Thread on the web of deception with Justin Sun around Huobi, stUSDT, and TUSD, as well as the TUSD relationship with Binance and the drain of real USD liquidity from the crypto ecosystem.

1/

1/

In late 2022, Justin Sun reportedly acquired a controlling stake in Huobi, now named HTX, which had over $1.5b USDT deposits at the time.

Over the summer deposited USDT funds started getting replaced by stUSDT. This substitution has been largely unnoticed by Huobi users.

2/

Over the summer deposited USDT funds started getting replaced by stUSDT. This substitution has been largely unnoticed by Huobi users.

2/

What is stUSDT?

stUSDT, controlled by Justin Sun, claims to provide a yield by investing in "Real World Assets" such as Treasury bills, while the actual flow of funds from Huobi's USDT to stUSDT and then to JustLendDAO indicates that no such investment into RWAs occurs.

3/

stUSDT, controlled by Justin Sun, claims to provide a yield by investing in "Real World Assets" such as Treasury bills, while the actual flow of funds from Huobi's USDT to stUSDT and then to JustLendDAO indicates that no such investment into RWAs occurs.

3/

We can follow these swaps very clearly on-chain. And let’s remember that stUSDT and USDT are considered as the same asset nativelyt on Huobi, as evidenced by their lack of stUSDT trading pairs. huobi.com

4/

4/

Instead, it goes to JustLend (under Sun's control), and the USDT is not burned. Huobi wallets have been found to transfer significant amounts of USDT to stUSDT's staking contract, then stUSDT circles back to Huobi h/t @Patrick_TanKT

Details here: medium.com

5/

Details here: medium.com

5/

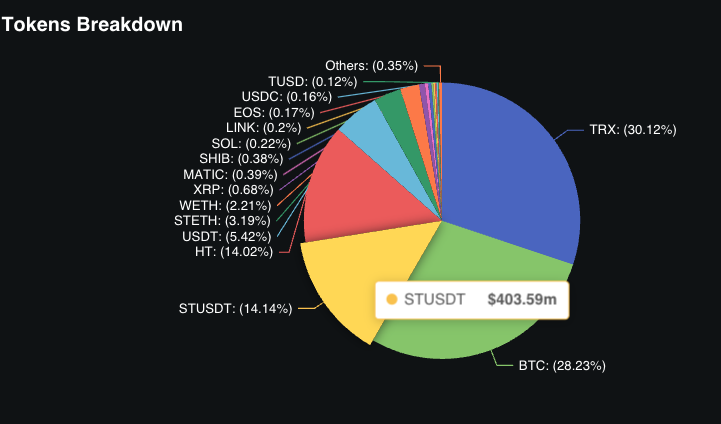

As seen in Bloomberg, you can see a shift in Huobi's reserves from July 1 to September 15. On July 1, USDT made up 18.8% of reserves, but by September 15, this had dwindled to just 4.7%, while Sun’s stUSDT, grew to represent 14.5% of reserves.

bloomberg.com

6/

bloomberg.com

6/

Huobi's USDT gets 'staked' for stUSDT, which then moves to JustLend, a platform Sun controls. The USDT never invests in RWAs, but just sits in JustLend, while Huobi users end up with stUSDT instead of the USDT they thought they owned. defillama.com

