As I promised with everyone.I'll bring my analysis about an undervalued Smallcap Auto Ancillary company whose clients are:-Hero Motocorp,Bajaj Auto, Tata Motors,JLR,Hyundai,Kia, Maruti. So, the name of that Auto Ancillary company is 'TALBROS AUTOMOTIVE COMPONENTS'

#TalbrosAuto

#TalbrosAuto

💫Sales of this division is 50% exports and 50% domestic sales.

💫Talbros is moving towards heavier machine components in this segment, to improve retail ratios.

💫Management is guiding towards Rs 300 Cr revenue in forgings segment in next three financial years

💫Talbros is moving towards heavier machine components in this segment, to improve retail ratios.

💫Management is guiding towards Rs 300 Cr revenue in forgings segment in next three financial years

💫This JV has received multi-year order from large European car maker for body in white parts.

💫The order supplies will begin in Q1FY22.

💫The annual order value is estimated at Rs 14.4 crores.

💫The order value is estimated at

approximately Rs. 92 crores over the life of

💫The order supplies will begin in Q1FY22.

💫The annual order value is estimated at Rs 14.4 crores.

💫The order value is estimated at

approximately Rs. 92 crores over the life of

with the help of JV partner.

💫Management has guided towards 30-40% CAGR growth in next 5 years in Talbros Marugo JV

☑️Low Capex And High Capacity Utilisation

💫The management has guided towards large order pipeline, and is expecting operating leverage benefits due to very low

💫Management has guided towards 30-40% CAGR growth in next 5 years in Talbros Marugo JV

☑️Low Capex And High Capacity Utilisation

💫The management has guided towards large order pipeline, and is expecting operating leverage benefits due to very low

capex required to fulfill orders

💫The management has guided towards 8 to 9 Cr capex in gaskets division(where capacity utilisation is 85%) and 7 to 8 Cr capex in forgings division(where capacity utilisation is 82 to 83%) in next one year.

💫This comprises of both-maintenance

💫The management has guided towards 8 to 9 Cr capex in gaskets division(where capacity utilisation is 85%) and 7 to 8 Cr capex in forgings division(where capacity utilisation is 82 to 83%) in next one year.

💫This comprises of both-maintenance

and growth capex.

☑️Many Production Capacities

💫The company has four gasket production facilities: two at Faridabad(Haryana), one at Pune (Maharashtra) and one at Sitarganj (Uttarakhand).

💫It has a materials division at Sohna, and a forging plant at Bawal in Rewari(Haryana)

☑️Many Production Capacities

💫The company has four gasket production facilities: two at Faridabad(Haryana), one at Pune (Maharashtra) and one at Sitarganj (Uttarakhand).

💫It has a materials division at Sohna, and a forging plant at Bawal in Rewari(Haryana)

☑️Leadership And Marquee Clients

💫The company is a single source supplier to 5 customers including Hero Motocorp and Bajaj Auto.

💫Other clients include Tata Motors, JLR, HMSI, Volvo, Hyundai, KIA and Maruti

💫The company is a single source supplier to 5 customers including Hero Motocorp and Bajaj Auto.

💫Other clients include Tata Motors, JLR, HMSI, Volvo, Hyundai, KIA and Maruti

☑️Fundamental Analysis

✅Market Capitalisation:- Rs 660 Cr(Smallcap)

✅Stock PE:- 11.9(Very Much Undervalued)

✅Industry PE:- 24.2

✅Dividend Yield:- 0.47%(Low Dividend)

✅ROCE:- 20.4%(Good)

✅ROE:- 17.8%(Good)

✅Face Value:- 10

✅Intrinsic Value:- Rs 717(Undervalued)

✅Market Capitalisation:- Rs 660 Cr(Smallcap)

✅Stock PE:- 11.9(Very Much Undervalued)

✅Industry PE:- 24.2

✅Dividend Yield:- 0.47%(Low Dividend)

✅ROCE:- 20.4%(Good)

✅ROE:- 17.8%(Good)

✅Face Value:- 10

✅Intrinsic Value:- Rs 717(Undervalued)

✅Chart Pattern📉📈 Financial Analysis⚖️♎ My Commentary👨💻

💫Chart Pattern Analysis(Weekly Time Frame)

✅The Stock is trading above all the EMAs and DMAs

✅A very nice accumulation has happened in this stock from Rs 385-540+ Zone

✅The stock is forming a very good support @505

💫Chart Pattern Analysis(Weekly Time Frame)

✅The Stock is trading above all the EMAs and DMAs

✅A very nice accumulation has happened in this stock from Rs 385-540+ Zone

✅The stock is forming a very good support @505

On weekly Timeframe Basis

✅The weakness will only come below Rs 505; below Rs 505 the support of the stock is placed at Rs 497/480+

✅ATH of the Stock came on FY22 as on 17/1/2022. ATH was @Rs 658

✅At its ATH, Market rewarded it with 17-18 PE Ratio with just 36.36 Earnings

✅The weakness will only come below Rs 505; below Rs 505 the support of the stock is placed at Rs 497/480+

