🔎A Guide to Detecting Fake Invoices under GST. Follow this 🧵to decode the details!

Fake invoices refer to documents that falsely represent a transaction between two parties, typically involving the exchange of goods or services for payment. These invoices are deliberately created to deceive and can be used for various fraudulent purposes. 📜

How do fraudsters typically obtain or create fake GST invoices? ⬇️

▶️ Fraudsters may target businesses by sending fake invoices for goods or services that were never ordered or received. The buyer, unaware of the fraud, claims inadmissible ITC for tax payment.

▶️ Invoices are issued to one entity, but the recipient is different. The recipient uses the ITC for GST payment when exporting goods, later claiming a refund. This results in the misuse of ITC and potential revenue loss for the government.

How to Identify Fake GST Invoices?

The following points to be kept in mind while identifying fake GST invoices ⬇️

The following points to be kept in mind while identifying fake GST invoices ⬇️

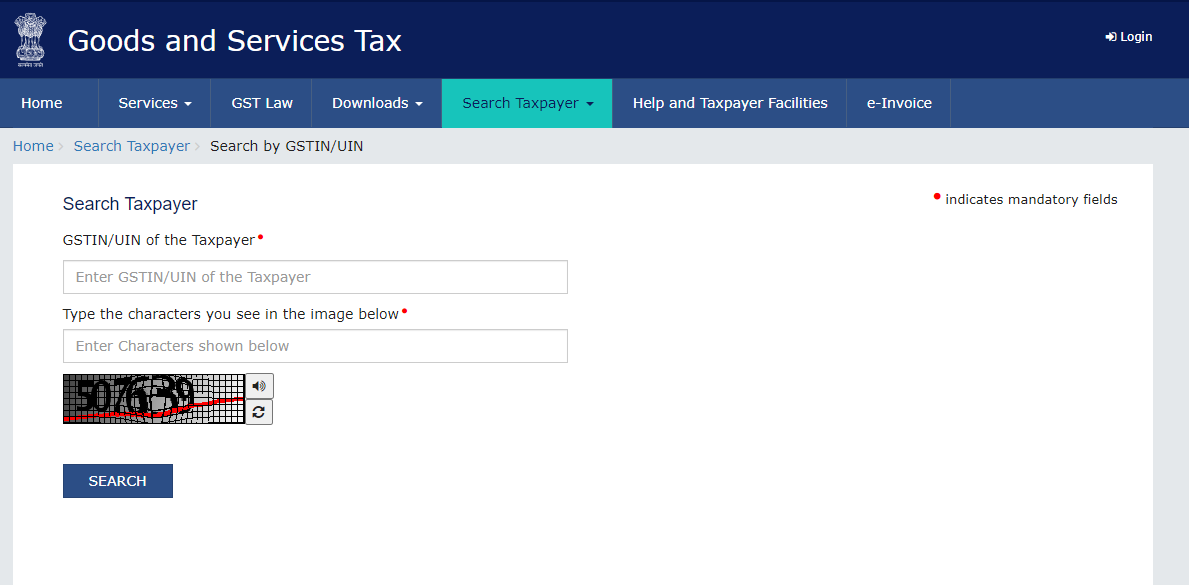

▶️ Check GST Registration Number

- Every registered supplier is assigned a 15-digit GSTIN, which includes the state code, PAN, and a unique registration number.

- Every registered supplier is assigned a 15-digit GSTIN, which includes the state code, PAN, and a unique registration number.

▶️Check the Invoice Number and Date

- Verify that the invoice number is unique and follows a consecutive pattern.

- Ensure that the date on the invoice falls within the prescribed timeline. Any discrepancies in the invoice number or date could indicate a fake invoice.

- Verify that the invoice number is unique and follows a consecutive pattern.

- Ensure that the date on the invoice falls within the prescribed timeline. Any discrepancies in the invoice number or date could indicate a fake invoice.

▶️ Check for HSN/SAC Code

- HSN code is assigned to goods, while SAC is assigned to services.

- Verify that the correct HSN or SAC code is mentioned on the invoice. This helps in classifying the goods or services correctly for tax purposes.

