In my opinion, $LUSD stands out as one of the most decentralized stablecoins.

Here's a thread on @LiquityProtocol's product mechanism, followed by metrics analysis in the next one.

Let's dive in🧵

Here's a thread on @LiquityProtocol's product mechanism, followed by metrics analysis in the next one.

Let's dive in🧵

(1/21)

In this thread, I will cover:

1️⃣ What is Liquity?

2️⃣ Stability pool, liquidation & redistribution

3️⃣ Hard and soft peg mechanisms

4️⃣ $LQTY

5️⃣ Final thoughts

In this thread, I will cover:

1️⃣ What is Liquity?

2️⃣ Stability pool, liquidation & redistribution

3️⃣ Hard and soft peg mechanisms

4️⃣ $LQTY

5️⃣ Final thoughts

(2/21)

1️⃣ What is Liquity?

A decentralized platform enabling users to deposit $ETH & borrow $LUSD at a 0% interest rate, with a one-time fee, and a collateral ratio of 110%.

Liquity is fully decentralized, with 3rd party frontends available.

1️⃣ What is Liquity?

A decentralized platform enabling users to deposit $ETH & borrow $LUSD at a 0% interest rate, with a one-time fee, and a collateral ratio of 110%.

Liquity is fully decentralized, with 3rd party frontends available.

(3/21)

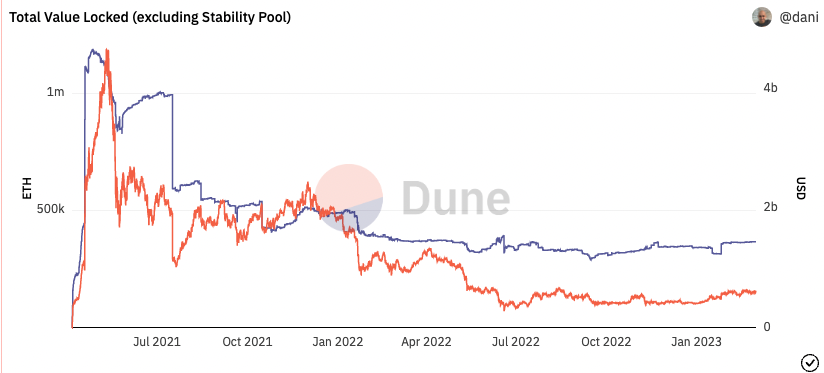

TVL in Liquity currently stands at $601M, with total revenue reaching $30M

Here are the the key benefits of @LiquityProtocol:

- 0% Interest

- Governance free

- Hard price ceiling and floor

- Censorship resistance

TVL in Liquity currently stands at $601M, with total revenue reaching $30M

Here are the the key benefits of @LiquityProtocol:

- 0% Interest

- Governance free

- Hard price ceiling and floor

- Censorship resistance

(4/21)

For those interested in minting LUSD and opening a Trove position, be sure to follow along with @BarryFried1's tweet thread.

He's got you covered with step-by-step instructions to ensure a seamless process.

For those interested in minting LUSD and opening a Trove position, be sure to follow along with @BarryFried1's tweet thread.

He's got you covered with step-by-step instructions to ensure a seamless process.

(5/21)

2️⃣ Stability pool, liquidation & redistribution

To ensure Liquity's solvency, the platform has established two layers of defense:

(i) Stability pool and liquidation as the first layer

(ii) Redistribution as the second layer

2️⃣ Stability pool, liquidation & redistribution

To ensure Liquity's solvency, the platform has established two layers of defense:

(i) Stability pool and liquidation as the first layer

(ii) Redistribution as the second layer

(6/21)

(i) Stability pool and liquidations as the first layer

The Stability Pool is the first line of defense in maintaining system solvency.

It ensures that the total LUSD supply always remains backed by acting as the source of liquidity to repay debt from liquidated Troves.

(i) Stability pool and liquidations as the first layer

The Stability Pool is the first line of defense in maintaining system solvency.

It ensures that the total LUSD supply always remains backed by acting as the source of liquidity to repay debt from liquidated Troves.

