Technology

Economics

Health

Automotive

Industry Evolution

Electric Vehicle Industry

Battery Industry

Over-capacity is a feature, not a bug, of industry evolution in China.

Understanding where we are industry development cycle by looking at past examples can help us predict how the EV and battery industry will evolve in China.

🧵 on dynamic capital creation & re-allocation

Understanding where we are industry development cycle by looking at past examples can help us predict how the EV and battery industry will evolve in China.

🧵 on dynamic capital creation & re-allocation

Today, the EV and battery industries are at a very predictable stage - lots of new entrants and the rush to achieve scale.

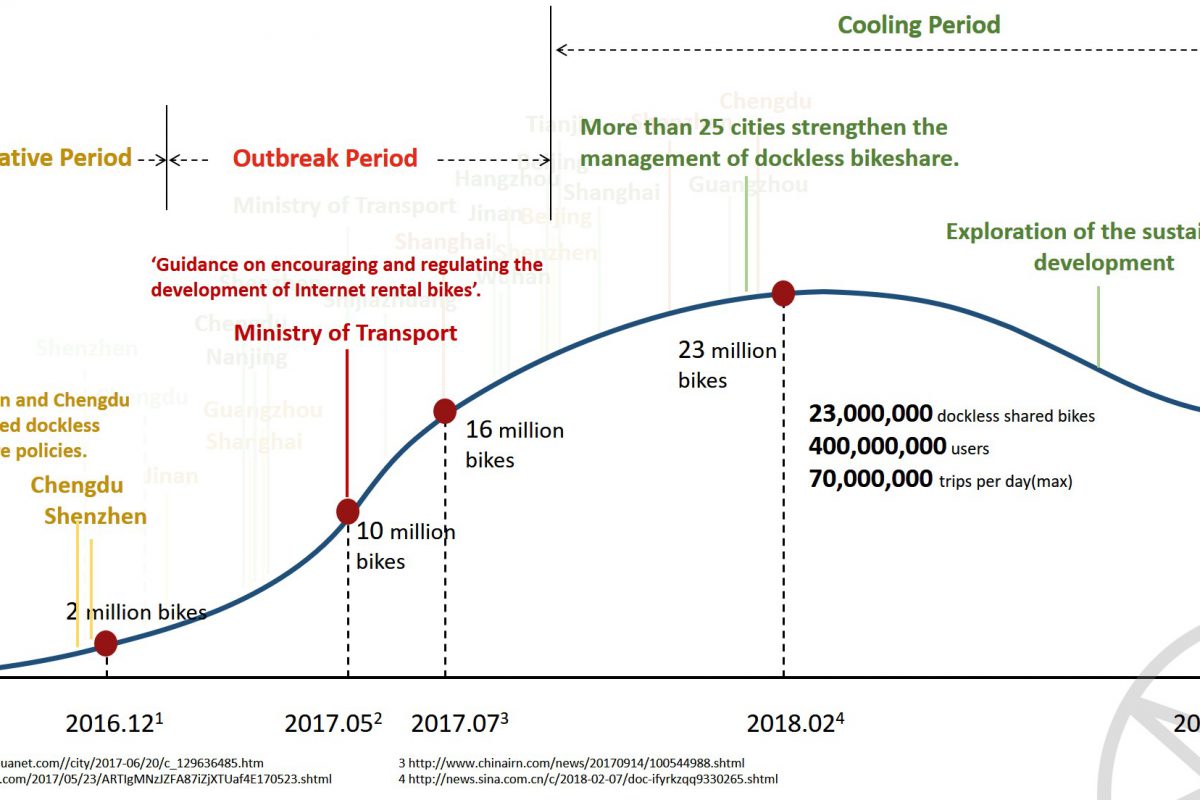

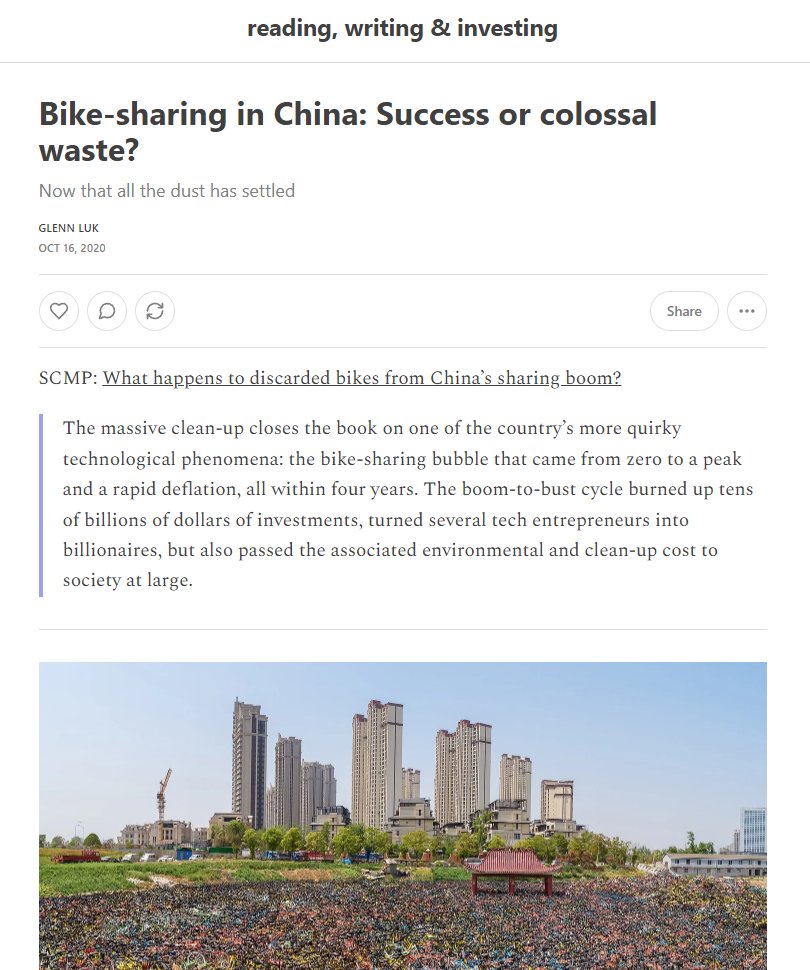

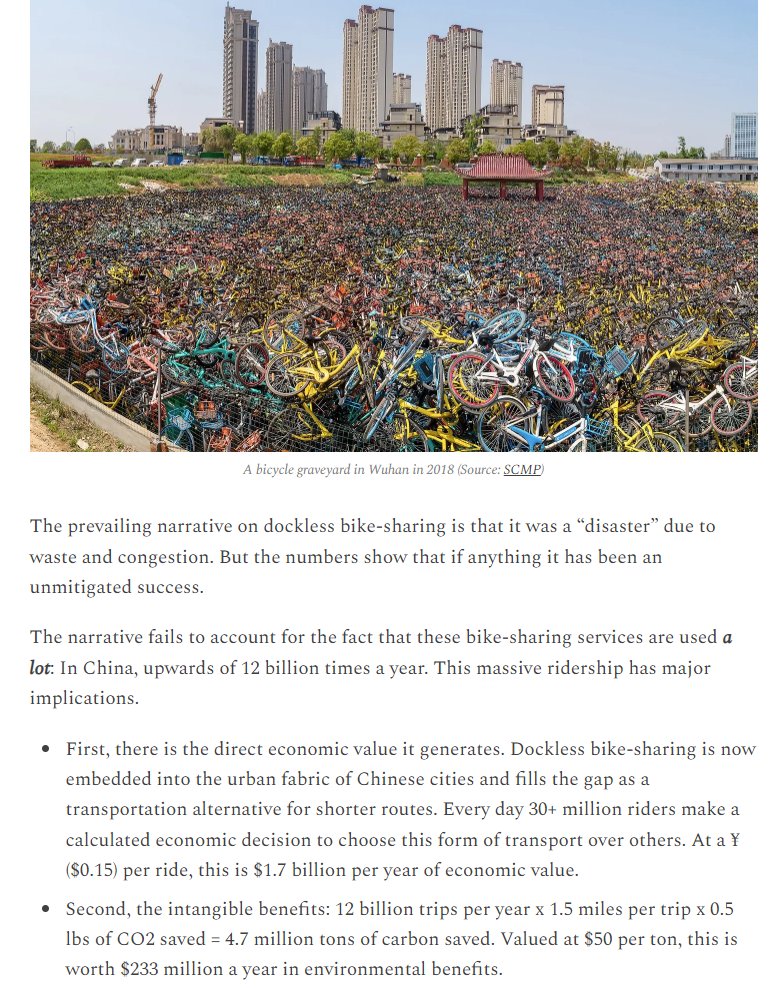

We have seen this phase multiple times in Chinese economic history, from the first era of ICE vehicles to local delivery to dockless bike-sharing.

We have seen this phase multiple times in Chinese economic history, from the first era of ICE vehicles to local delivery to dockless bike-sharing.

In each case, there is an intense period of competition out of which the top contenders emerge, and other competitors merge or are shut down, their assets absorbed by the winners.

Eventually the industry reaches stable competition, equilibrium and stable returns.

Eventually the industry reaches stable competition, equilibrium and stable returns.

Over-capacity at this stage is a feature, not a bug.

It's a filter in the Darwinian process of weeding out less-competent or qualified competitors.

More important to capital efficiency in the long run is getting through this phase quickly.

