What is a payment Bank?

Payments banks are a new model of banks, conceptualized by the Reserve Bank of India (RBI), which cannot issue credit.

These banks can accept a restricted deposit, which is currently limited to ₹200,000 per customer.

Both current account and savings accounts can be operated by such banks

Payments banks are a new model of banks, conceptualized by the Reserve Bank of India (RBI), which cannot issue credit.

These banks can accept a restricted deposit, which is currently limited to ₹200,000 per customer.

Both current account and savings accounts can be operated by such banks

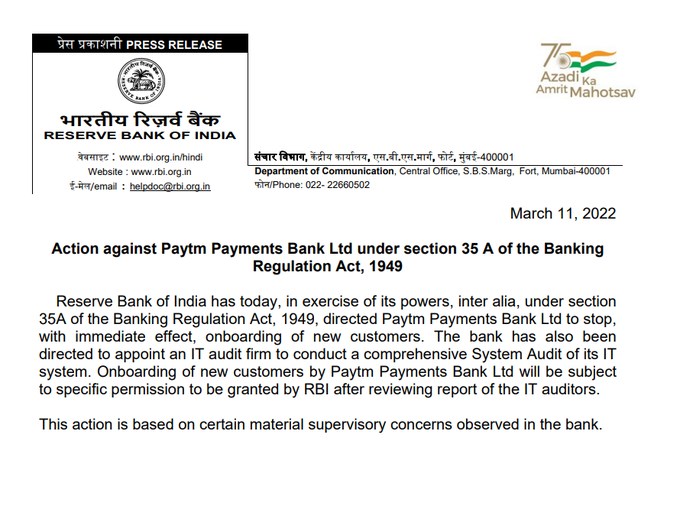

Payment Banks are regulated by Reserve Bank of India

They must follow the rules laid down by the regulator

Onboarding rules and functioning rules have been set by the regulator

They must follow the rules laid down by the regulator

Onboarding rules and functioning rules have been set by the regulator

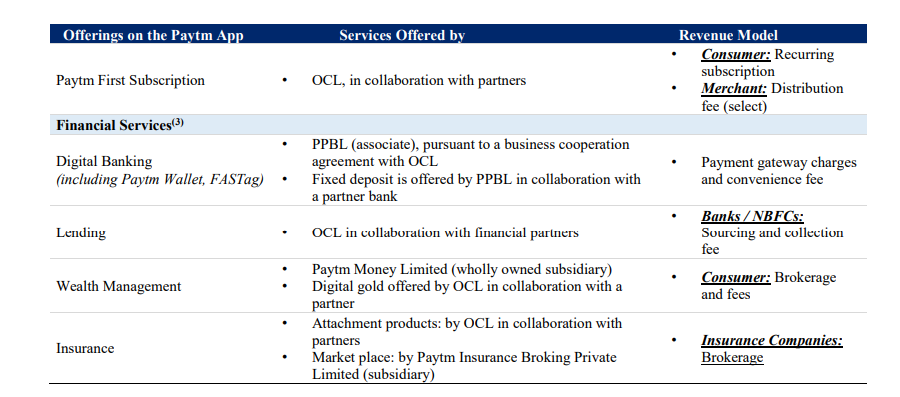

Product offering of Paytm Payments Bank

1.Paytm Wallet

2. Savings accounts

3.Paytm UPI

4.Fixed deposits

5.Corporate salary accounts

6. Domestic Money Transfer

7. Fastag

8.National Automated Clearing House

The money that you keep in Paytm is housed under Paytm payments bank

The fastag money is also housed under Paytm Payments Bank

1.Paytm Wallet

2. Savings accounts

3.Paytm UPI

4.Fixed deposits

5.Corporate salary accounts

6. Domestic Money Transfer

7. Fastag

8.National Automated Clearing House

The money that you keep in Paytm is housed under Paytm payments bank

The fastag money is also housed under Paytm Payments Bank

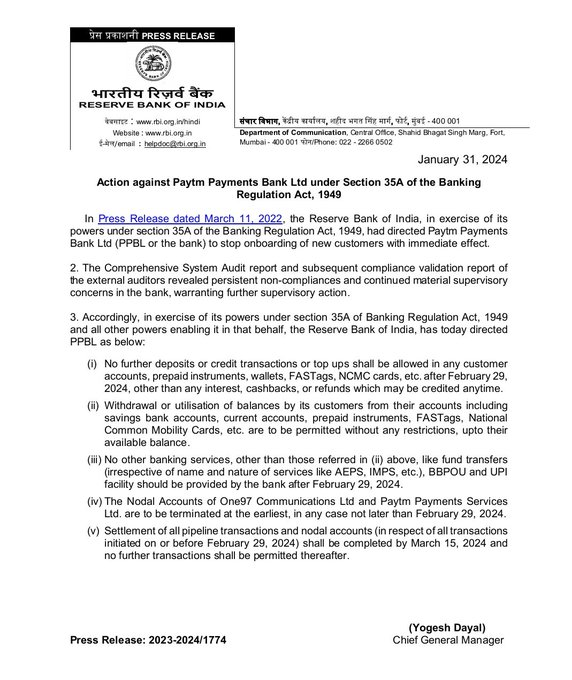

RBI action yesterday:-

After an audit by external auditor

RBI found that there were repeated non compliances by Paytm Payment Banks

RBI then directed Paytm to

1. Stop accepting deposits

2. Allowed customers to withdraw deposits

This effectively means RBI has directed Paytm Payments banks to stop core payment banking operations effective Feb 29.

