Family wealth is a long-term game played by long-term people.

To win, you need structures that keep your wealth "in-house".

That's why you need a Family Bank.

Here's how it works:

To win, you need structures that keep your wealth "in-house".

That's why you need a Family Bank.

Here's how it works:

The Family Bank is a wealth structure families use to build generational wealth.

Every family's long-term wealth includes:

• Social Capital - member's relationships

• Human Capital - members & their well-being

• Intellectual Capital - members' skills & knowledge

Every family's long-term wealth includes:

• Social Capital - member's relationships

• Human Capital - members & their well-being

• Intellectual Capital - members' skills & knowledge

With funding secured, the young entrepreneur:

• struggles

• learns new skills

• forms new helpful relationships

• gains traction and ultimately succeeds

Question: How much of this new wealth leaks from your family?

Answer: All of it.

• struggles

• learns new skills

• forms new helpful relationships

• gains traction and ultimately succeeds

Question: How much of this new wealth leaks from your family?

Answer: All of it.

Yes: they own the equity, did the work & deserve the financial rewards.

But what about the valuable:

• new relationships?

• new knowledge and experience?

• opportunity for closer bonds as family?

It's is an unfortunate & unnecessary leak of your family's wealth.

But what about the valuable:

• new relationships?

• new knowledge and experience?

• opportunity for closer bonds as family?

It's is an unfortunate & unnecessary leak of your family's wealth.

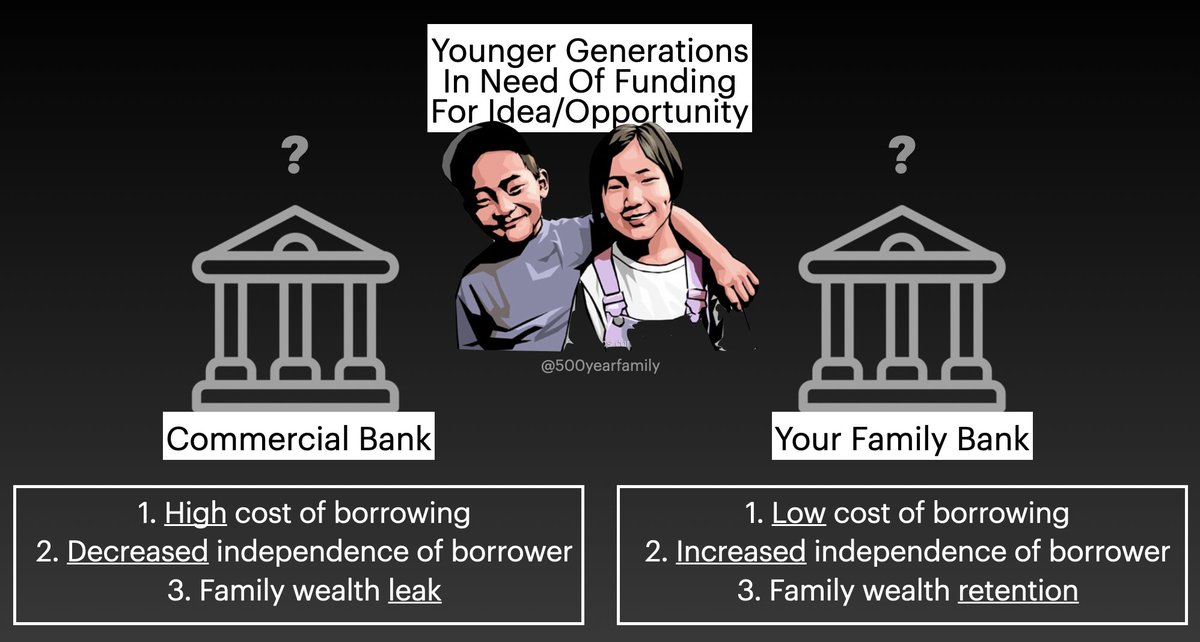

Enter the Family Bank:

•Informal wealth structure (not a separate entity)

•Gives loans to invest in family member's development

•Loans at low rates not publicly available at banks/lender

•Loan terms require all new capital be brought back to the family

Here's how it works:

•Informal wealth structure (not a separate entity)

•Gives loans to invest in family member's development

•Loans at low rates not publicly available at banks/lender

•Loan terms require all new capital be brought back to the family

Here's how it works:

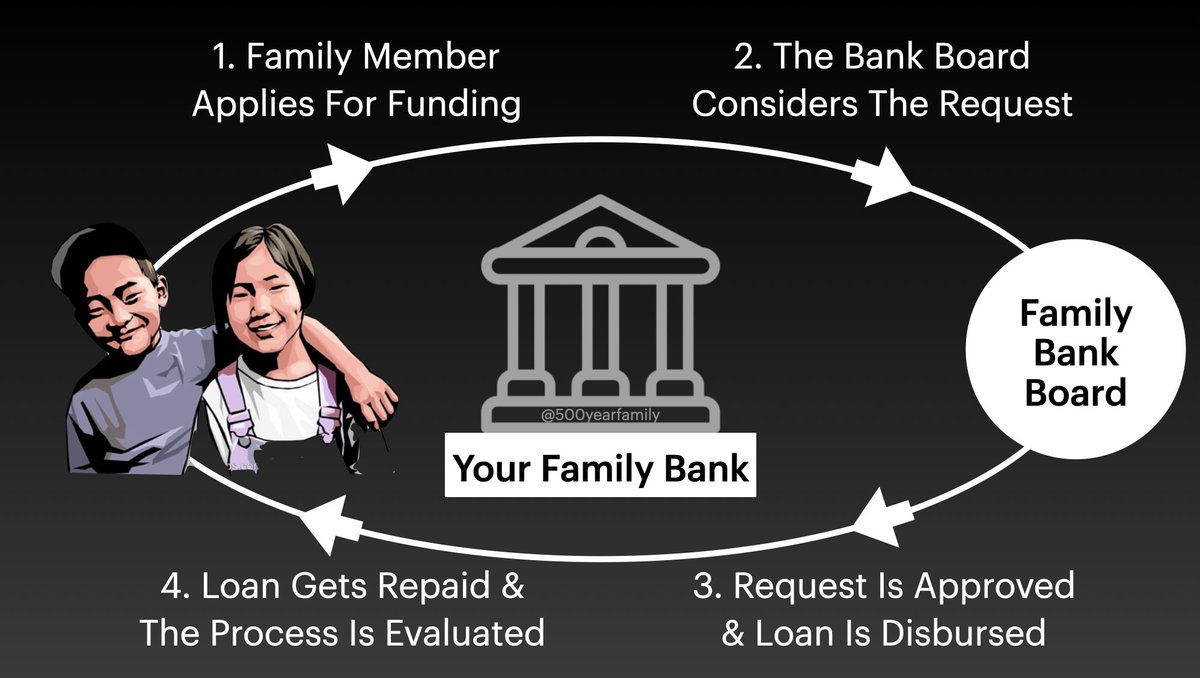

1. Family Member Applies For Funding:

It could be a business idea or an educational opportunity.

They present a written proposal to the "Bank Board" (usually parents or grandparents) detailing the amount requested and use of the funds.

It could be a business idea or an educational opportunity.

They present a written proposal to the "Bank Board" (usually parents or grandparents) detailing the amount requested and use of the funds.

2. The Bank Board Considers The Request

The Board meets, discusses, and communicates feedback/follow-up questions/concerns.

If adjustments are needed, now's the time.

The Board looks for reasons to say "yes" but values a growth opportunity for the younger family member most.

The Board meets, discusses, and communicates feedback/follow-up questions/concerns.

If adjustments are needed, now's the time.

The Board looks for reasons to say "yes" but values a growth opportunity for the younger family member most.

3. Loan Is Approved & Funds Are Disbursed

The favorable loan has ongoing caveats for the borrower.

Like ongoing interest payments, they give:

•regular updates on how they're doing

•regular updates on what they're learning

•regular introductions to new friends & colleagues

The favorable loan has ongoing caveats for the borrower.

Like ongoing interest payments, they give:

•regular updates on how they're doing

•regular updates on what they're learning

•regular introductions to new friends & colleagues

4. Loan Is Repaid & Process Is Evaluated

Ideally the loan gets repaid, and funds are used again for the next family member.

The loan may not get repaid, and that's okay.

Again, the priority is the ongoing growth of the family's human, intellectual, & social capital.

Ideally the loan gets repaid, and funds are used again for the next family member.

The loan may not get repaid, and that's okay.

Again, the priority is the ongoing growth of the family's human, intellectual, & social capital.

The Family Bank Advantage:

•Reinforcement Of Family Values

•Keeping Long-Term Wealth "In-House"

•Meaningful Practice Making Joint Decisions Together

•Valuable Entrepreneurial Development For Younger Generations

•Reinforcement Of Family Values

•Keeping Long-Term Wealth "In-House"

•Meaningful Practice Making Joint Decisions Together

•Valuable Entrepreneurial Development For Younger Generations

That's it!

If you enjoyed this thread, then:

→ Follow me @500YearFamily for weekly info like this.

→ RT the first tweet to share it with others.

If you enjoyed this thread, then:

→ Follow me @500YearFamily for weekly info like this.

→ RT the first tweet to share it with others.

I give a full blueprint & templates for building your own Family Bank in my new course: Foundations.

Price increases soon ↓ 500yearfamily.com

Price increases soon ↓ 500yearfamily.com

Every Monday I share one deep-dive insight into building generational wealth.

Join 2,000+ subscribers who read it every week: 500yearfamily.com

Join 2,000+ subscribers who read it every week: 500yearfamily.com

Loading suggestions...