7/

7/

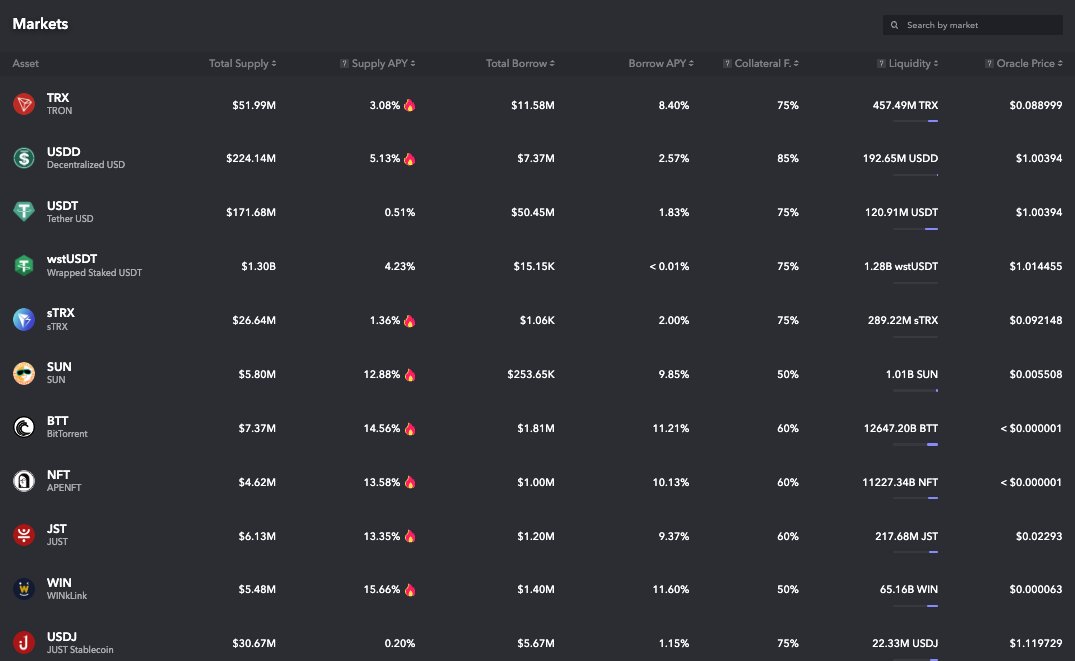

Looking at JustLend, currently, there is 1.30B stUSDT supplied earning 4.23%, with only 15.15K of borrow earning 0.01%.

The “Real World Asset” story is a lie.

app.justlend.org

8/

The “Real World Asset” story is a lie.