It's a filter in the Darwinian process of weeding out less-competent or qualified competitors.

More important to capital efficiency in the long run is getting through this phase quickly.

Rapid creation and destruction. Build fast and tear it down (re-allocate labor and capital resources to other sectors) fast.

One under-appreciated aspect of China's economy is its ability to build fast but also re-allocate capital and labor quickly.

One under-appreciated aspect of China's economy is its ability to build fast but also re-allocate capital and labor quickly.

Over-capacity is mitigated by being able to rapidly and cost-effectively ramp down after the initial burst.

ICE factories can switch out certain line equipment and start pumping out EVs.

All those discarded shared bikes were cost-effectively recycled.

ICE factories can switch out certain line equipment and start pumping out EVs.

All those discarded shared bikes were cost-effectively recycled.

We saw dynamic re-allocation characteristic of China's economy feature prominently during the GFC.

The exogeneous shock of the GFC meant tens of millions of migrant workers suddenly found that their factories had closed down and would not re-open.

The exogeneous shock of the GFC meant tens of millions of migrant workers suddenly found that their factories had closed down and would not re-open.

But very quickly, these blue-collar laborers were absorbed into the growing domestic construction industry, helped by the $4T stimulus packaged aimed to counter-act the effects of the GFC on its export processing industry in the coastal regions.

Over-capacity in China is not the anathema it is in other countries because its economy has proven to be able to rapidly and dynamically re-allocate labor and capital between sectors.