Effectively Paytm cannot keep the money you deposit with them.

They will now have to tie up with banks to keep this money with Banks

After an audit by external auditor

RBI found that there were repeated non compliances by Paytm Payment Banks

RBI then directed Paytm to

1. Stop accepting deposits

2. Allowed customers to withdraw deposits

This effectively means RBI has directed Paytm Payments banks to stop core payment banking operations effective Feb 29.

Effectively Paytm cannot keep the money you deposit with them.

They will now have to tie up with banks to keep this money with Banks

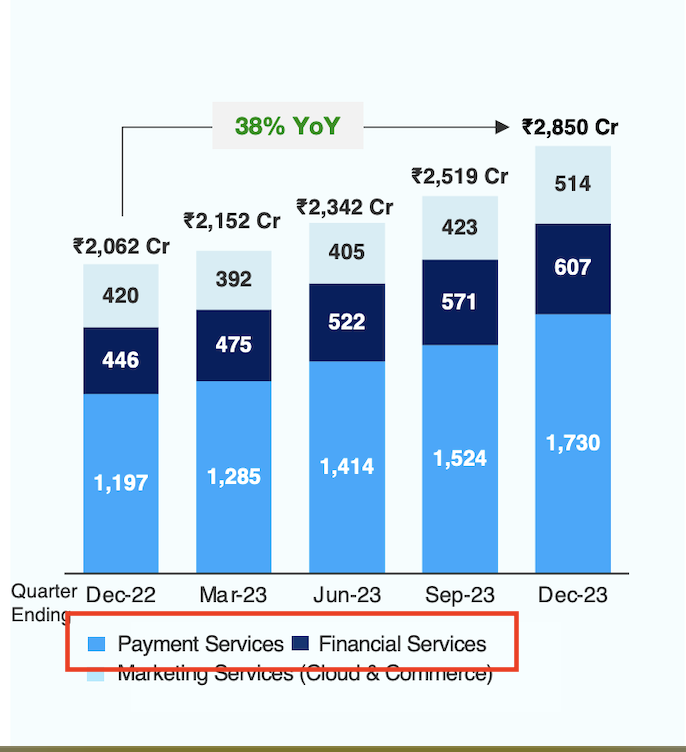

This could not have come at a worse time for Paytm.

The RBI circular on unsecured lending has already meant tat they need to scale down the sub 50,000 loans

x.com

The RBI circular on unsecured lending has already meant tat they need to scale down the sub 50,000 loans

x.com

Valuation:-

Paytm is still valued at 48,000cr.

Federal bank which made 1,000cr profits last 12 months is valued at 28,000cr.

It is hard to give a concrete valuation to Paytm

But the valuation is not cheap

Paytm is still valued at 48,000cr.

Federal bank which made 1,000cr profits last 12 months is valued at 28,000cr.

It is hard to give a concrete valuation to Paytm

But the valuation is not cheap

So what next for Paytm?

RBI's decision on Paytm Payments Banks is a severe blow to Paytm.

The company will have to rework its entire payments business model

The company is already facing a rework of its lending business.

Given the headwinds,

Times are not easy for Paytm

RBI's decision on Paytm Payments Banks is a severe blow to Paytm.

The company will have to rework its entire payments business model

The company is already facing a rework of its lending business.

Given the headwinds,

Times are not easy for Paytm

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

Disclaimer:-

This is my own study.

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

This is my own study.

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

Loading suggestions...