app.justlend.org

8/

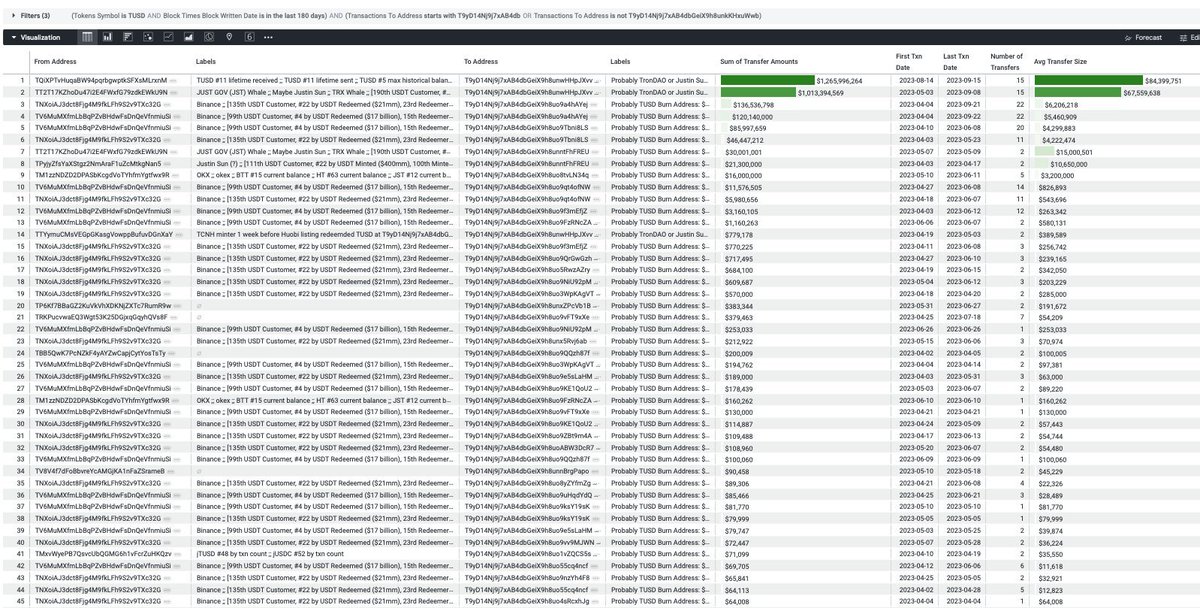

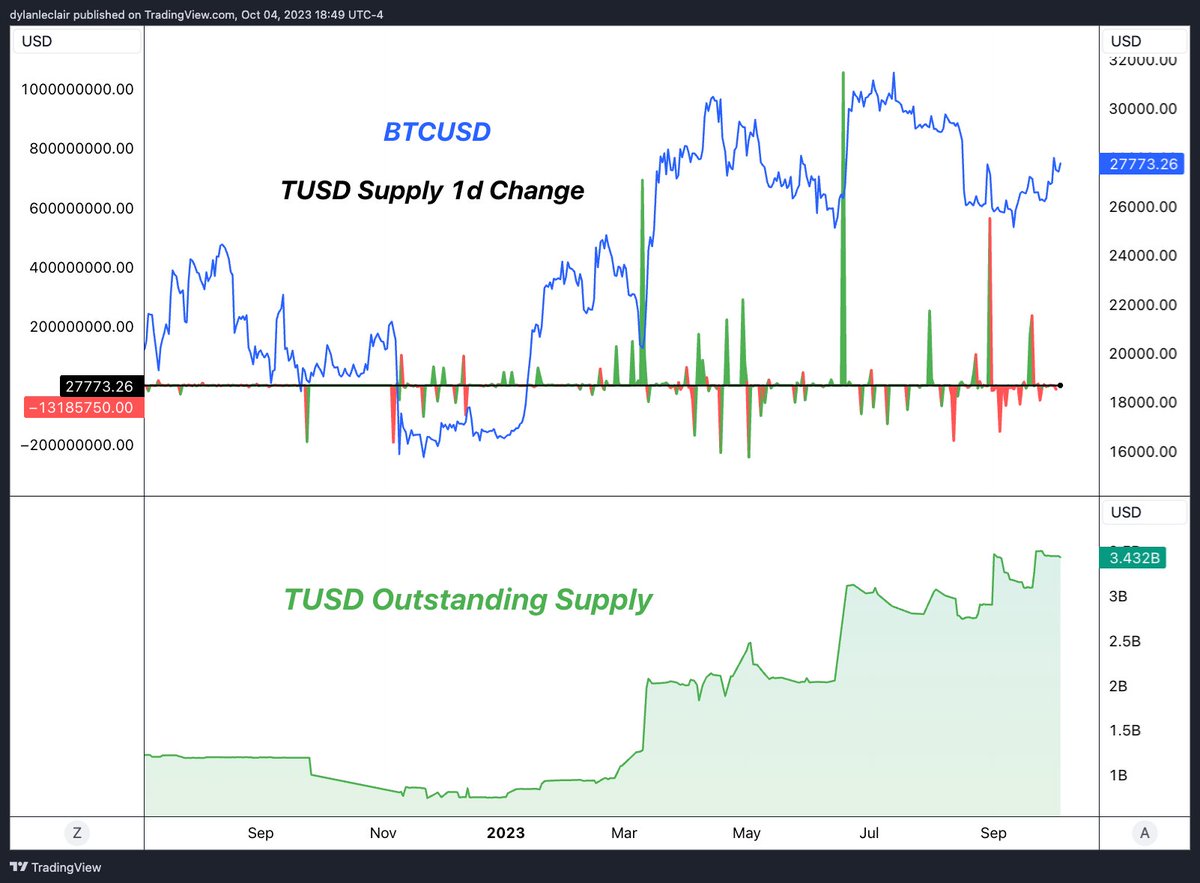

However, it isn’t uniquely USDT this is happening with, TUSD, which is also controlled by Sun, plays a part. Over the last 6 months, a significant portion of TUSD burns have been attributed to just two wallets, both associated w/ Sun.

