The credit rating agency Fitch just downgraded the United States.

What are the implications for investors and markets?

A thread.

1/

What are the implications for investors and markets?

A thread.

1/

Today you are likely to read plenty of scary and fear-mongering headlines.

In this thread instead we’ll take a step back and rationally assess what the US downgrade means for investors and markets out there.

2/

In this thread instead we’ll take a step back and rationally assess what the US downgrade means for investors and markets out there.

2/

The chart above shows the US spending on interest payments nearing an annualized $1 trillion: a scary chart…if you think the US government has a constrained budget like a household.

But that’s not how it works.

4/

But that’s not how it works.

4/

I wrote at length about this on The Macro Compass, so I'll make it short here: the government doesn't ''need money'' to spend money like a household.

Government deficit spending creates private sector money in the first place.

In other words...

5/

Government deficit spending creates private sector money in the first place.

In other words...

5/

...yes government interest payments are rising but it’s not like the US needs to ‘’choose’’ between spending on interest and spending money in the real economy – its balance sheet doesn’t work like ours

Ok, but how does the downgrade affect investors and market participants?

6/

Ok, but how does the downgrade affect investors and market participants?

6/

The key point is that US Treasuries now have their second-best rating at AA+ instead of AAA given that only Moody’s preserved its top rating for the US.

US Treasuries are the most widely used form of collateral in the world due to...

7/

US Treasuries are the most widely used form of collateral in the world due to...

7/

...their high rating, liquidity, deep repo market and solid democratic foundations/rule of law: does the downgrade affect that?

Let’s have a quick look at how different institutional players would be affected by this.

8/

Let’s have a quick look at how different institutional players would be affected by this.

8/

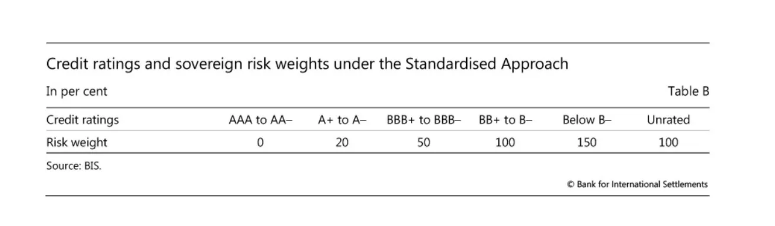

...for government bonds rated between AAA and AA- for its standardized approach. Most banks actually choose an internal-rating based (IRB) approach and in that case most jurisdictions apply an exception for any investment-grade rated domestic government bond which...

10/

10/

...automatically assigns them a 0% risk weight anyway!

Bottom line: for banks this downgrade makes no difference at all.

Pension funds are also large buyers of Treasuries: they use them as a long duration asset to match their long liabilities and as collateral.

11/

Bottom line: for banks this downgrade makes no difference at all.

Pension funds are also large buyers of Treasuries: they use them as a long duration asset to match their long liabilities and as collateral.

11/

For a pension fund AAA-rated or AA+ rated US Treasuries would still fall in the hedging camp or in the defensive asset allocation camp and a one-notch downgrade wouldn’t make the difference.

When it comes to collateral usage...

12/

When it comes to collateral usage...

12/

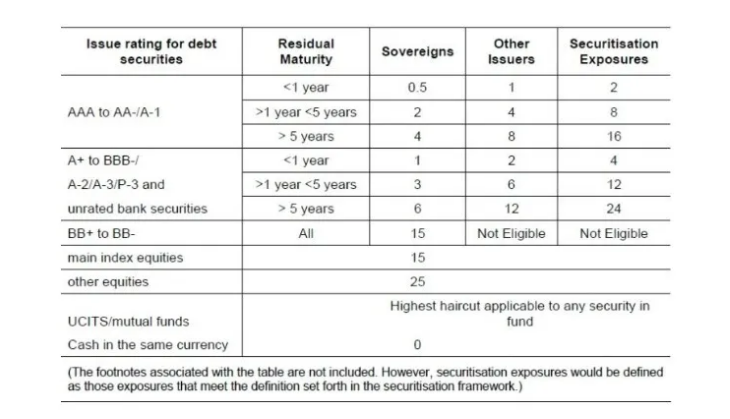

As you can see, bonds rated between AAA and AA- all fall within the same bucket.

Certain pension funds have stricter collateral demands and only accept AAA collateral though, but still the marginal impact of the Fitch downgrade is likely to be extremely minor.

14/

Certain pension funds have stricter collateral demands and only accept AAA collateral though, but still the marginal impact of the Fitch downgrade is likely to be extremely minor.

14/

Last but not least: FX reserve managers!

Chinese or Brazil corporates selling stuff for USD will deposit these USD in the domestic banking system and so the Bank of Brazil and PBOC would be in charge of investing these USDs in safe, liquid assets – yep: US Treasuries.

15/

Chinese or Brazil corporates selling stuff for USD will deposit these USD in the domestic banking system and so the Bank of Brazil and PBOC would be in charge of investing these USDs in safe, liquid assets – yep: US Treasuries.

15/

As you can see, for most institutional players out there this downgrade has no material impact that would make them a force-seller of US Treasuries.

In the short-term markets can overinterpret and overreact, so it’s important to keep track of sentiment and price action...

17/

In the short-term markets can overinterpret and overreact, so it’s important to keep track of sentiment and price action...

17/

...and if you enjoyed this thread and want much more of this content multiple times a week, come and sign up to TheMacroCompass.com.

Thanks for reading, and looking forward to welcoming you on The Macro Compass!

18/18

Thanks for reading, and looking forward to welcoming you on The Macro Compass!

18/18

Loading suggestions...