Today's moontower isn't paywalled. Headed off to vacation tomorrow so writing will resume in early Dec

Happy Thanksgiving and thanks to y'all for the encouragement and support

☮️🐫

Ok let's thread this sucker...

Happy Thanksgiving and thanks to y'all for the encouragement and support

☮️🐫

Ok let's thread this sucker...

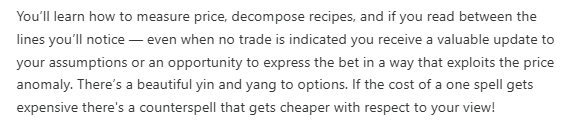

When you learn a new language you ascend levels of competence. You start with everyday words and basic grammar with a goal of at least being comprehensible. This will unlock simple conversations, a milestone that enables and encourages regular practice.

Like getting through the first month of guitar when you just wrestle with physical finger placement and learning your A, E, G, C, D open chords. The moment you can fluidly switch between the chords you can play the majority of music you hear on the radio...

that's when your learning takes off.

With enough practice in language or music you can think outside your native tongue or improvise in real-time. In skill acquisition terms, you have achieved “unconscious competence”.

With enough practice in language or music you can think outside your native tongue or improvise in real-time. In skill acquisition terms, you have achieved “unconscious competence”.

Options are the language of risk

You start by mapping basic vocabulary to real-world sensation. “Long call” = “happy if stock go up”. With practice, you develop taste in how to use this vocabulary.

You start by mapping basic vocabulary to real-world sensation. “Long call” = “happy if stock go up”. With practice, you develop taste in how to use this vocabulary.

In English, “I know how you feel” expresses empathy but you don’t say that to someone who just lost a loved one both because it’s not true (you don’t know how they feel) and because this comment awkwardly makes the moment about you...

Well-intentioned commiseration clumsily executed.

Trade structuring can be clumsily executed too. You think something could double in the next 6 months and you…sold puts?

Trade structuring can be clumsily executed too. You think something could double in the next 6 months and you…sold puts?

If you are right, congratulations on making a tiny bit of cash on direction but opportunity costing yourself a small fortune by expressing the trade with a short vol position when your entire thesis insinuates orgasmic levels of vol!

Wizardry

You have a book of spells. You desire stealth so you look up “cloak of invisibility” and see you need some a salamander tail, a runestone and peroxide to conjure it. Common ingredients in a sorcerer’s home.

You have a book of spells. You desire stealth so you look up “cloak of invisibility” and see you need some a salamander tail, a runestone and peroxide to conjure it. Common ingredients in a sorcerer’s home.

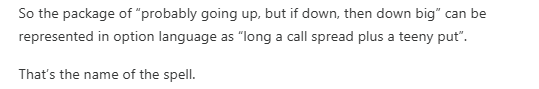

In investing you have a sense that a stock is “probably going higher but if I’m wrong I'm really wrong.” That's a natural language description of a somewhat routine scenario. You need to translate that to code. Option code.

❓What instrument is levered to the “probability that a stock goes up”?

✅A call spread (if this is not clear, review a deeper understanding of vertical spreads)

❓What instrument is levered to “if down, magnitude is yuuuge”?

✅A far OTM put x.com

✅A call spread (if this is not clear, review a deeper understanding of vertical spreads)

❓What instrument is levered to “if down, magnitude is yuuuge”?

✅A far OTM put x.com

Now, as a wizard you can adjust the size, ratio, and particular strike to both

a) suit your taste and

b) take “what the option market is giving you”

a) suit your taste and

b) take “what the option market is giving you”

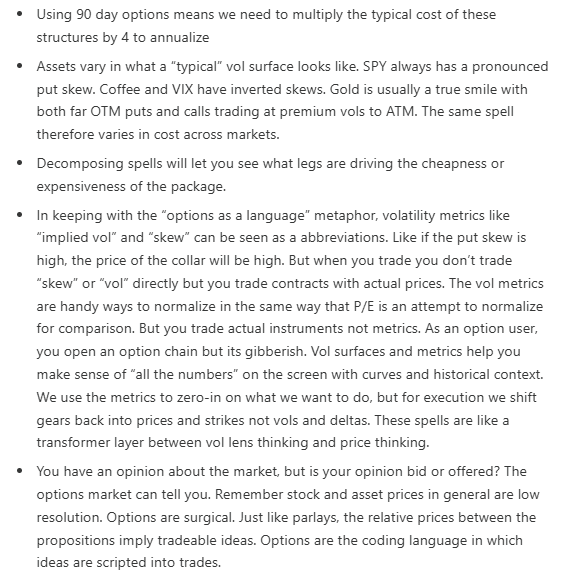

What the option market is giving you

This ties right back to the most underappreciated concept in trading….is it bid or offered?

