LSDfi is the hot narrative on CT right now.

However, @eigenlayer is unlocking the potential of ETH staking, & most are unaware about it.

This thread will delve into the WHY & HOW of Eigenlayer in a way that even your granny gets it!

No jargons, just simplified tech.

Lets go🧵

However, @eigenlayer is unlocking the potential of ETH staking, & most are unaware about it.

This thread will delve into the WHY & HOW of Eigenlayer in a way that even your granny gets it!

No jargons, just simplified tech.

Lets go🧵

Abbreviations used in the thread :

Eigenlayer == 'EL'

Ethereum network == 'ETH'

Data Availability == 'DA'

Eigenlayer == 'EL'

Ethereum network == 'ETH'

Data Availability == 'DA'

This thread will cover:

1️⃣ 'Why' of EL

1.1 Ethereum’s innovation

1.2 Issues with middleware on ETH

2️⃣ 'How' of EL

3️⃣ Benefits of EL

3.1 No marginal cost of capital

3.2 Value alignment

3.3 Customizable slashing conditions

3.4 Reduces systemetic risk

4️⃣ EL's DA layer

Dive in 🪂

1️⃣ 'Why' of EL

1.1 Ethereum’s innovation

1.2 Issues with middleware on ETH

2️⃣ 'How' of EL

3️⃣ Benefits of EL

3.1 No marginal cost of capital

3.2 Value alignment

3.3 Customizable slashing conditions

3.4 Reduces systemetic risk

4️⃣ EL's DA layer

Dive in 🪂

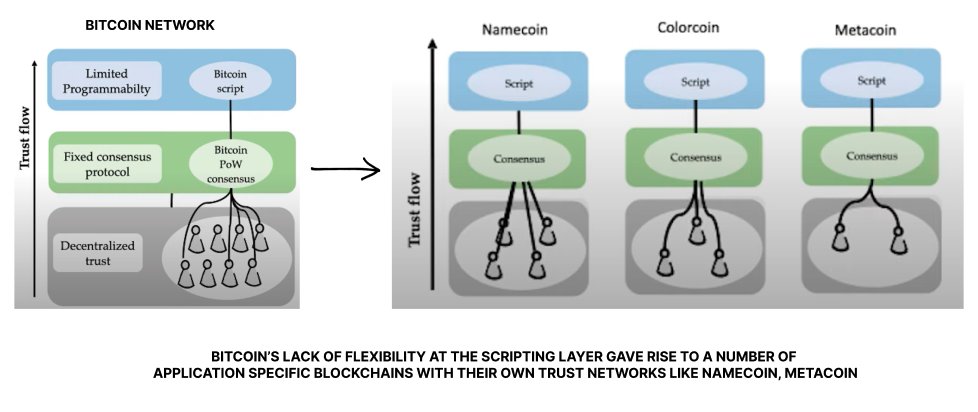

But apart from the new scripting layer, you needed a separate trust layer too.

There was no way to borrow trust from existing trust networks.

A new trust layer meant getting validators/ miners in place, which is very hard to do.

There was no way to borrow trust from existing trust networks.

A new trust layer meant getting validators/ miners in place, which is very hard to do.