h/t @ChainArgos x.com

9/

h/t @ChainArgos x.com

9/

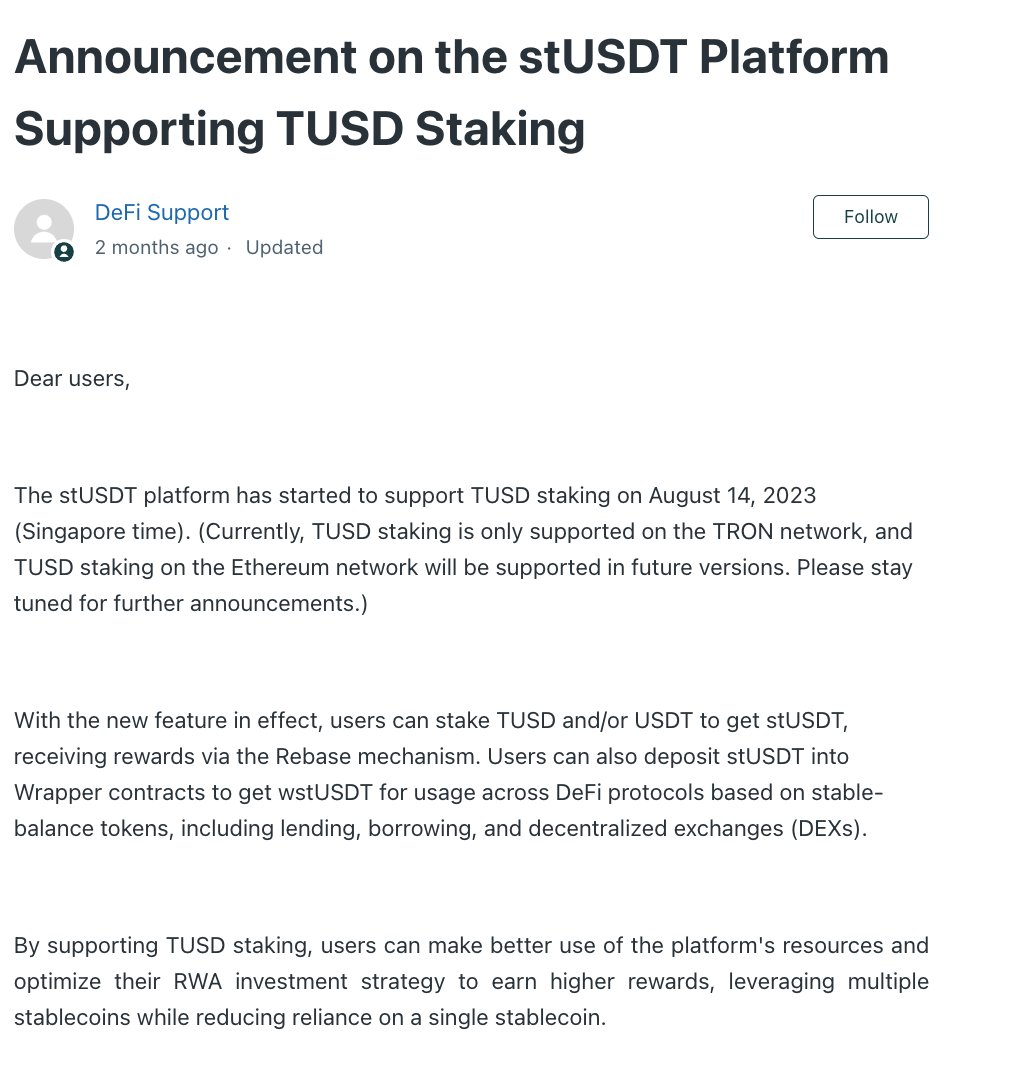

So isn’t it convenient that you can now “stake” TUSD, to mint stUSDT: tinyurl.com

In theory TUSD/USDT is burned, so that the supply decreases and the supposed cash backing it invests in Tbills that earn a yield thats passed onto the holders of stUSDT.

10/

In theory TUSD/USDT is burned, so that the supply decreases and the supposed cash backing it invests in Tbills that earn a yield thats passed onto the holders of stUSDT.

10/

TLDR: Use the USDT brand and it’s reputation internationally, swap it for fake stUSDT while it appears as regular USDT in the UI/UX on Huobi.

And then what? What's the end goal? Why create an IOU of another stable and trick your users behind the user interface?

12/

And then what? What's the end goal? Why create an IOU of another stable and trick your users behind the user interface?