- HSN code is assigned to goods, while SAC is assigned to services.

- Verify that the correct HSN or SAC code is mentioned on the invoice. This helps in classifying the goods or services correctly for tax purposes.

▶️ Verify the Invoice Value and Tax Amount

- Ensure that the invoice mentions the correct invoice value, including the tax amount.

- Ensure that the invoice mentions the correct invoice value, including the tax amount.

- Cross-check the tax amount by using the GST calculator available on the GST portal. The tax amount should be calculated based on the applicable GST rate for the goods or services provided.

▶️ Validate Other Details

- Check other details on the invoice, such as the name and address of the supplier, as well as your own details if you are the recipient.

- Check other details on the invoice, such as the name and address of the supplier, as well as your own details if you are the recipient.

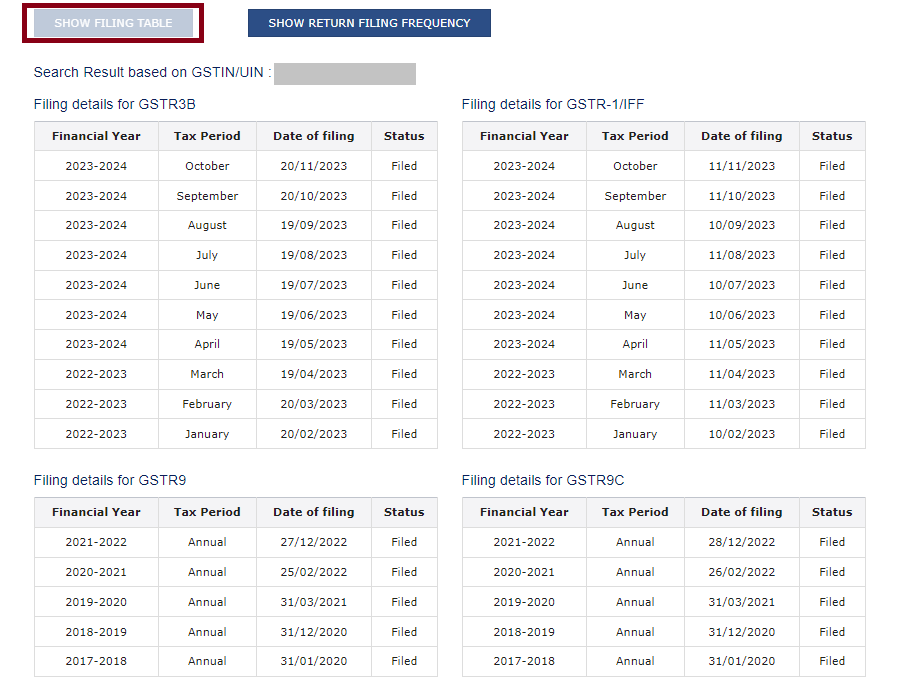

▶️ Check Filling Status

The tax payment status of the supplier on the GST portal can be checked.

The tax payment status of the supplier on the GST portal can be checked.

▶️ Penalty for issuing fake invoice under GST

The penalties are categorized based on the amount of Input Tax Credit availed or utilized by the taxpayer with the help of fake invoices. ⬇️

The penalties are categorized based on the amount of Input Tax Credit availed or utilized by the taxpayer with the help of fake invoices. ⬇️

- If the ITC availed or utilized by the taxpayer with the help of fake invoices exceeds Rs. 5 Crore, the taxpayer can face imprisonment for up to 5 years along with a fine.

- If the ITC availed or utilized exceeds Rs. 2 Crore but doesn’t exceed Rs. 5 Crore, the taxpayer can face imprisonment for up to 3 years and a fine.

- If the ITC availed or utilized exceeds Rs. 1 Crore but doesn’t exceed Rs. 5 Crore, the taxpayer can face imprisonment for up to 3 years and a fine.

- If a taxpayer commits or is involved in any of the offenses mentioned above, they can face imprisonment for up to 6 months or a fine or both.

Loading suggestions...