Best Possible Answers:

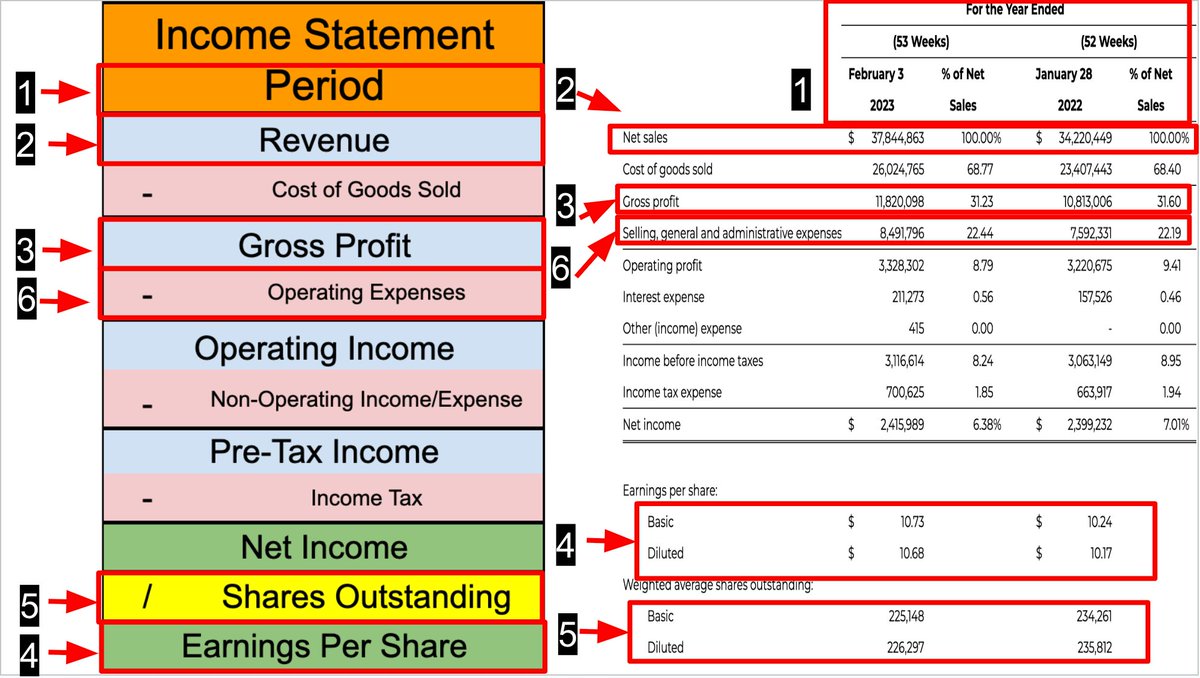

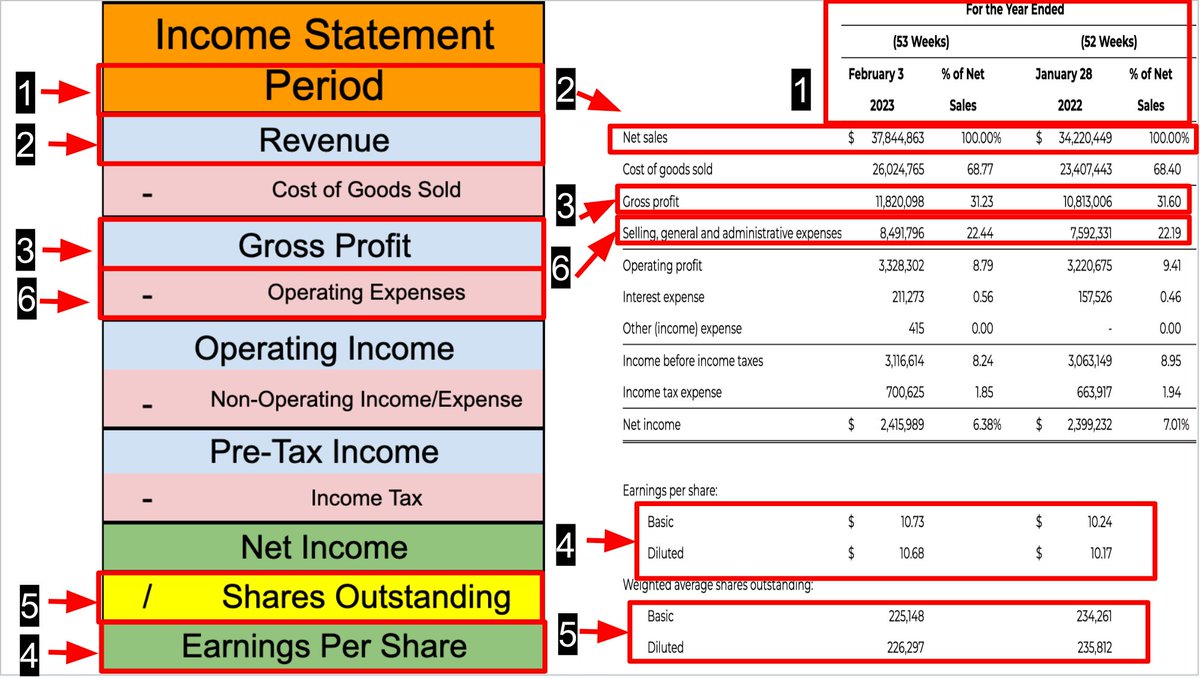

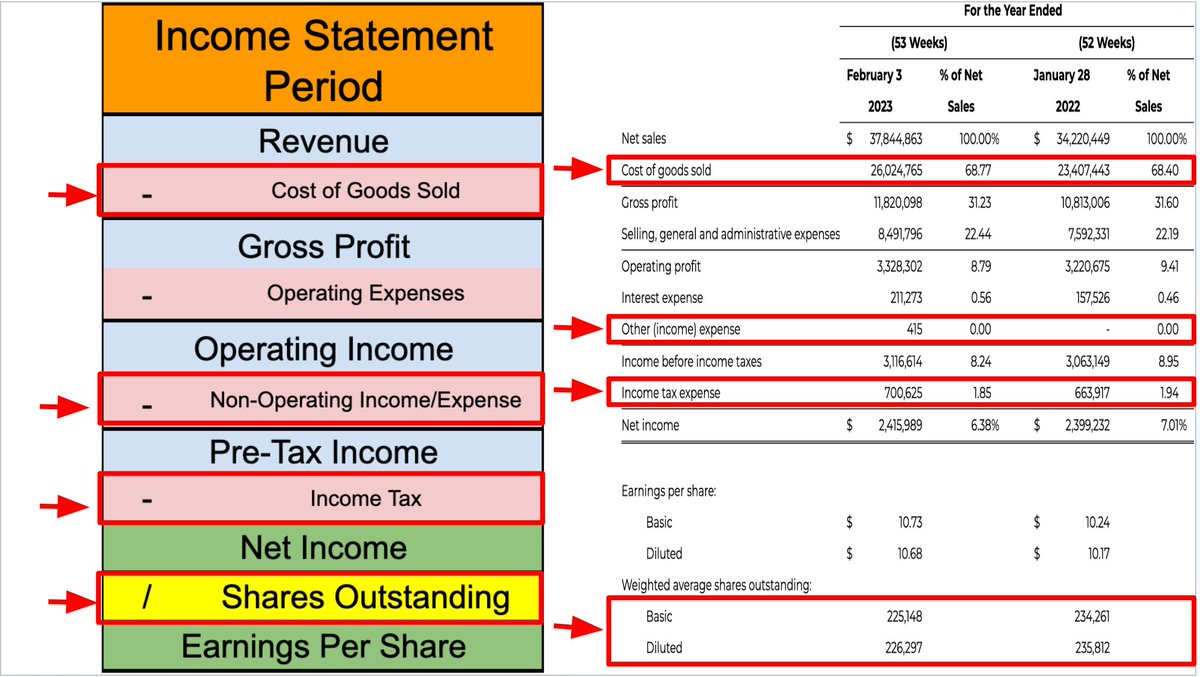

1) Multiple Annual Periods

2) Growing quickly (30%+)

3) Growing faster than revenue

4) Growing faster than gross profit

5) Declining

6) Growing slower than revenue

1) Multiple Annual Periods

2) Growing quickly (30%+)

3) Growing faster than revenue

4) Growing faster than gross profit

5) Declining

6) Growing slower than revenue

I’d never invest without MUCH more analysis than this.