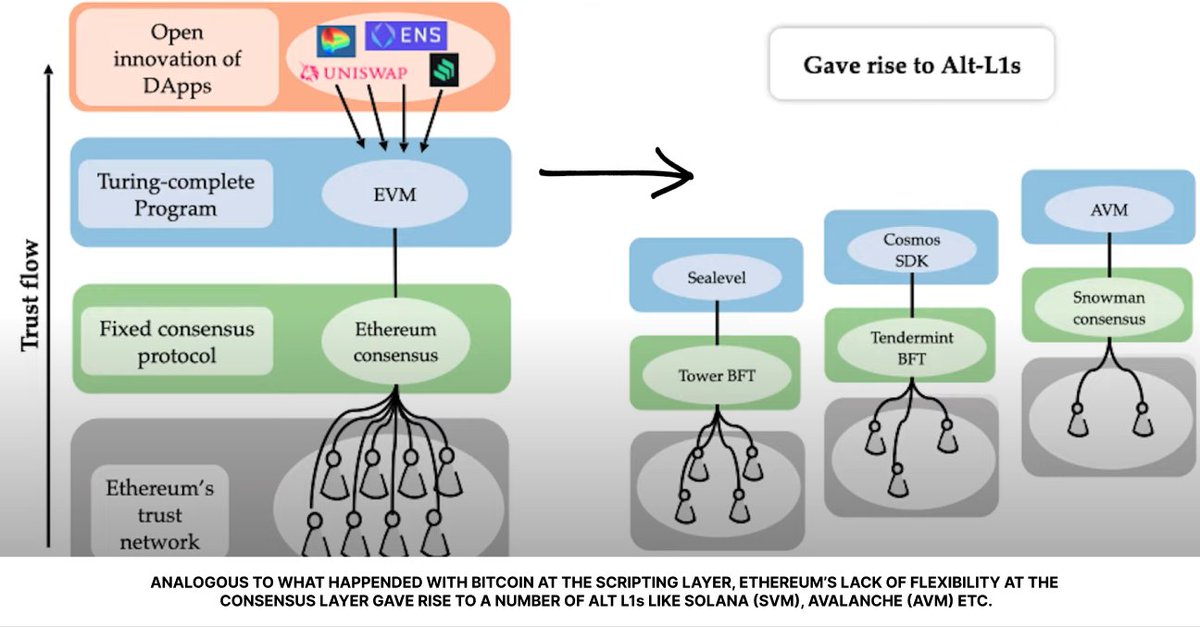

The lack of customization of BTC at scripting layer gave rise chains like namecoin & metacoin.

Similarly, lack of customization of ETH at consensus layer gave rise to Alt L1s.

What ETH did to BTC at the scripting layer, @eigenlayer is trying to do to ETH at the consensus layer.

Similarly, lack of customization of ETH at consensus layer gave rise to Alt L1s.

What ETH did to BTC at the scripting layer, @eigenlayer is trying to do to ETH at the consensus layer.

1.2 Issues with middleware on ETH

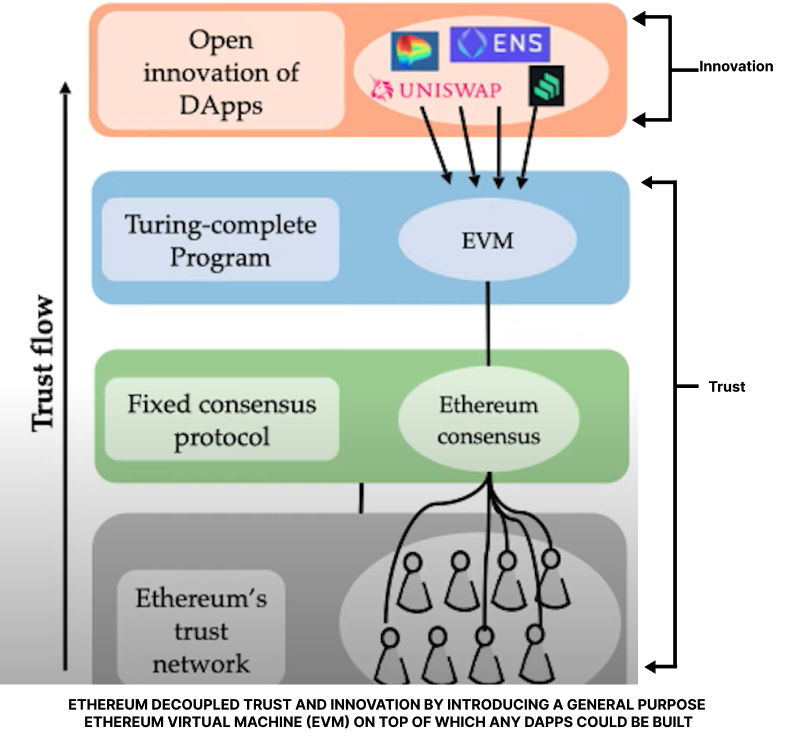

The Dapps built on top of Ethereum borrow security from ETH’s trust layer.

ETH helps with transaction ordering and trasaction execution i.e. block making.

Anything else apart from this, a separate trust network is needed.

The Dapps built on top of Ethereum borrow security from ETH’s trust layer.

ETH helps with transaction ordering and trasaction execution i.e. block making.

Anything else apart from this, a separate trust network is needed.

Thus, if you need to read data from the internet (oracles), read data from another blockchain (bridges), run a different execution engine (SVM) --> you will have to create a new trust network.