12/

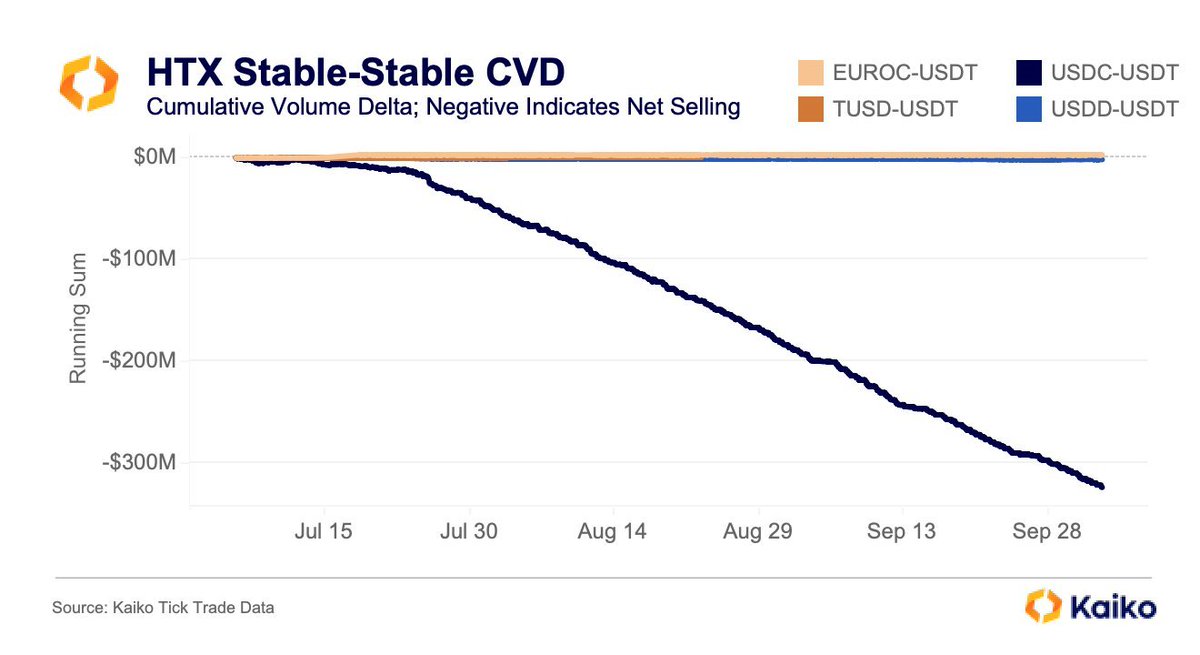

For one, selling the USDT (which is actually mostly stUSDT) for USDC on Huobi.

Data from @KaikoData shows this clearly through the USDC-USDT Cumulative Volume Delta (CVD) on Huobi, with $325mn USDT has been sold off for USDC in just over 2 months.

x.com

13/

Data from @KaikoData shows this clearly through the USDC-USDT Cumulative Volume Delta (CVD) on Huobi, with $325mn USDT has been sold off for USDC in just over 2 months.