If you believe that an asset’s upcoming moves are distributed so it probably goes up but if not it crashes, you know what spell to cast.

This ties right back to the most underappreciated concept in trading….is it bid or offered?

If you believe that an asset’s upcoming moves are distributed so it probably goes up but if not it crashes, you know what spell to cast.

That's half the battle.

Next question:

Is the option market offering you the ingredients for the spell at an attractive price? Or is every wizard trying to cast the same spell and bidding for the same ingredients?

Next question:

Is the option market offering you the ingredients for the spell at an attractive price? Or is every wizard trying to cast the same spell and bidding for the same ingredients?

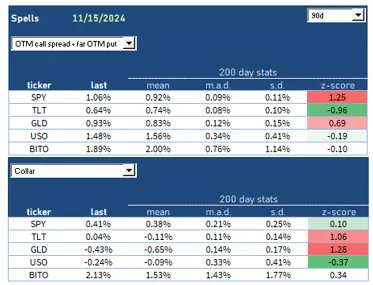

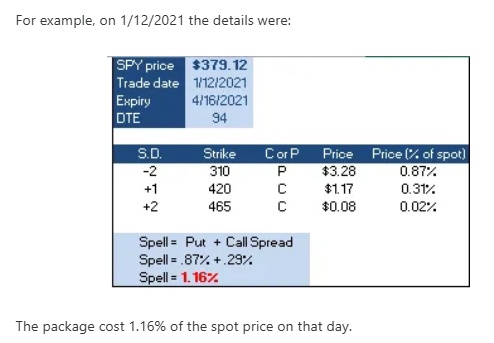

Let’s get to some data.

Setup

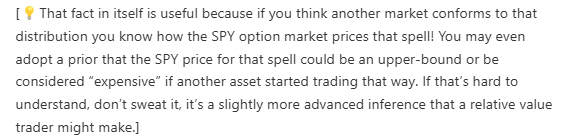

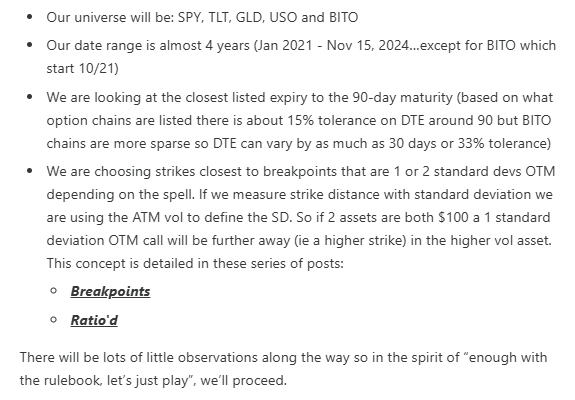

We are going to look at 2 spells that can make sense for betting on “probably going up, but if down, then down big”. An interesting thing about this distribution how its kinda the base case distribution for SPY right?

Setup

We are going to look at 2 spells that can make sense for betting on “probably going up, but if down, then down big”. An interesting thing about this distribution how its kinda the base case distribution for SPY right?

Both history and the options market agree that the SPY proposition looks like “hey you’ll make some money on average and every now and then there will be a big drawdown. also, don’t expect the market to crash up overnight”. x.com