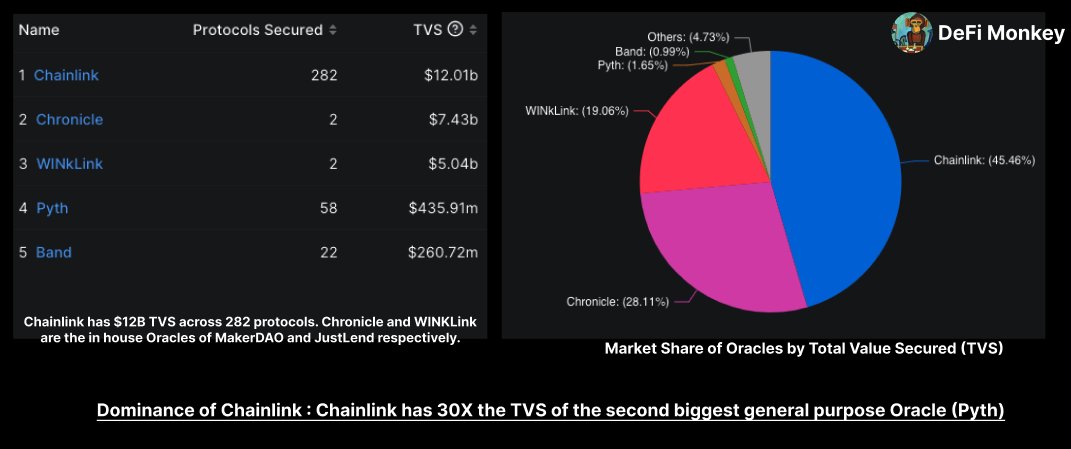

This is the reason Oracles like @chainlink have their own trust network & validators.

This is the reason Oracles like @chainlink have their own trust network & validators.

For high network security, you need high capital to be staked.

Here in lies the problem.

Each $ of capital staked has a cost of capital associated with it, i.e. a real yield that the staker has to earn on it for it to make sense for them.

Here in lies the problem.

Each $ of capital staked has a cost of capital associated with it, i.e. a real yield that the staker has to earn on it for it to make sense for them.

Example : for $10 Billion staked in an oracle network, you need to pay 5-10% of APR on the capital staked to sustain it in a non speculative way.

This means, $0.5B - $1B per annum is the cost of capital needed to secure the network with $10B.

Whew!

This means, $0.5B - $1B per annum is the cost of capital needed to secure the network with $10B.

Whew!

Thus, most middleware systems are not capped by operational cost, they are capped by capital cost.

For any POS system, the operational cost is mostly 5% while the capital cost is 95%.

Ex. Lido node operators earn 5% of the reward, while the capital staker earns 90% of reward.

For any POS system, the operational cost is mostly 5% while the capital cost is 95%.

Ex. Lido node operators earn 5% of the reward, while the capital staker earns 90% of reward.

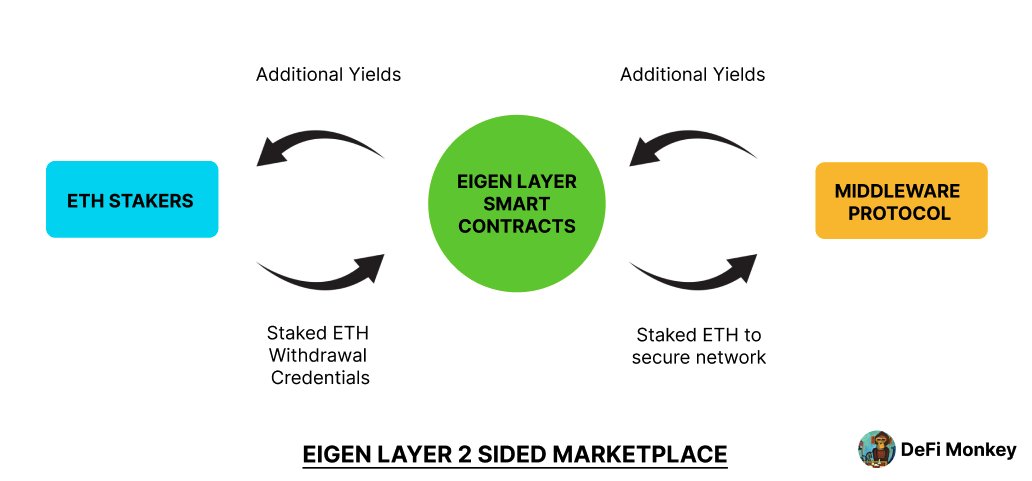

If an existing ETH staker wants to opt into EL, they will just set the withdrawal credentials to the EL smart contracts.

As a result, the staked ETH can be used by EL to secure the trust network of other middleware (like an Oracle), with its own slashing conditions.

As a result, the staked ETH can be used by EL to secure the trust network of other middleware (like an Oracle), with its own slashing conditions.