x.com

13/

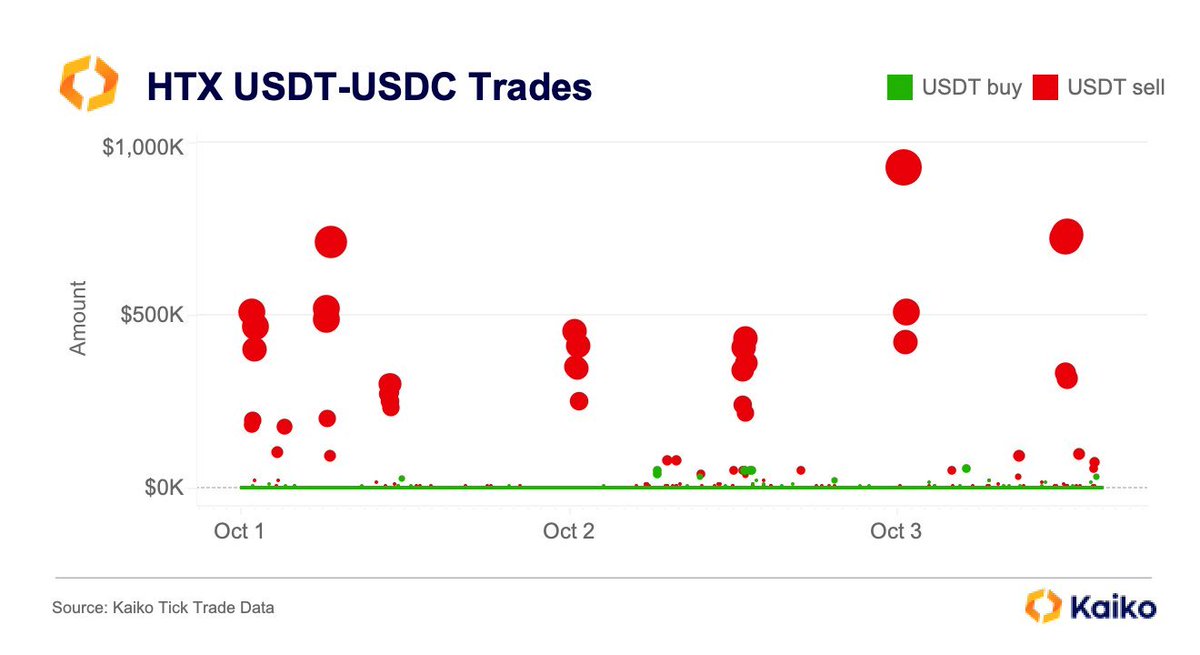

Data from just over the last few days shows every single transaction over $100k is swapping USDT for USDC on the pair.

x.com

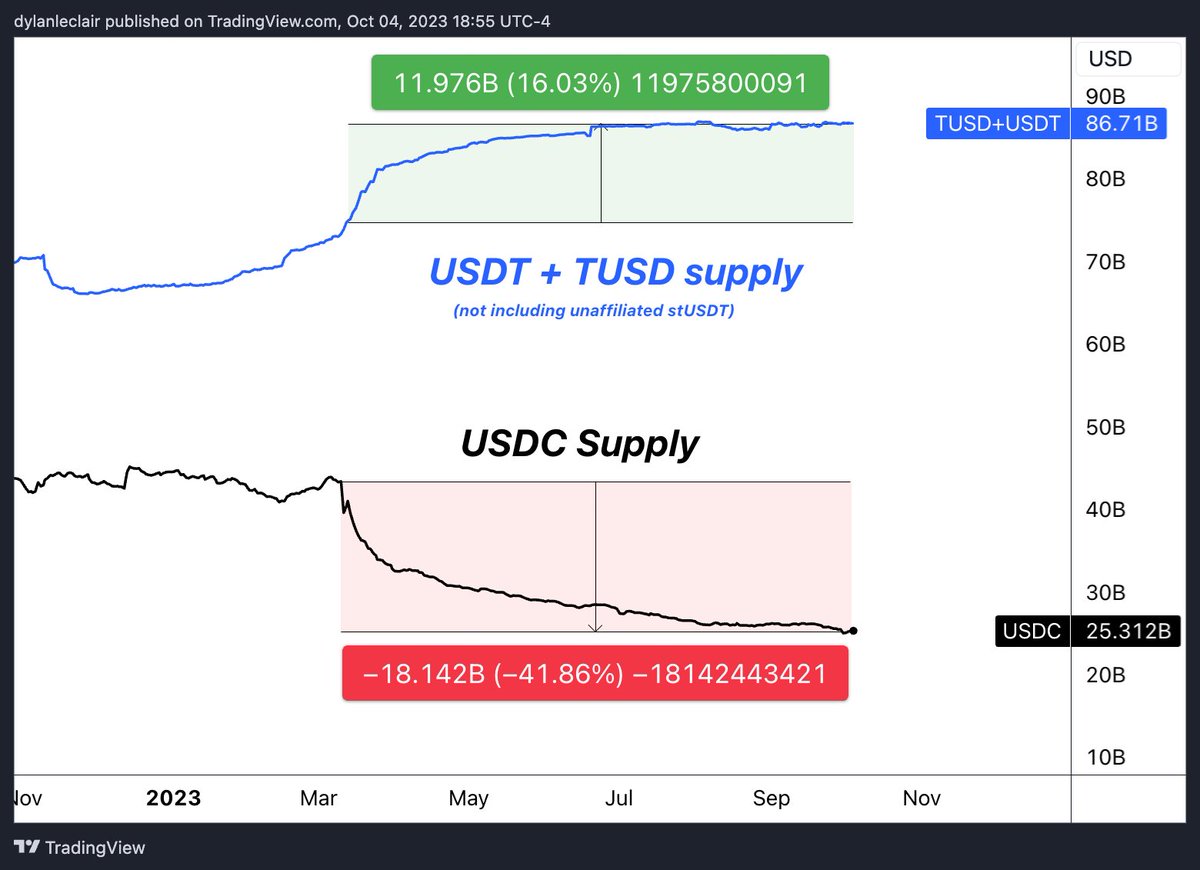

To reiterate, it's mostly stUSDT under the surface, being sold in hordes for USDC, which then can be redeemed for USD at Circle.

