Re: Oil-The Great Re-Opening (Or NOT)

As I've been saying, I would LOVE to be proven wrong on my ST bear view on Oil given my LT bull positioning, but anyone betting on a big rebound based on the Great China Re-Opening needs to be very careful. (THREAD)

As I've been saying, I would LOVE to be proven wrong on my ST bear view on Oil given my LT bull positioning, but anyone betting on a big rebound based on the Great China Re-Opening needs to be very careful. (THREAD)

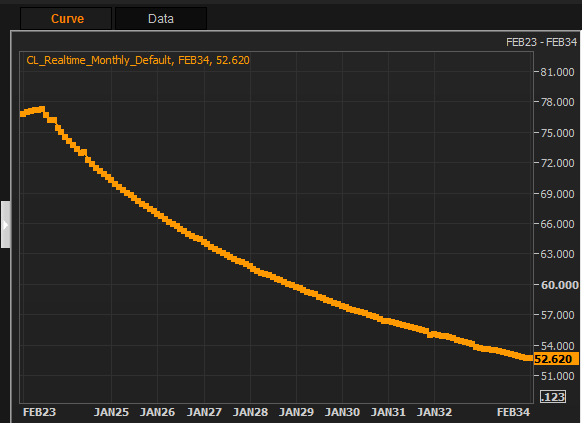

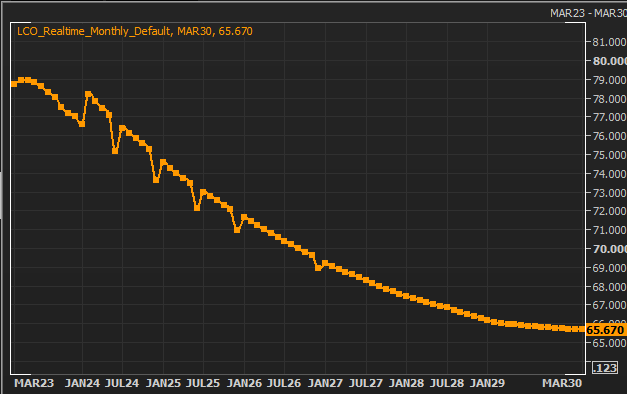

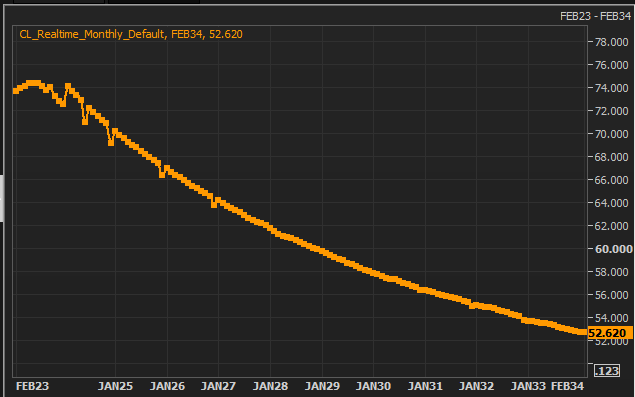

Imho, US-centric Oil investors have been lulled into a false sense of security in our artificially depressed stocks thanks to SPR releases. Despite this "tightness," forward curves are now in contango in the front. Why?

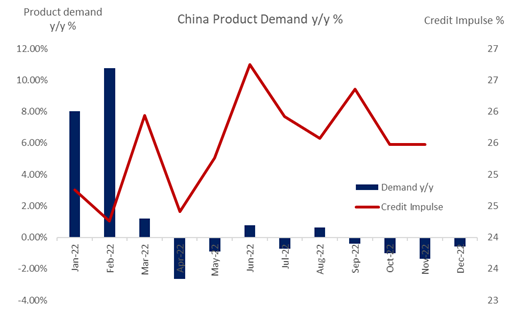

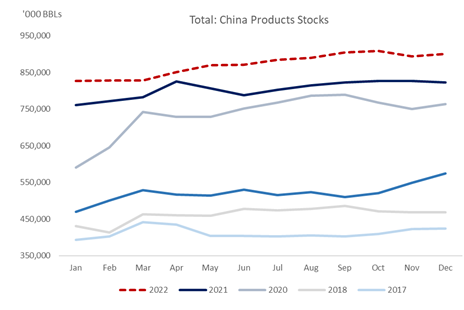

Now look at China. As @BurggrabenH was early to point out, CHINA IS AT PRODUCT TANK-TOPS -- and not the Lululemon kind!

Those who have followed me for a while know that I've had an LT Structural Bull thesis on Oil since 2016, expressed through a post-reorg PE with a 10-year horizon.

That does NOT mean there can't be bearish ST cycles within LT structural cycles.

That does NOT mean there can't be bearish ST cycles within LT structural cycles.

At the beginning of 2021, the stars lined up from BOTH a LT and ST perspective, and I was very BULLISH Oil:

Oil made a HUGE move during 2021 through Q2'2022, and I became CAUTIOUS in April, 2022 (a wee bit early, but it turned out to be the right call):

I sounded further warnings this summer as the USD Wrecking Ball shot the moon:

I also pointed out the LACK OF SIGNAL in current US "physical tightness" IF THERE IS DEMAND DESTRUCTION INTO INELASTIC SUPPLY:

And here we are:

- Forward curves in contango in the front

- China at product tank-tops

- Demand slowing worldwide

- Forward curves in contango in the front

- China at product tank-tops

- Demand slowing worldwide

What would change my thinking in the ST?