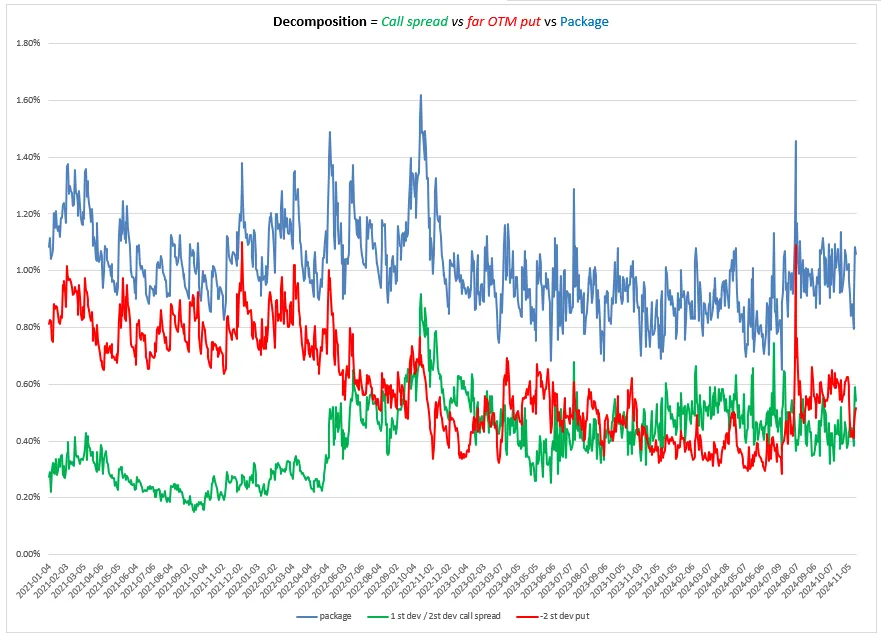

Exploring the 1 sd collar spell

The next spell is the 1 sd collar (also known as a risk reversal or god help you if you trade commodities, “a fence”)

Long 1-s.d OTM.put

-

1-s.d. OTM call

Notice how this is put “minus” call...

The next spell is the 1 sd collar (also known as a risk reversal or god help you if you trade commodities, “a fence”)

Long 1-s.d OTM.put

-

1-s.d. OTM call

Notice how this is put “minus” call...

that means if the collar trades for a positive value then the put price > call price.

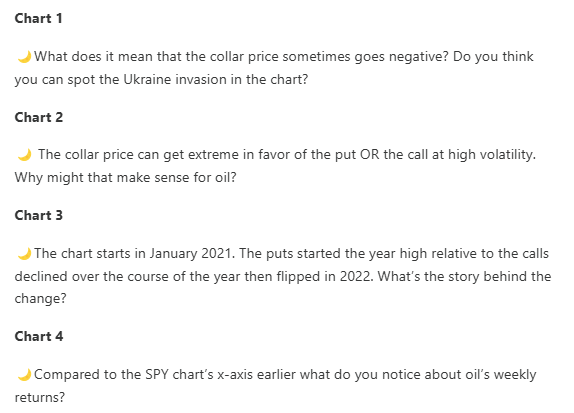

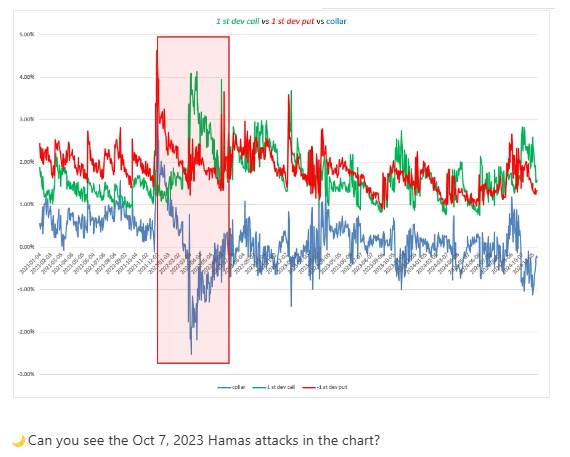

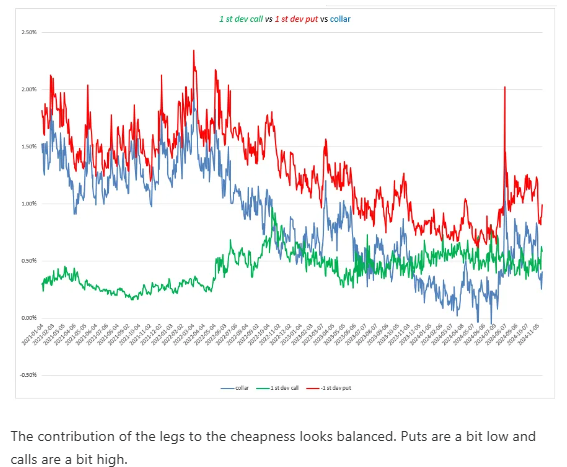

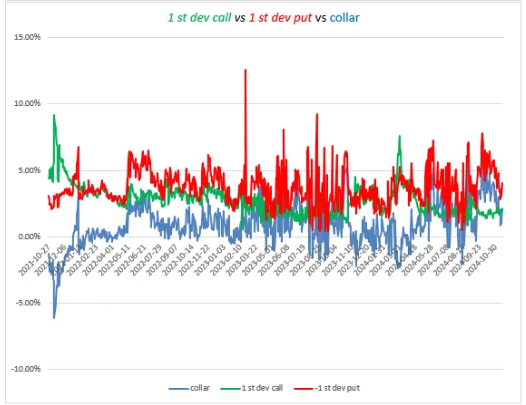

Let’s use USO, the oil etf. Instead of pointing out what’s interesting in each of the charts I will cherry-pick questions so you can practice. x.com

