1⃣ CCI Basics

• CCI > 100 = Bullish

• CCI < -100 = Bearish

Wanna learn more about this indicator? Watch this video 👇

youtu.be

• CCI > 100 = Bullish

• CCI < -100 = Bearish

Wanna learn more about this indicator? Watch this video 👇

youtu.be

2⃣Entry criteria

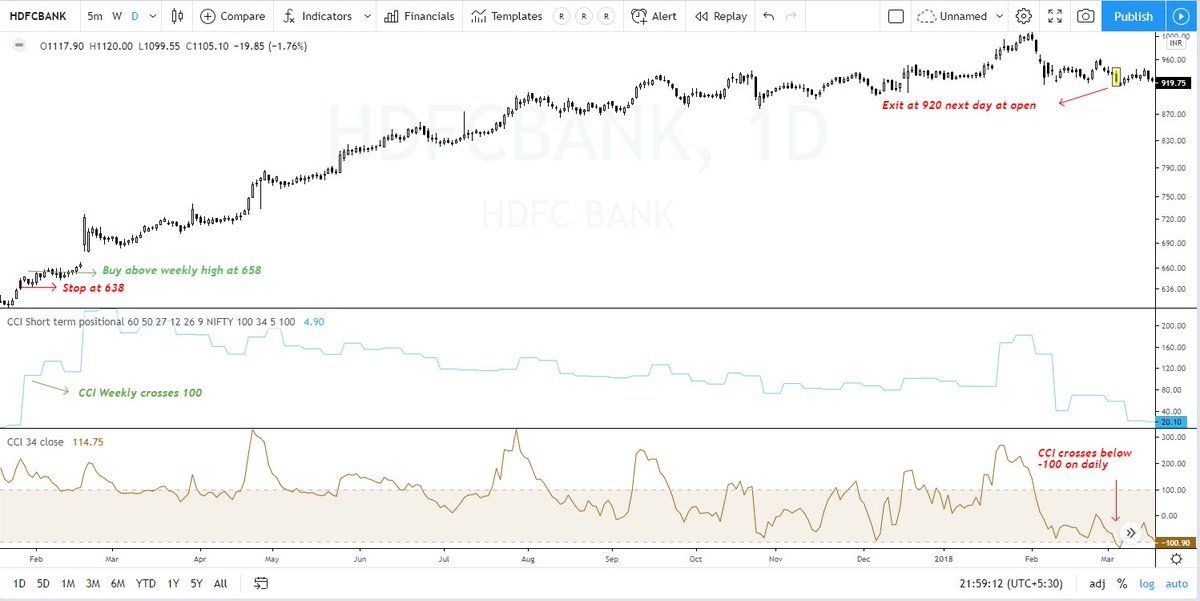

• CCI(34) on Weekly crossed above 100

• CCI(34) on Daily >100

• Entry: above weekly swing high

• Stoploss: Recent swing low on daily chart

• CCI(34) on Weekly crossed above 100

• CCI(34) on Daily >100

• Entry: above weekly swing high

• Stoploss: Recent swing low on daily chart

3⃣Exit criteria

• CCI(34) on Daily < -100

• Holding period: Few days to many months

Pyramiding your winners should be considered to make your winners big.

• CCI(34) on Daily < -100

• Holding period: Few days to many months

Pyramiding your winners should be considered to make your winners big.

4⃣ Why trade using multi-timeframe?

• This is a top-down approach where we observe the larger trend of the stock before we take entries on the smaller or medium trend of the stock

• This concept can be compared to tides in the sea

Details in video👇

youtu.be

• This is a top-down approach where we observe the larger trend of the stock before we take entries on the smaller or medium trend of the stock

• This concept can be compared to tides in the sea

Details in video👇

youtu.be

5⃣ A larger wave in the sea will overpower the smaller waves, no matter what, simply because the larger waves have more velocity and force.

In a similar way, a stock trending in the larger TF will overpower the smaller TF trend and will eventually take the stock price higher.

In a similar way, a stock trending in the larger TF will overpower the smaller TF trend and will eventually take the stock price higher.

6⃣ While trading this strategy we presume this will work & buy stock in the shorter TF just when the larger TF is showing bullishness. This ensures we are in the right direction.

In case the stock reverses, we exit based on the stop loss or based on the exit criteria.

In case the stock reverses, we exit based on the stop loss or based on the exit criteria.

7⃣ Just to be clear, this is NOT a holy grail strategy but helps one catch the shorter/medium trend very well.

You WILL have losing trades.

So, it is important to consider proper position sizing and assess your risk before entry.

Let's look at some examples 👇

You WILL have losing trades.

So, it is important to consider proper position sizing and assess your risk before entry.

Let's look at some examples 👇

This strategy can also be applied on Smallcap & Midcap stocks! Do run this strategy over many stock to understand how it works.

Do run this strategy over many stocks to understand it!

If you loved this strategy👇

1. Retweet the first post in this thread

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com

If you loved this strategy👇

1. Retweet the first post in this thread

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com

Get big discounts on Tradingview plans!

Loading suggestions...