3️⃣ Benefits of EL

3.1 No marginal cost of capital

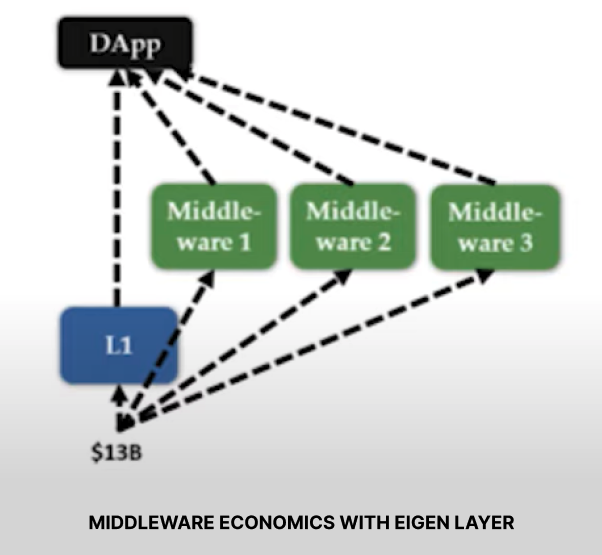

There is no need to get additional capital for the new trust network.

If the marginal operational cost for the staker is justifiied by the revenue earned on the middleware, it makes sense for them to opt-in.

3.1 No marginal cost of capital

There is no need to get additional capital for the new trust network.

If the marginal operational cost for the staker is justifiied by the revenue earned on the middleware, it makes sense for them to opt-in.

3.2 Value alignment

EL enables additional yield on top of staked ETH.

The fact that there are more potential yield opportunities for staked ETH, increases the value of the $ETH token itself.

This helps align stakers, middleware protocols & the ETH community (token holders).

EL enables additional yield on top of staked ETH.

The fact that there are more potential yield opportunities for staked ETH, increases the value of the $ETH token itself.

This helps align stakers, middleware protocols & the ETH community (token holders).

3.3 Customizable slashing conditions

For a middleware protocol, customized slashing conditions can be set.

These slashing conditions cannot be integrated at the base ETH layer, but can be done as an opt in layer as part of the new trust network (making it on chain verifiable).

For a middleware protocol, customized slashing conditions can be set.

These slashing conditions cannot be integrated at the base ETH layer, but can be done as an opt in layer as part of the new trust network (making it on chain verifiable).

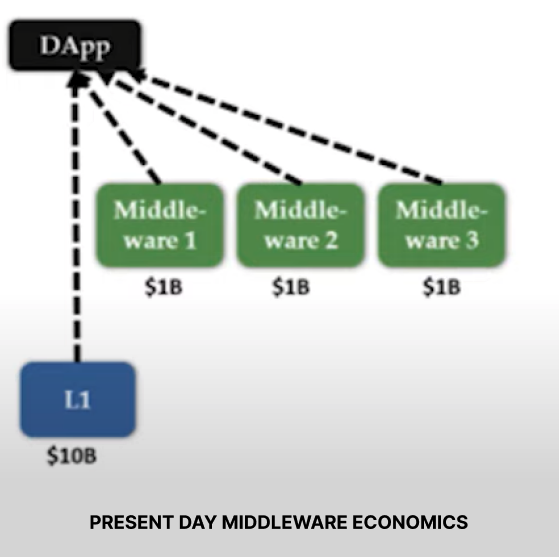

The cost of corruption of the Dapp here is the min of out of the $ staked for each of the networks.

Even if one amongst them is corrupted, the Dapp gets corrupted.

Thus, the cost of corrupting the Dapp is $1B in this case.

Even if one amongst them is corrupted, the Dapp gets corrupted.

Thus, the cost of corrupting the Dapp is $1B in this case.

4️⃣ EL's DA layer

EL has built a hyperscale data availability (DA) layer as one of it's early offerings.

DA is one of the key bottlenecks to ETH scalability.

@0xMantle is already building a modular rollup using EL's DA layer!

EL has built a hyperscale data availability (DA) layer as one of it's early offerings.

DA is one of the key bottlenecks to ETH scalability.

@0xMantle is already building a modular rollup using EL's DA layer!

For those of you who want to dig deeper, here is the link to the discussion on this topic, with participation from Vitalik and Sreeram.

While Vitalik seems to acknowledge EL's value proposition, he says it is no substitute to EIP 4844 (we agree!).

ethresear.ch

While Vitalik seems to acknowledge EL's value proposition, he says it is no substitute to EIP 4844 (we agree!).

ethresear.ch

Thanks for reading the long thread, anon!

If you liked it, please like and share it.

I am still a novice learner in the space, so apologies for any errors.

Feel free to suggest feedback and changes.

If you liked it, please like and share it.

I am still a novice learner in the space, so apologies for any errors.

Feel free to suggest feedback and changes.

Loading suggestions...