Let’s use USO, the oil etf. Instead of pointing out what’s interesting in each of the charts I will cherry-pick questions so you can practice. x.com

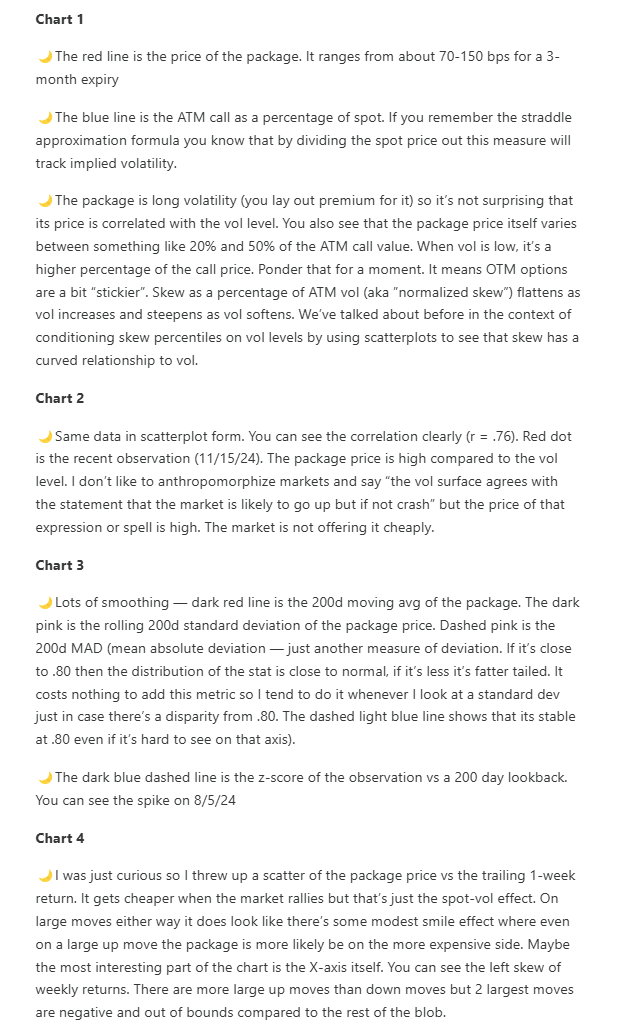

The decomposition of the collar into the separate call and put legs will let you see the drivers.

In early 2022, you can see the put leg was relatively stable after peaking at the end of 2021 but the collapse in collar pricing was driven by the calls exploding higher. x.com

In early 2022, you can see the put leg was relatively stable after peaking at the end of 2021 but the collapse in collar pricing was driven by the calls exploding higher. x.com

[We don’t have this in moontowerai but we’re excited about all the wood we’re gonna chop in 2025 😉]

Actually on the 10 screens bit — a normal human thinks that sounds like a nightmarish work environment. But you have to have some faith that this works just like walking and chewing gum.

You get used to it. Plus all the dashboards are the survivors of the evolutionary screen-space tournament. What’s left is a bunch of tables and charts that your eyes easily scan and process into a gestalt.

It’s like the market is having conversations all around you but a well-constructed cockpit will simulate the cocktail party effect — you’ll identify the most prominent features of what market parameters are changing today.

This is the “science” part. The actions are the art.

This is the “science” part. The actions are the art.

Stay groovy

☮️

☮️

Loading suggestions...

![[A little bonus section] https://t.co/nYLqvnIAaH](https://pbs.twimg.com/media/Gc6k0G7aAAE4OMg.png)

![[A little bonus section] https://t.co/nYLqvnIAaH](https://pbs.twimg.com/media/Gc6k3l-aYAAuOE2.png)

![[More story time] https://t.co/YLmy9iJVl6](https://pbs.twimg.com/media/Gc6mKWQaAAUKWA8.png)