The biggest roadblock to business growth is money.

But how do you know which new initiative to chase?

Use this 5-part framework to decide:

But how do you know which new initiative to chase?

Use this 5-part framework to decide:

Tuesday I wrote about maintenance CapEx. This is the equipment needed to keep your business going at the same size.

Today, we talk about growth CapEx, which is what you need to grow your business.

We break the process down into 5 steps.

Let’s dig in:

Today, we talk about growth CapEx, which is what you need to grow your business.

We break the process down into 5 steps.

Let’s dig in:

1. Identify and prioritize

“I just evaluate the opportunities that are brought to me.”

Noooooo.

You prioritize the loudest people and they learn they have to be loud to win.

Every business should have annual strategic planning.

This moves you from reactive to proactive mode.

“I just evaluate the opportunities that are brought to me.”

Noooooo.

You prioritize the loudest people and they learn they have to be loud to win.

Every business should have annual strategic planning.

This moves you from reactive to proactive mode.

2. Evaluate proposals against your strategic goals

Ask:

1. Which most aligns with my goals?

2. Which pair together well?

3. What could I afford?

By evaluating them TOGETHER, we assure we don’t get bias that can occur when viewing them alone.

Rate them based on their urgency.

Ask:

1. Which most aligns with my goals?

2. Which pair together well?

3. What could I afford?

By evaluating them TOGETHER, we assure we don’t get bias that can occur when viewing them alone.

Rate them based on their urgency.

3. Calculate the cost

Hot take time: NPV and IRR stink.

They are:

- Complicated to calculate

- Easy to manipulate

- Ignore project size

Instead, I focus on:

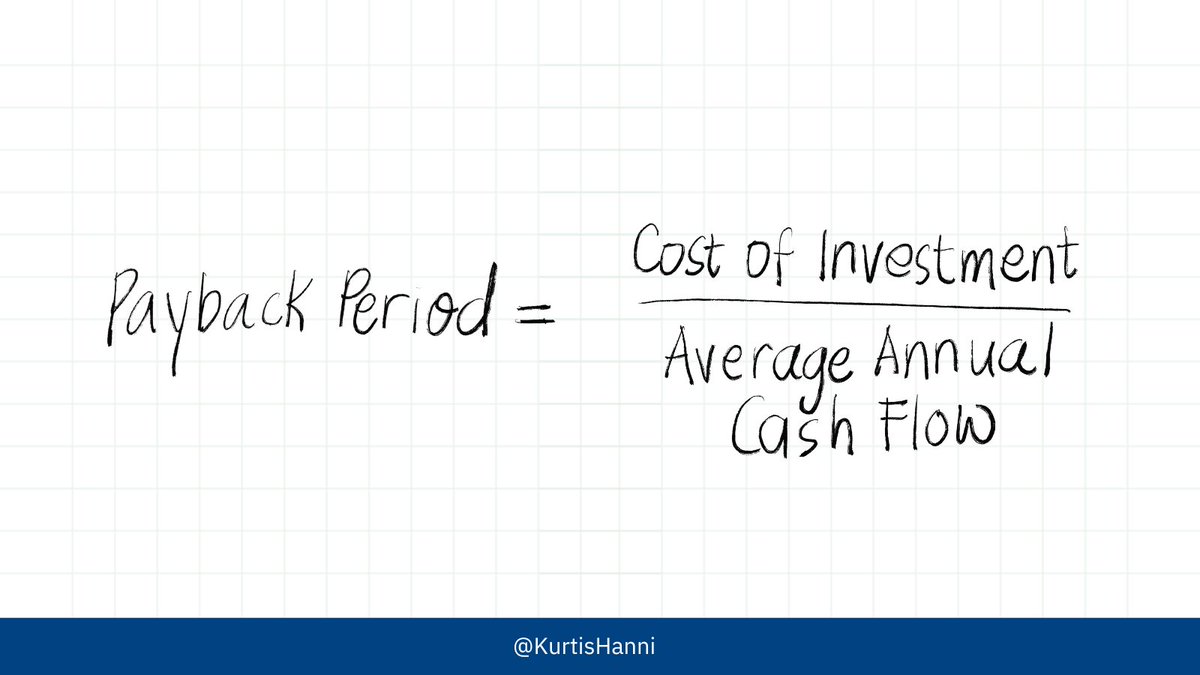

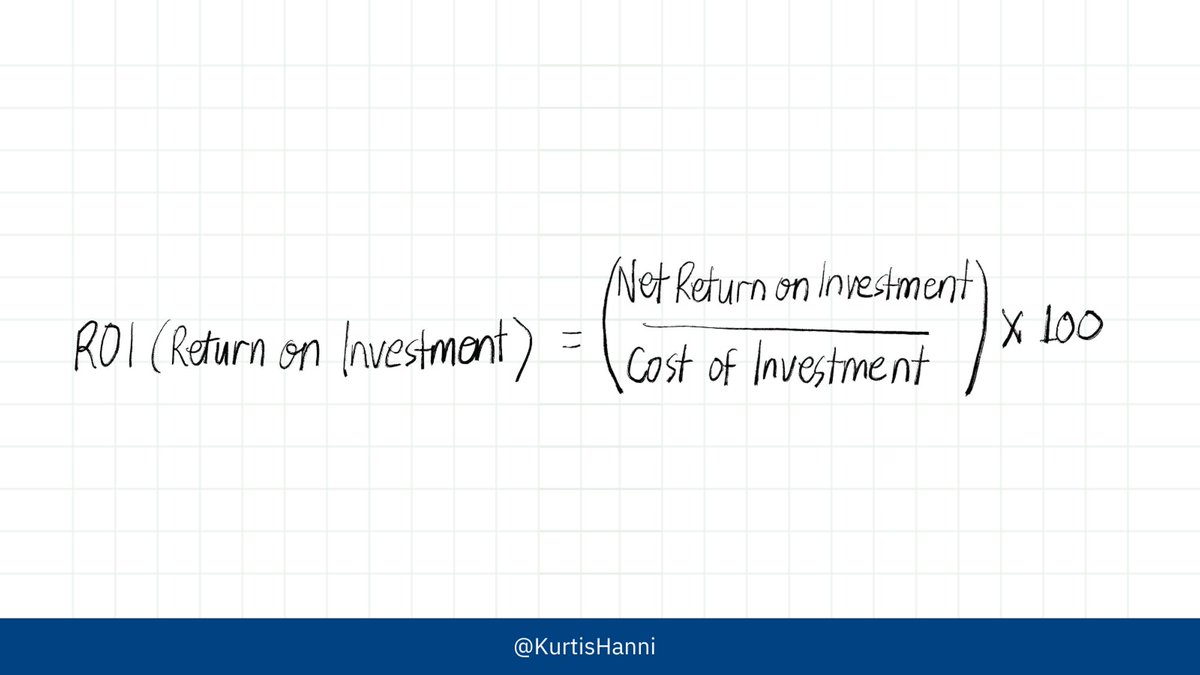

• Payback

• Return on Investment (ROI)

• Cash flow impact

I go in-depth on NPV & IRR here:

kurtishanni.com

Hot take time: NPV and IRR stink.

They are:

- Complicated to calculate

- Easy to manipulate

- Ignore project size

Instead, I focus on:

• Payback

• Return on Investment (ROI)

• Cash flow impact

I go in-depth on NPV & IRR here:

kurtishanni.com

• Impact on cash flows

Whether buying straight up or taking out a loan, you need to understand impact on cash and cash flow.

Ask:

- How long will it take to replenish?

- What’s my cash flow margin?

- What would make it catastrophic?

- How could it limit options tomorrow?

Whether buying straight up or taking out a loan, you need to understand impact on cash and cash flow.

Ask:

- How long will it take to replenish?

- What’s my cash flow margin?

- What would make it catastrophic?

- How could it limit options tomorrow?

4. Assess your risks and do scenario planning

• Risk Assessment

Everyone miss-assesses risk.

Look in-dept at:

1. Market

2. Financial

3. Operational

Spend the majority of your time on this step.

It’s the most important because a miss-assessment could damage your business.

• Risk Assessment

Everyone miss-assesses risk.

Look in-dept at:

1. Market

2. Financial

3. Operational

Spend the majority of your time on this step.

It’s the most important because a miss-assessment could damage your business.

• Scenario Analysis

Create different scenarios with the formulas above,

then “plug” risk into each.

Make sure you:

- Create ideal & worst case

- Combine different options

- Use consistent assumptions

- Ask others to check your math

- Write up pros & cons of each scenario

Create different scenarios with the formulas above,

then “plug” risk into each.

Make sure you:

- Create ideal & worst case

- Combine different options

- Use consistent assumptions

- Ask others to check your math

- Write up pros & cons of each scenario

5. Make a choice

You now “know” what you need to know.

3 steps to finalize the process:

• Determine your desire

• Create a plan

• Communicate it

We’ll dig into this Tuesday, but subscribers read it on Thursday.

Join 20k subscribed & read it here:

kurtishanni.com

You now “know” what you need to know.

3 steps to finalize the process:

• Determine your desire

• Create a plan

• Communicate it

We’ll dig into this Tuesday, but subscribers read it on Thursday.

Join 20k subscribed & read it here:

kurtishanni.com

Thank you for reading!

If you enjoyed this thread:

• Follow me @KurtisHanni for more threads like this

• RT the tweet below to share this thread with your audience

If you enjoyed this thread:

• Follow me @KurtisHanni for more threads like this

• RT the tweet below to share this thread with your audience

Loading suggestions...