14/

x.com

To reiterate, it's mostly stUSDT under the surface, being sold in hordes for USDC, which then can be redeemed for USD at Circle.

14/

Even if you remove the first month post SVB collapse, the CVD for the pair is still + 4-5 billion of net buying for USDC.

Also according to Arkham, Binance wallets preceding the SVB crash to today are -4.27b USDC +384.1m USDT (static comparison ).

tinyurl.com

16/

Also according to Arkham, Binance wallets preceding the SVB crash to today are -4.27b USDC +384.1m USDT (static comparison ).

tinyurl.com

16/

Let's also note Binance’s curious relationship with TUSD.

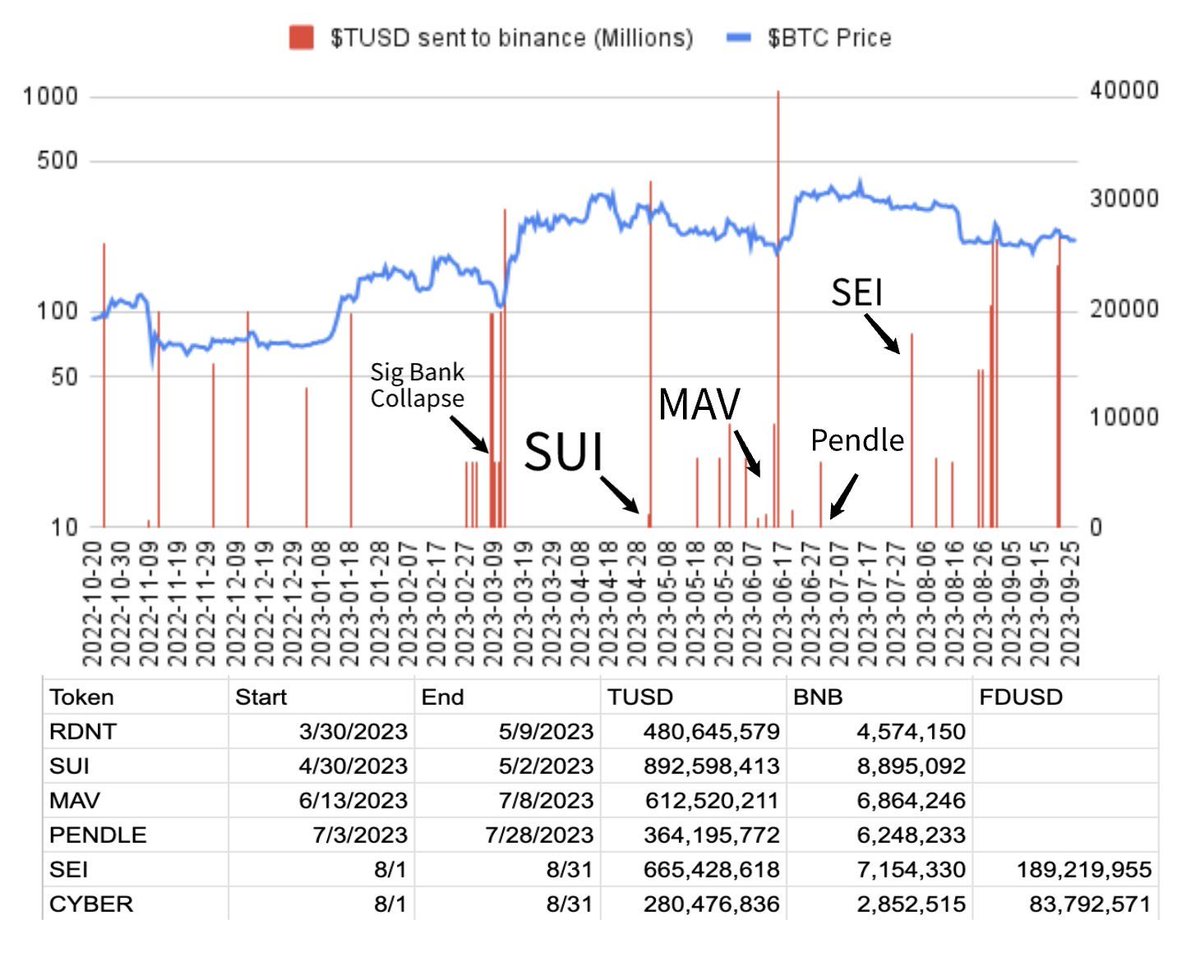

On March 15th, mere days after the SVB collapse, and Binance reenabling USDC trading on the platform, 0% fee trading on little known TUSD was enabled for BTCTUSD, ETHTUSD, and BNBTUSD pairs. x.com

17/

On March 15th, mere days after the SVB collapse, and Binance reenabling USDC trading on the platform, 0% fee trading on little known TUSD was enabled for BTCTUSD, ETHTUSD, and BNBTUSD pairs. x.com

17/

Never-mind that TUSD attestations are blatantly unreliable/shady, and its largest mints are coincidentally timed perfectly w/ market selloffs, x.com

But the world’s largest exchange is promoting said stablecoin w/ zero fee trading for its largest pairs?

20/