Instead, it should be viewed as part of a "guided tournament" to enable rapid industry evolution and allow the best market players to emerge.

Pick your favorite one as an analogy: I'll go with the NCAA's March Madness.

Pick your favorite one as an analogy: I'll go with the NCAA's March Madness.

For EVs and batteries, a much larger industry with a more extended product cycle than shared bikes, this stage will inevitably take longer than two years.

But out of it, "only the strong will survive" and they will also be the ones reaping the massive rewards.

But out of it, "only the strong will survive" and they will also be the ones reaping the massive rewards.

This is why when people talk about how the "economic model needs to change" ...

... it sounds weird b/c for the past forty years it has been continuously mobilizing and re-allocating capital and labor resources in a series of overlapping sector evolutions.

... it sounds weird b/c for the past forty years it has been continuously mobilizing and re-allocating capital and labor resources in a series of overlapping sector evolutions.

Indeed, the process of resource re-allocation out of property began nearly a decade ago - that is when employment and construction actually peaked/flatlined.

With 3RL, it started to decline, which means those resources are now actively moving to sectors like EV and battery mfg.

With 3RL, it started to decline, which means those resources are now actively moving to sectors like EV and battery mfg.

When we drill down into China's economy by sector and think about it in terms of capital and labor instead of top-level GDP accounting identities, these shifts and cycles become much more clear.

Loading suggestions...