

I usually bid between the bottom two bands, same target.

If price moves much outside of them, chances are good that that fair value I'm targeting... probably isn't any more.

If we're generally trending up? That fair value is probably gonna shift upward on a regular basis

maybe don't be selling shit

same is true in reverse of a bear trend

maybe don't be selling shit

same is true in reverse of a bear trend

last but not least, you can use a VWMA to approximate the fair value price *on average* over the last (whatever number you pick) candles.

can be useful during trends to see whether the dominant side of the market is staying that way

can be useful during trends to see whether the dominant side of the market is staying that way

anyways, that's the end of the thread

it was long

maybe useful

you can either like and rt or you can just go do something else, I'm not particular

cya nerds

it was long

maybe useful

you can either like and rt or you can just go do something else, I'm not particular

cya nerds

P.S.

while all this is magic line on chart go boing, the concept of fair value and making money by trading reversion to it is a large part of many quantitative strategies as well

thinking of a market in terms of fair value leads to sustainable alpha

prediction is just gambling

while all this is magic line on chart go boing, the concept of fair value and making money by trading reversion to it is a large part of many quantitative strategies as well

thinking of a market in terms of fair value leads to sustainable alpha

prediction is just gambling

@zuqkah (I have to draw it twice, one on each template on top of each other)

Loading suggestions...