Accounting (and investing) is FILLED with nuance.

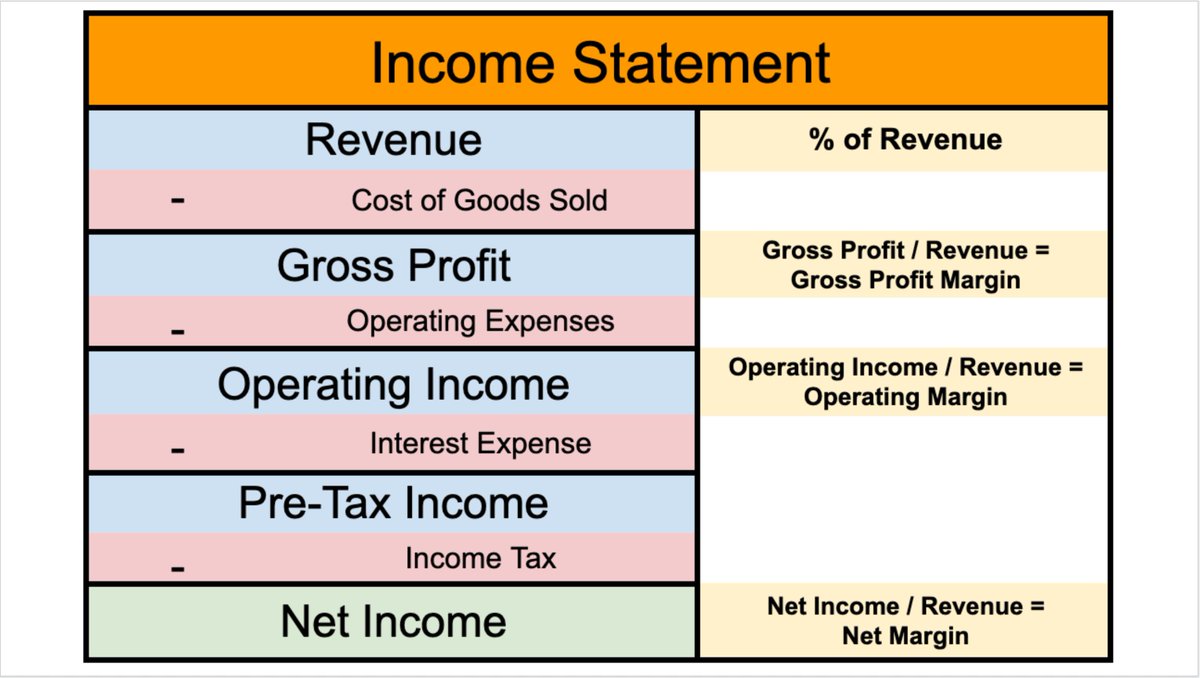

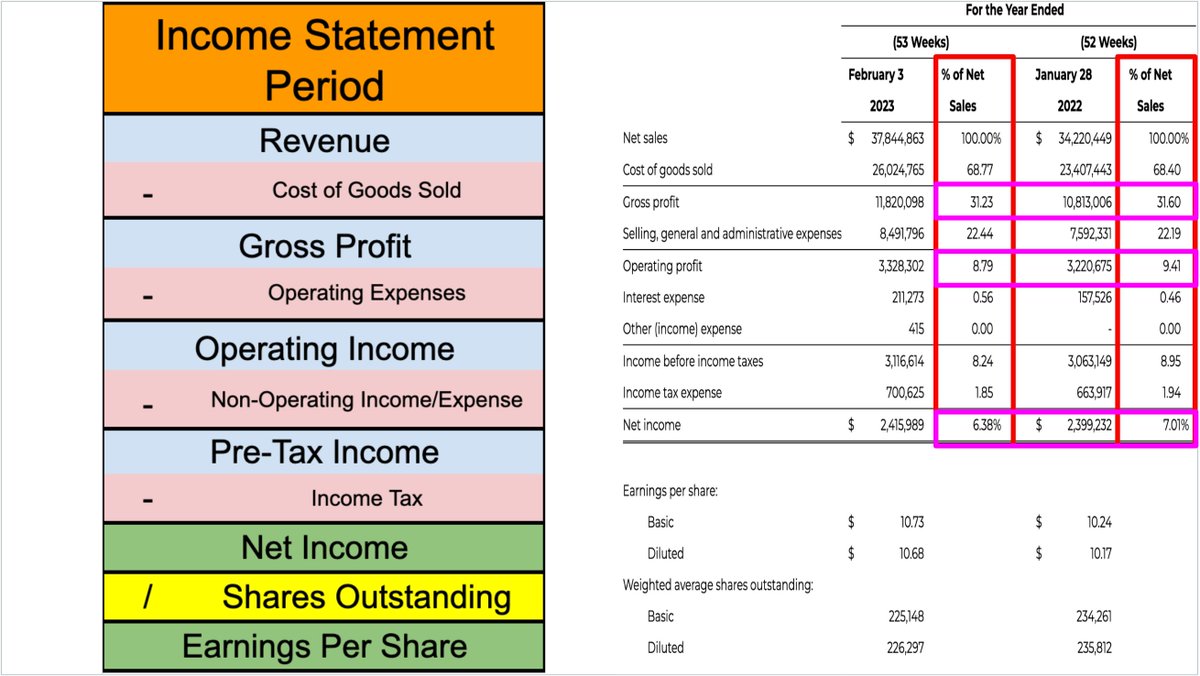

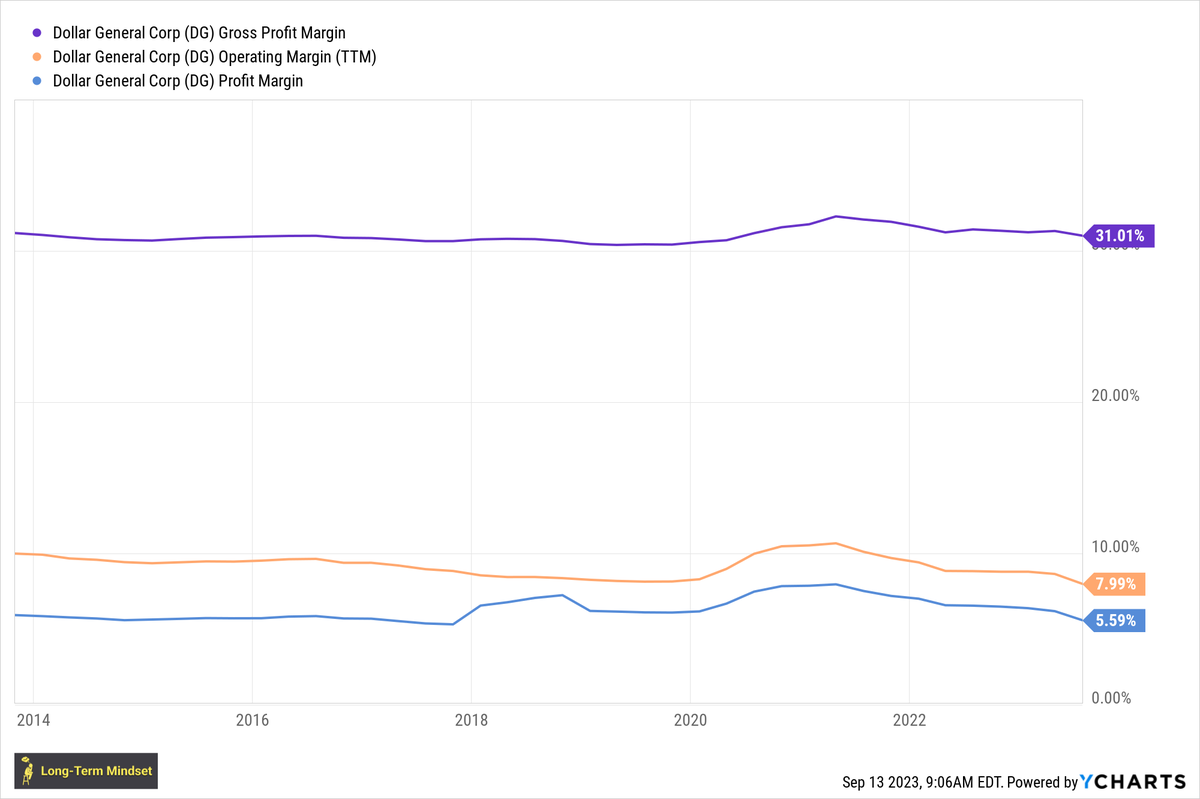

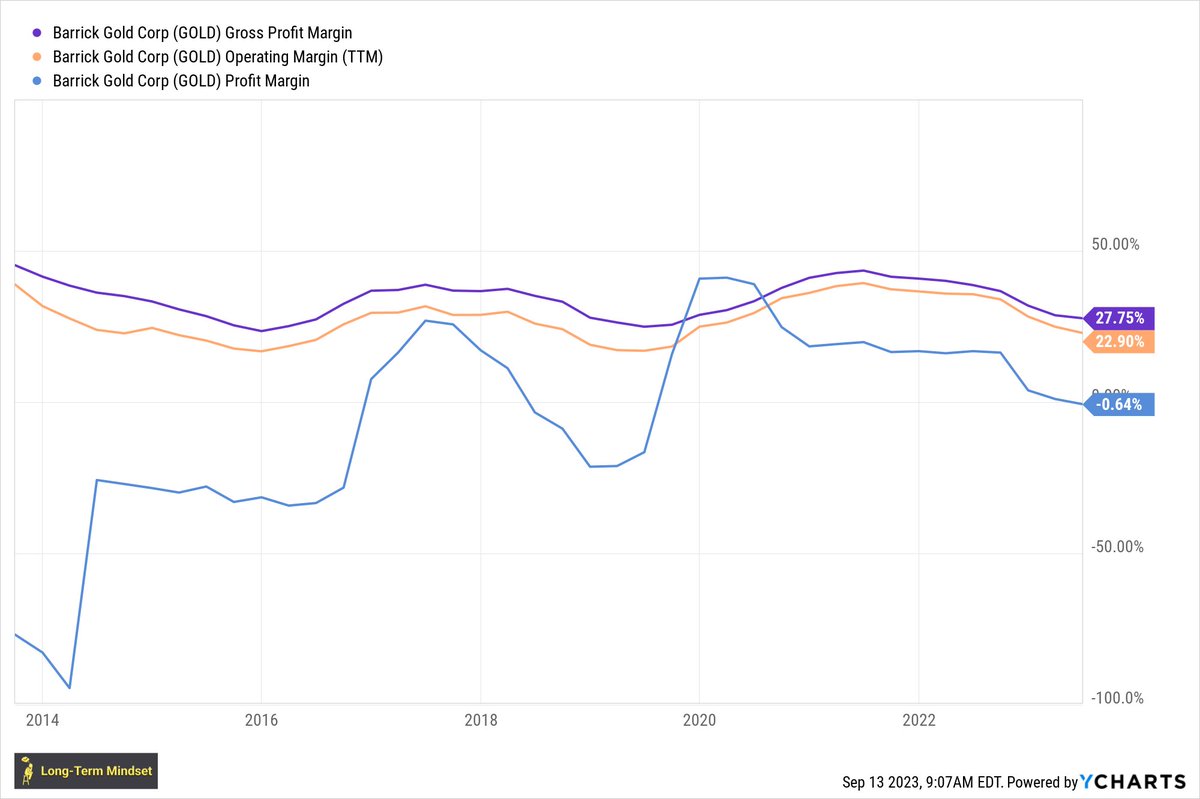

Still, with less than 2 minutes of analysis, you can quickly determine if a company is profitable, growing/shrinking, and worthy of a deeper dive.

Accounting (and investing) is FILLED with nuance.

Still, with less than 2 minutes of analysis, you can quickly determine if a company is profitable, growing/shrinking, and worthy of a deeper dive.

Want to learn how Warren Buffett analyzes an income statement?

Join me TOMOROW (9/14) for a webinar where we'll discuss his financial statements 'rules of thumb' in detail.

RSVP here (it's free):

lu.ma

Join me TOMOROW (9/14) for a webinar where we'll discuss his financial statements 'rules of thumb' in detail.

RSVP here (it's free):

lu.ma

Enjoy this thread?

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

Follow me @BrianFeroldi for more content like this.

I demystify finance with 1-2 threads each week.

Want to share? Retweet the first tweet below:

I demystify the stock market.

Want a copy of my stock investing checklist?

Grab it here (for free):

brianferoldi.com

Want a copy of my stock investing checklist?

Grab it here (for free):

brianferoldi.com

Loading suggestions...