(7/21)

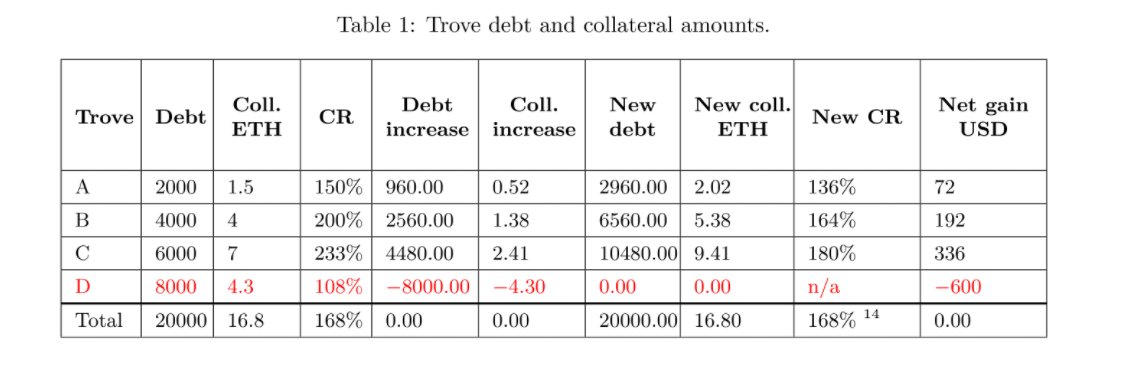

When any Trove is liquidated, an amount of LUSD corresponding to the remaining debt of the Trove is burned from the Stability Pool’s balance to repay its debt.

In exchange, the entire collateral from the Trove is transferred to the Stability Pool.

When any Trove is liquidated, an amount of LUSD corresponding to the remaining debt of the Trove is burned from the Stability Pool’s balance to repay its debt.

In exchange, the entire collateral from the Trove is transferred to the Stability Pool.

(8/21)

The Stability Pool is funded by users transferring LUSD into it (called Stability Providers).

Over time, Stability Providers lose a pro-rata share of their LUSD deposits while gaining a pro-rata share of the liquidated collateral.

The Stability Pool is funded by users transferring LUSD into it (called Stability Providers).

Over time, Stability Providers lose a pro-rata share of their LUSD deposits while gaining a pro-rata share of the liquidated collateral.

(9/21)

However, because Troves are likely to be liquidated at just below 110% collateral ratios, it is expected that Stability Providers will receive a greater dollar-value of collateral relative to the debt they pay off.

However, because Troves are likely to be liquidated at just below 110% collateral ratios, it is expected that Stability Providers will receive a greater dollar-value of collateral relative to the debt they pay off.

(11/21)

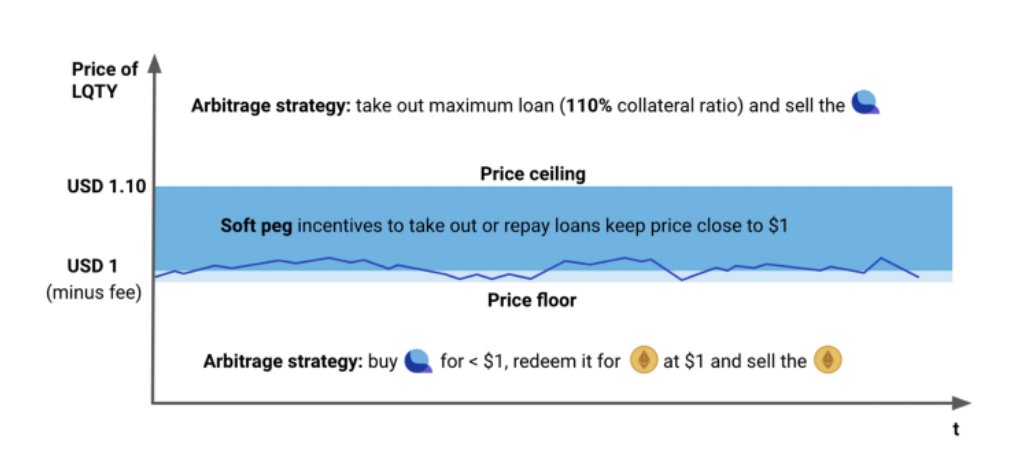

3️⃣ Hard and soft peg mechanisms

In order to protect users against LUSD depeg, @LiquityProtocol has adopted the hard and soft peg mechanisms.

