There is a lot of politics going on regarding the Adani & LIC nexus.

Let's understand the facts.

[A thread...]

Let's understand the facts.

[A thread...]

[2] But, LIC has other mandates too (and rightly so)

- For example: given the fact that the size of LIC's investment is 30Lakh crore (out of entire 40Lakh crore insurance industry money), the size of the firm is huge.

- It can't simply take and cut positions in stocks.

- For example: given the fact that the size of LIC's investment is 30Lakh crore (out of entire 40Lakh crore insurance industry money), the size of the firm is huge.

- It can't simply take and cut positions in stocks.

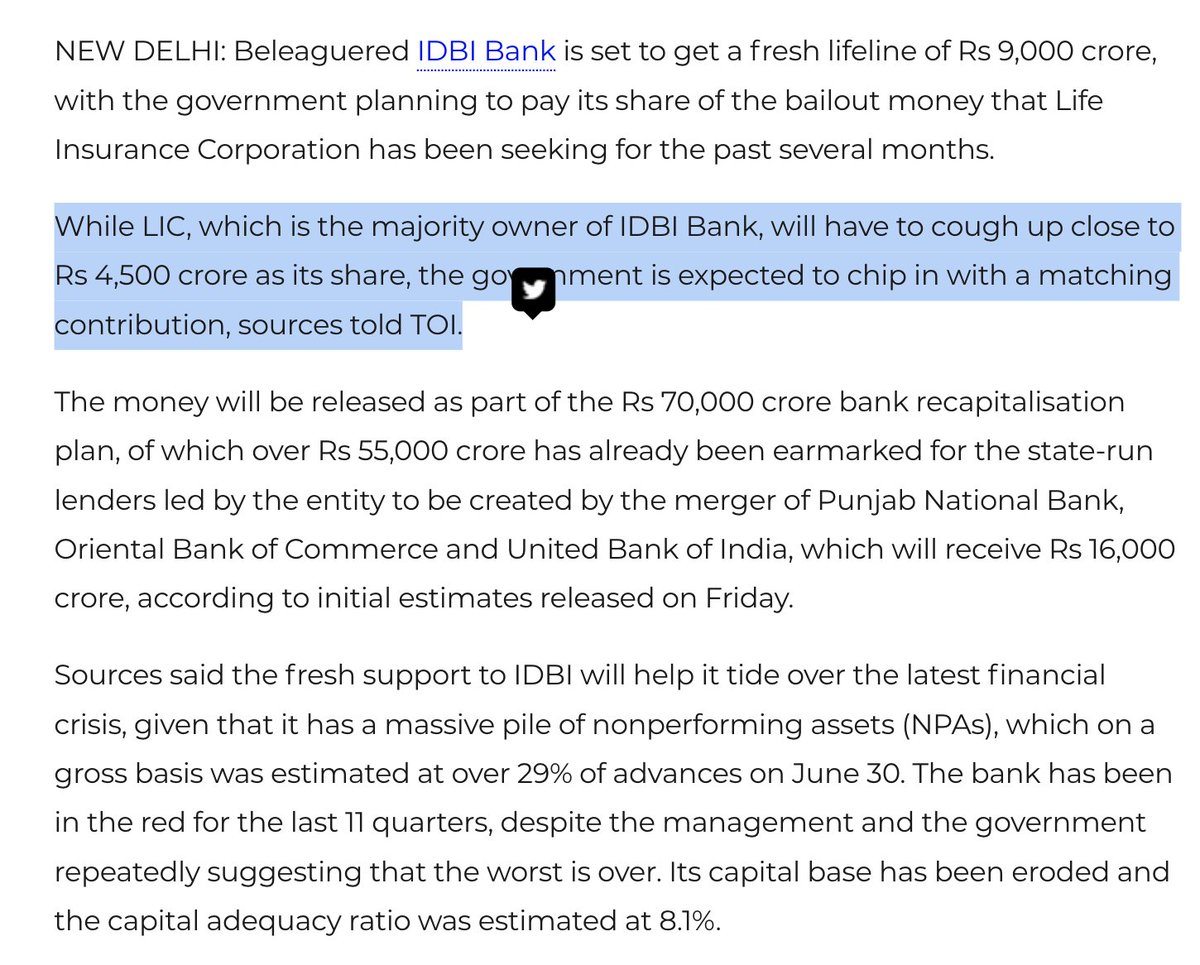

From time to time, it has been made to bail out banks.

Even SBI, recently bailed out Yes Bank.

Reason: banks are strategically important assets. If one bank defaults, many other banks who inter-lend, might default.

So makes sense.

Even SBI, recently bailed out Yes Bank.

Reason: banks are strategically important assets. If one bank defaults, many other banks who inter-lend, might default.

So makes sense.

[3] The story however, gets complicated when it comes to Adani.

The decision to invest in Adani stocks by LIC, was not a necessary requirement.

Mutual Funds had stayed away. And, Adani is a private firm (almost 74% owned by a single family).

The decision to invest in Adani stocks by LIC, was not a necessary requirement.

Mutual Funds had stayed away. And, Adani is a private firm (almost 74% owned by a single family).

But, things were going well, and no one questioned the move:

As of Jan, 30th: LIC said the total purchase value of equity under all Adani group companies is ₹30,127Cr.

This was procured over the years.

As of Jan, 30th: LIC said the total purchase value of equity under all Adani group companies is ₹30,127Cr.

This was procured over the years.

Before the Hindenburg Saga: the value was January 27, ₹56,142 crore.

LIC never booked any profits.

After the fall, the stock value stands at: ₹27,000 crore.

This is a loss of more than 3000Cr on the principle amount.

LIC never booked any profits.

After the fall, the stock value stands at: ₹27,000 crore.

This is a loss of more than 3000Cr on the principle amount.

[5] It is completely fine for a Hedge Fund to take risk with their client's money. Because their clients want the fund to chase growth.

But it is surprising to see, LIC not sticking to its own mandate.

And, risking their client's money who were investing for their retirement.

But it is surprising to see, LIC not sticking to its own mandate.

And, risking their client's money who were investing for their retirement.

[7] The story of Adani stock could ofcourse change.

BUT, when public money is being put to speculative purpose, you should ask rational questions.

BUT, when public money is being put to speculative purpose, you should ask rational questions.

Today it is Adanis, tomorrow, if this is approved as a system,

then honestly any private firm can be supported at length on taxpayer's money.

Again, not making this topic political: because SBI & LIC have been used as tools for political outcomes by several parties.

then honestly any private firm can be supported at length on taxpayer's money.

Again, not making this topic political: because SBI & LIC have been used as tools for political outcomes by several parties.

Unless, you ask questions, this game will continue.

A simple retweet will get this info to more people (please retweet the first tweet).

This is not a question of being a leftist/rightist, be a rationalist.

And, look at facts. Facts are apolitical.

A simple retweet will get this info to more people (please retweet the first tweet).

This is not a question of being a leftist/rightist, be a rationalist.

And, look at facts. Facts are apolitical.

Loading suggestions...

![[1] Here is the entire investment portfolio of LIC.

Since it is an Indian Public Sector life insur...](https://pbs.twimg.com/media/Fp4d99paAAAhvSj.jpg)

![[4] In the stock market (or with any investments for that matter), it is okay to make a loss.

That...](https://pbs.twimg.com/media/Fp4iWQFaYAIS5WZ.jpg)

![[6] Even more surprising: LIC decided not to cut its loss when the crisis was brought to light.

No...](https://pbs.twimg.com/media/Fp4jFt2akAE4CG5.jpg)