Joel Greenblatt outperformed by almost 50% (!) for 20 years

How he did this?

These 15 quotes will teach you his philosophy x.com

How he did this?

These 15 quotes will teach you his philosophy x.com

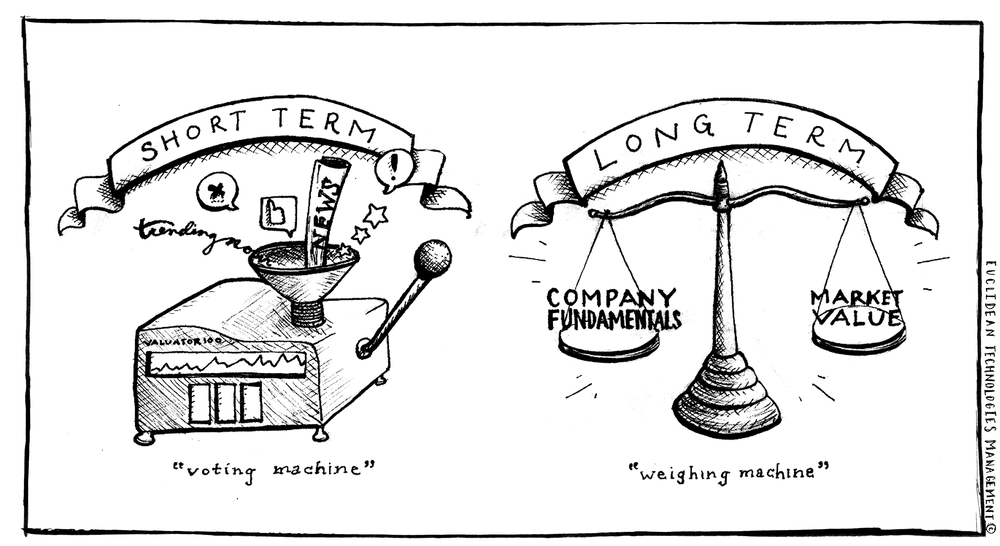

3. The long-term

"The market’s very emotional, but over time, doing something logical and systematic does work. The market eventually gets it right." x.com

"The market’s very emotional, but over time, doing something logical and systematic does work. The market eventually gets it right." x.com

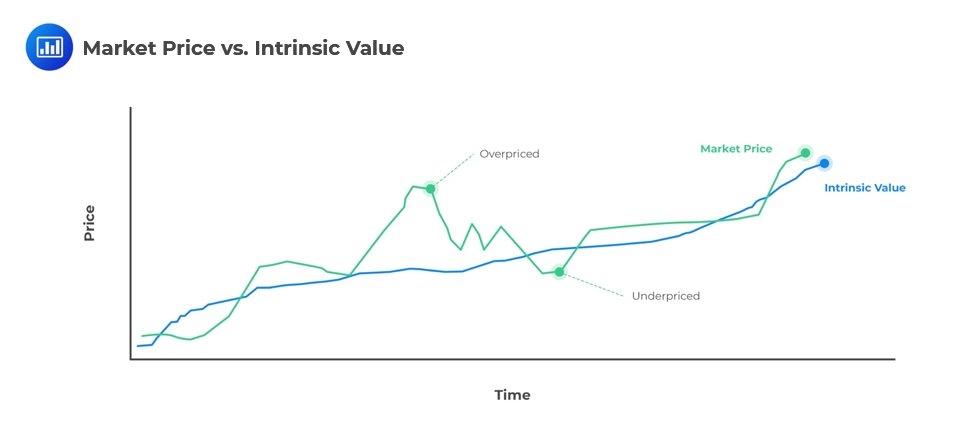

4. Undervaluation

"The secret to successful investing is relatively simple: Figure out the value of something and then pay a lot less." x.com

"The secret to successful investing is relatively simple: Figure out the value of something and then pay a lot less." x.com

5. Sit back and relax

"Long-term investing is like cooking rice with a closed lid. After one has put in just the right amount of water and set on the flame, sit back, and let it cook." x.com

"Long-term investing is like cooking rice with a closed lid. After one has put in just the right amount of water and set on the flame, sit back, and let it cook." x.com

6. Have a plan

"Choosing individual stocks without any idea of what you’re looking for is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot." x.com

"Choosing individual stocks without any idea of what you’re looking for is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot." x.com

7. The best ideas win

"Remember, it’s the quality of your ideas, not the quantity that will result in the big money." x.com

"Remember, it’s the quality of your ideas, not the quantity that will result in the big money." x.com

8. Only invest in no-brainers

"I wait until an investment idea is so good, it hits me over the head like an anvil." x.com

"I wait until an investment idea is so good, it hits me over the head like an anvil." x.com

9. Budgeting

"Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market – and stick with it!" x.com

"Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market – and stick with it!" x.com

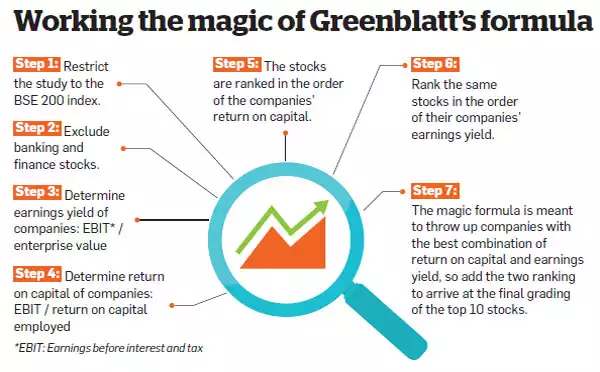

10. The magic formula

"If I plug my estimates into the Magic Formula, and it comes out cheap, that’s good." x.com

"If I plug my estimates into the Magic Formula, and it comes out cheap, that’s good." x.com

11. Do your homework

"Usually what happens is, the stock price is like a rubber band. It stretches away from value. If we’re good at valuing businesses, the rubber band will snap back." x.com

"Usually what happens is, the stock price is like a rubber band. It stretches away from value. If we’re good at valuing businesses, the rubber band will snap back." x.com

12. Only invest in high-conviction ideas

"The most successful horseplayers (I guess they lose the least) are the ones who don’t bet on every race but wager on only those occasions when they have a clear conviction." x.com

"The most successful horseplayers (I guess they lose the least) are the ones who don’t bet on every race but wager on only those occasions when they have a clear conviction." x.com

13. Diversification

"You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term." x.com

"You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term." x.com

14. The short-term

"Stock prices move around wildly over very short periods of time. This does not mean that the values of the underlying companies have changed very much during that same period." x.com

"Stock prices move around wildly over very short periods of time. This does not mean that the values of the underlying companies have changed very much during that same period." x.com

15. Concentration

"By not placing all your eggs in a buggy-whip, breast-implant, pet-rock, or huckapoo-sweater company, you can diversify that portion of your risk that comes from the misfortunes of any individual company." x.com

"By not placing all your eggs in a buggy-whip, breast-implant, pet-rock, or huckapoo-sweater company, you can diversify that portion of your risk that comes from the misfortunes of any individual company." x.com

That's it for today.

Do you want more? Here's a summary of all public writings of Joel Greenblatt: compounding-quality.kit.com

Do you want more? Here's a summary of all public writings of Joel Greenblatt: compounding-quality.kit.com

Loading suggestions...