I'm not here to shill you random altcoins.

My mission is to equip you with investing tools that will enable your long-term success.

I want to teach you to fish, so you'll never go hungry again.

My mission is to equip you with investing tools that will enable your long-term success.

I want to teach you to fish, so you'll never go hungry again.

Throughout the past year, my entire focus has been on leveling up my investing framework.

After thousands of hours, I am excited to share with you my updated framework and investing methodology.

This framework is what I use to develop my deep dive threads (e.g. Chainlink).

After thousands of hours, I am excited to share with you my updated framework and investing methodology.

This framework is what I use to develop my deep dive threads (e.g. Chainlink).

Here are the 11 categories that I use to structure my research:

1. Overview

2. Use Case

3. Adoption

4. Revenue

5. Tokenomics

6. Treasury

7. Governance

8. Team & Investors

9. Competitors

10. Risks & Audits

11. Summary

Don't forget to bookmark this post for future reference.

1. Overview

2. Use Case

3. Adoption

4. Revenue

5. Tokenomics

6. Treasury

7. Governance

8. Team & Investors

9. Competitors

10. Risks & Audits

11. Summary

Don't forget to bookmark this post for future reference.

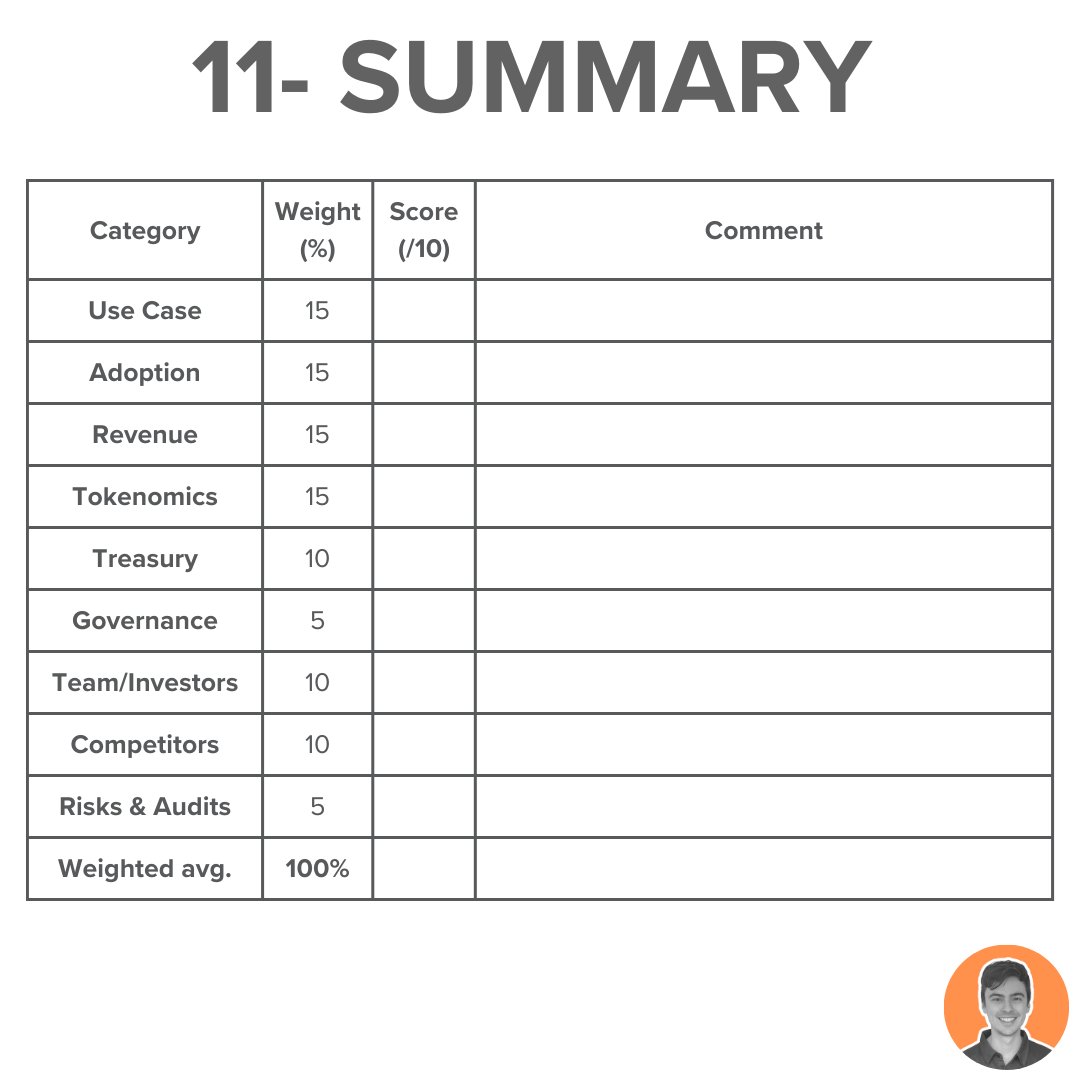

Now the fun part.

You get to score each project.

Step 1: determine what weighting you give each of the 10 categories.

What is more important to you? Tokenomics or Governance.

For me, the most important categories are:

Use case, Adoption, Revenue & Tokenomics.

You get to score each project.

Step 1: determine what weighting you give each of the 10 categories.

What is more important to you? Tokenomics or Governance.

For me, the most important categories are:

Use case, Adoption, Revenue & Tokenomics.

Step 2: now you can give an individual rating for each category.

The project might have fantastic tokenomics but a terrible governance structure.

Or terrific revenue streams but the treasury is bare.

I like to use a google sheet where I update the scores for each project.

The project might have fantastic tokenomics but a terrible governance structure.

Or terrific revenue streams but the treasury is bare.

I like to use a google sheet where I update the scores for each project.

The beauty of this framework is its customizability.

Use it however you like. Add categories, change weightings or tweak the scoring system.

Most importantly, you now have a process in place to make investment decisions.

Investing without a process is just gambling.

Use it however you like. Add categories, change weightings or tweak the scoring system.

Most importantly, you now have a process in place to make investment decisions.

Investing without a process is just gambling.

Links to some of my favourite resources:

@DefiLlama

@tokenterminal

@bubblemaps

@ReveloIntel

@coingecko

@Token_Unlocks

@ArkhamIntel

@DefiLlama

@tokenterminal

@bubblemaps

@ReveloIntel

@coingecko

@Token_Unlocks

@ArkhamIntel

If you enjoyed this thread, then:

→ Follow me @jake_pahor for weekly info like this.

→ RT the first tweet to share it with others.

→ Follow me @jake_pahor for weekly info like this.

→ RT the first tweet to share it with others.

Loading suggestions...