3️⃣ Hard and soft peg mechanisms

In order to protect users against LUSD depeg, @LiquityProtocol has adopted the hard and soft peg mechanisms.

(14/21)

4️⃣ $LQTY

$LQTY is the utility token of Liquity. It rewards early adopters, frontend operators, and captures the fee revenue generated by the system.

$LQTY has a total supply of 100M, with a Mcap of $162M.

4️⃣ $LQTY

$LQTY is the utility token of Liquity. It rewards early adopters, frontend operators, and captures the fee revenue generated by the system.

$LQTY has a total supply of 100M, with a Mcap of $162M.

(15/21)

To receive $LQTY rewards, Users can:

- Deposit LUD into stability pool

- Provider of Frontends

- Provide Liquidity to the LUSDETH Uniswap pool

To receive $LQTY rewards, Users can:

- Deposit LUD into stability pool

- Provider of Frontends

- Provide Liquidity to the LUSDETH Uniswap pool

(16/21)

$LQTY holders can stake their tokens and earn fees generated by loan issuance and LUSD redemption.

However, there is no airdrop campaign for the token. The only means of acquiring $LQTY is through providing liquidity to the protocol

$LQTY holders can stake their tokens and earn fees generated by loan issuance and LUSD redemption.

However, there is no airdrop campaign for the token. The only means of acquiring $LQTY is through providing liquidity to the protocol

(17/21)

5️⃣ Final thoughts

Liquity has devised a meticulous strategy to uphold $LUSD peg by employing a 110% collateral ratio and strategic defense mechanisms.

5️⃣ Final thoughts

Liquity has devised a meticulous strategy to uphold $LUSD peg by employing a 110% collateral ratio and strategic defense mechanisms.

(18/21)

With the SEC's crackdown on "centralized" stablecoins, $LUSD has well positioned itself as a decentralized currency being governance-free, censorship-resistant and immutable.

With the SEC's crackdown on "centralized" stablecoins, $LUSD has well positioned itself as a decentralized currency being governance-free, censorship-resistant and immutable.

(19/21)

Tagging @LiquityProtocol experts for thoughts🤩

@kindahangry

@korpi87

@rick_liquity

@anasakkad

@thedefivillain

@ugliestduck

@DerrickN_

@Subli_Defi

@TokenBrice

@Ishanb22

@BarryFried1

@0x_d24

Tagging @LiquityProtocol experts for thoughts🤩

@kindahangry

@korpi87

@rick_liquity

@anasakkad

@thedefivillain

@ugliestduck

@DerrickN_

@Subli_Defi

@TokenBrice

@Ishanb22

@BarryFried1

@0x_d24

(20/21)

My CT mentors who are expert threadooors you must follow😙 (Part I)

@defi_mochi

@eli5_defi

@DefiIgnas

@midoji7

@karl_0x

@DeFiMinty

@Slappjakke

@rektdiomedes

@TheDeFinvestor

@LouisCooper_

@BackTheBunny

@crypto_linn

@DegenSpartan

@0xCrypto_doctor

@wintersoldierxz

My CT mentors who are expert threadooors you must follow😙 (Part I)

@defi_mochi

@eli5_defi

@DefiIgnas

@midoji7

@karl_0x

@DeFiMinty

@Slappjakke

@rektdiomedes

@TheDeFinvestor

@LouisCooper_

@BackTheBunny

@crypto_linn

@DegenSpartan

@0xCrypto_doctor

@wintersoldierxz

(21/21)

My CT mentors who are expert threadooors you must follow😙 (Part II)

@charlie_defi

@alpha_pls

@DeFi_Cheetah

@Louround_

@CryptoDeFiGuy

@0xJamesXXX

@ThorHartvigsen

@Chinchillah_

@0xTindorr

@0xCrypto_doctor

@VirtualKenji

@DefiPrinces

@crypto_linn

@DAdvisoor

My CT mentors who are expert threadooors you must follow😙 (Part II)

@charlie_defi

@alpha_pls

@DeFi_Cheetah

@Louround_

@CryptoDeFiGuy

@0xJamesXXX

@ThorHartvigsen

@Chinchillah_

@0xTindorr

@0xCrypto_doctor

@VirtualKenji

@DefiPrinces

@crypto_linn

@DAdvisoor

Loading suggestions...