✅ATH of the Stock came on FY22 as on 17/1/2022. ATH was @Rs 658

✅At its ATH, Market rewarded it with 17-18 PE Ratio with just 36.36 Earnings

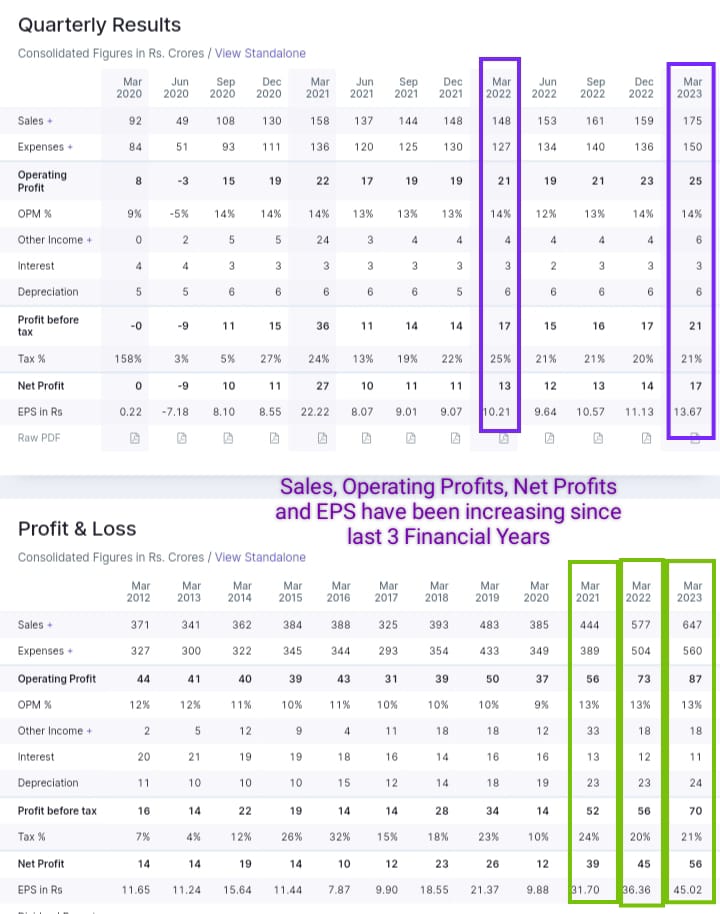

increasing since the last 4 years

✅Company's Sales has increased by about 12.12% on YOY Basis and Operating Profits has increased by about 20% on YOY Basis

✅EPS has increased from 36.36 to 45.02

✅TALBROS AUTOMATIVE EPS is increasing since 2016 itself(Ignore 2020) it is a

✅Company's Sales has increased by about 12.12% on YOY Basis and Operating Profits has increased by about 20% on YOY Basis

✅EPS has increased from 36.36 to 45.02

✅TALBROS AUTOMATIVE EPS is increasing since 2016 itself(Ignore 2020) it is a

Microcap Company and it has full potential 💎💎 to become a Small Cap company

✅In last Bull Market 🐂 is has traded at 29 PE Ratio at 20 PE Ratio its share price can reach at Rs 900+

✅If the market Rewards it at last Bull Market PE Ratio its share price is coming at Rs 1300+

✅In last Bull Market 🐂 is has traded at 29 PE Ratio at 20 PE Ratio its share price can reach at Rs 900+

✅If the market Rewards it at last Bull Market PE Ratio its share price is coming at Rs 1300+

(1300 is not the final target my long term target 🎯 is Rs 1100+ Target 🎯 will increase if the company continues to perform well)

✅Counter Thesis

With just 7-8% Margins and Sales of Rs 393 Cr the Market has rewarded NDR AUTO with Rs 475 Cr Market Capitalisation and 16.9 PE

✅Counter Thesis

With just 7-8% Margins and Sales of Rs 393 Cr the Market has rewarded NDR AUTO with Rs 475 Cr Market Capitalisation and 16.9 PE

Ratio. Now, try to find out the actual and real value 💎💎 of TALBROS AUTOMATIVE COMPONENTS. The company is currently, pulling out 13-14% Margins. Market Capitalisation= Sales and PE Ratio is only 11.9 when Industry PE Ratio is at 24.2 and Intrinsic value is at Rs 717

I'm not giving any B/S Advice. I've given every informationℹ️ about this company. Now, it is on Investors to take their own assessments. If you Buy on the basis of this thread 🧵 and make profits you'll not share your profits with me likewise I'll not be responsible for loss too.

This thread🧵took about 12 Hours of time. Try to retweet ♻️ this thread so that it reaches more and more market participants. Your Retweet will motivate me to make more Business thread 🧵 of undervalued companies. I'm again repeating that this is not a Buy advice.

#TalbrosAuto

#TalbrosAuto

Loading suggestions...