3. Relative outperformance

: It is nothing but outperformance.

: If index falls by 2% and these stocks are stable it is highly probable that they will rise again when index is flat if not +ve

: Their fall as compared to index is always small and rise always big

: It is nothing but outperformance.

: If index falls by 2% and these stocks are stable it is highly probable that they will rise again when index is flat if not +ve

: Their fall as compared to index is always small and rise always big

7. VCP

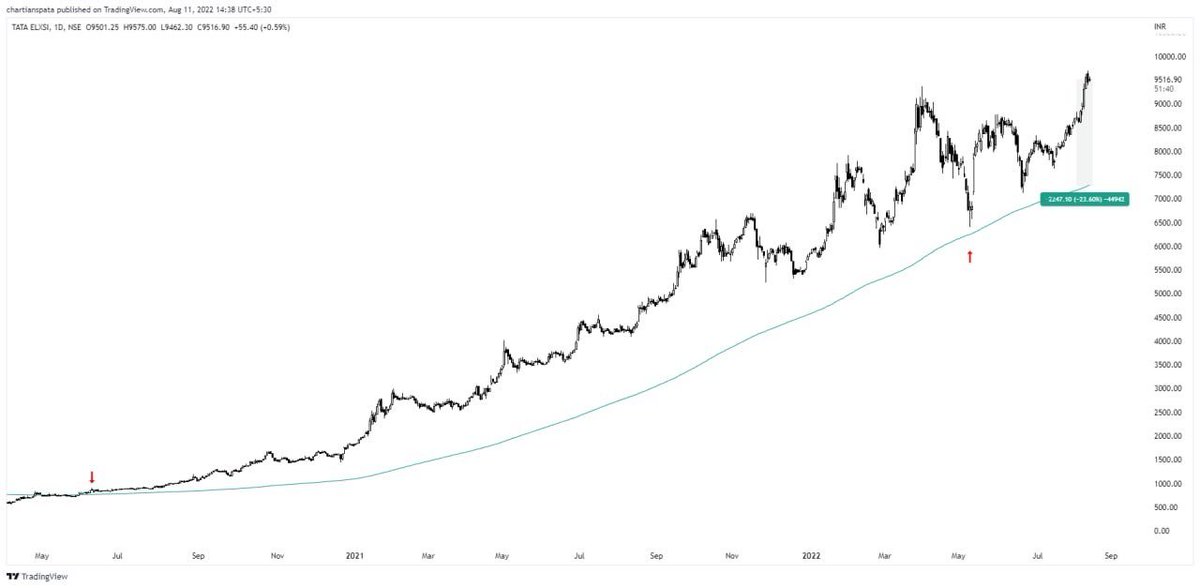

: After every dip stock tends to show volatility contraction

: This simply means that every fall is smaller than previous one

: They show contraction before upthrust

: After every dip stock tends to show volatility contraction

: This simply means that every fall is smaller than previous one

: They show contraction before upthrust

8. Pattern inside pattern

: They usually move in range and consolidation

: After every move these stocks have tendencies to make a range snd then move up

: In that range some stocks make CNH or INVHNS and then give breakout of a bigger flag kind of s thing

: They usually move in range and consolidation

: After every move these stocks have tendencies to make a range snd then move up

: In that range some stocks make CNH or INVHNS and then give breakout of a bigger flag kind of s thing

: Discretion observation over the time : This can help you enter more qty and with defined stop1311

: Even if they make LL they tend to make them within a defined pattern

11. Pull out investment

: Want to actually ride a bagger ? Then I usually exit 70-80% positions once the stock does a 100% move

Once that happens I practically get free money and compounding plays its role.

: Want to actually ride a bagger ? Then I usually exit 70-80% positions once the stock does a 100% move

Once that happens I practically get free money and compounding plays its role.

For more such strategies and Market updates like and retweet this below tweet :

Loading suggestions...