But the world’s largest exchange is promoting said stablecoin w/ zero fee trading for its largest pairs?

20/

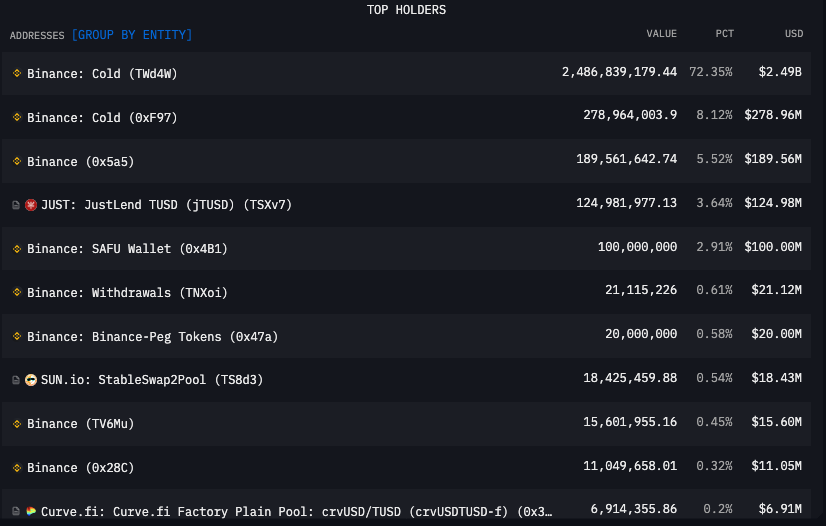

By the way, let's note the token distribution for TUSD, shall we?

platform.arkhamintelligence.com

21/

platform.arkhamintelligence.com

21/

TLDR/END:

1) Sun is creating a web of deception in order to siphon USD liquidity out of crypto using a multitude of fake stablecoins, and dare I say:

He is a fraud.

2) CZ and his embrace of TUSD, despite it being very suspect, is also ominous, and reeks of desperation.

1) Sun is creating a web of deception in order to siphon USD liquidity out of crypto using a multitude of fake stablecoins, and dare I say:

He is a fraud.

2) CZ and his embrace of TUSD, despite it being very suspect, is also ominous, and reeks of desperation.

3) TUSD minting patterns during selloffs are suspect/must be noted

4) Huobi users, get out of USDT, into another asset, and withdraw immediately

5) It's no wonder the Chief Strategy Offer for Circle is saying that the crypto ecosystem is blatantly counterfeiting USD.

END

4) Huobi users, get out of USDT, into another asset, and withdraw immediately

5) It's no wonder the Chief Strategy Offer for Circle is saying that the crypto ecosystem is blatantly counterfeiting USD.

END

Loading suggestions...