If the Forces of Supply Curtailment (EU Embargoes leading to Russian shut-ins) and/or additional OPEC+ cuts EXCEED the Forces of Demand Destruction. Been saying this for months now.

If the Forces of Supply Curtailment (EU Embargoes leading to Russian shut-ins) and/or additional OPEC+ cuts EXCEED the Forces of Demand Destruction. Been saying this for months now.

I had hopes that EU Embargoes forcing Russian shut-ins might induce a ST spike and actually made a little $ in November riding that theme, but I had little conviction it would last so I took the $ and ran.

Nevertheless, this is something to watch:

Nevertheless, this is something to watch:

Here's the problem:

The EU Embargoes might be self-defeating.

The EU Embargoes might be self-defeating.

Here's the other problem:

MbS let his ego to "stick it to Biden" get the better of him and acted too early.

MbS let his ego to "stick it to Biden" get the better of him and acted too early.

And finally, of course, we have a Fed that is hell-bent on creating enough DEMAND DESTRUCTION (of everything, not just Oil) to stuff the Inflation Genie back into the 2% bottle.

"But even 2008 barely saw much actual demand destruction!"

Here's the problem with that argument: it's not just about demand destruction, it's about TOTAL DEMAND SHORTFALL AGAINST EXPECTATIONS:

Here's the problem with that argument: it's not just about demand destruction, it's about TOTAL DEMAND SHORTFALL AGAINST EXPECTATIONS:

The good news is that the USD Wrecking Ball has taken a breather (for now), as the world seems to over-weight second derivatives of price (slowing CPI GROWTH) vs. the still extremely high first derivatives of price and extrapolating this to an imminent Fed Pivot.

The bad news is that I think the imminent Fed Pivot thesis will get rug-pulled and we will see another resurgence of the USD Wrecking Ball.

I remain optimistic for 2024 and beyond, but it's simply too cloudy right now for me to see the ST/LT stars aligning. (END THREAD)

This seems like a hedged, bullshit statement coming from a position of weakness (because India and China can’t take much more embargoed Russian oil) rather than volitional intent to support the market. 500k would be a disappointment from a supply curtailment view.

@BurggrabenH

@BurggrabenH

Don’t say we didn’t warn you. 👇

Some myths to debunk about the Great China Reopening:

Myth 1: China has just been lifted from complete lockdown, and revenge travel is about to explode.

Myth 1: China has just been lifted from complete lockdown, and revenge travel is about to explode.

Reality 1: China was never under complete lockdown. Specific airline routes and cities may have gotten locked down from time to time, but it’s not as if the entire country was ever fully locked down.

Myth 2: Chinese Jet Fuel demand is massively below 2021 levels, which in turn is massively below pre-Covid levels.

Reality 2:

Chinese Jet Fuel demand, per Lakshmi:

2019: 650kbpd

2021: 450kbpd

2022: 400kbpd

Reality 2:

Chinese Jet Fuel demand, per Lakshmi:

2019: 650kbpd

2021: 450kbpd

2022: 400kbpd

Myth 3: Chinese Jet Fuel demand (and therefore Chinese revenge travel) drives Chinese Oil demand.

Reality 3:

Components of Chinese Oil demand, from Lakshmi:

Jet Fuel: 3%

Building: 8%

Petrochemicals: 12%

Reality 3:

Components of Chinese Oil demand, from Lakshmi:

Jet Fuel: 3%

Building: 8%

Petrochemicals: 12%

So I ask the Great China Reopening Bulls:

How will the China Reopening thesis trump the China Real Estate Crash thesis when it comes to Oil demand?

The Chinese Revenge Travel narrative is seductive, and I’d really love to believe it as an LT Bull, but I remain cautious ST.

How will the China Reopening thesis trump the China Real Estate Crash thesis when it comes to Oil demand?

The Chinese Revenge Travel narrative is seductive, and I’d really love to believe it as an LT Bull, but I remain cautious ST.

Important chart to keep in mind, courtesy of Lakshmi/Cap One:

Noticed the flip back to Backwardation this am as well. Watching this and RUB perking as signs of EU Embargoes forcing Russian shut-ins. Not sure if forces of Supply Curtailment can win over forces of Demand Destruction in the ST, but it is the key variable.

Nasty rejection at the $82 nexus. Don't say you weren't warned. @BurggrabenH

I'm neither a ST Oil Pollyanna Bull staring into the face of a hard landing, nor am I an LT Oil Bear believing in a dystopian world that de-civilizes with decreasing energy intensity. @PauloMacro gives some good perspectives.

The ONE constant in investing in O&G is this:

If you are hubristic and become overzealous / tribal in your thinking, you will get DECAPITATED.

If you are hubristic and become overzealous / tribal in your thinking, you will get DECAPITATED.

Lakshmi gets to the HEART of the Great China Re-Opening fallacy this am:

"We are not starting in a 3-4 MBPD on avg demand hole in demand from China, we are starting from a few hundred thousand barrels per day on avg hole in demand from China."

@BurggrabenH

"We are not starting in a 3-4 MBPD on avg demand hole in demand from China, we are starting from a few hundred thousand barrels per day on avg hole in demand from China."

@BurggrabenH

Oops.

China Re-Opening Hyperventilation making the rounds again, this time emboldened by steepened backwardation in recent weeks.

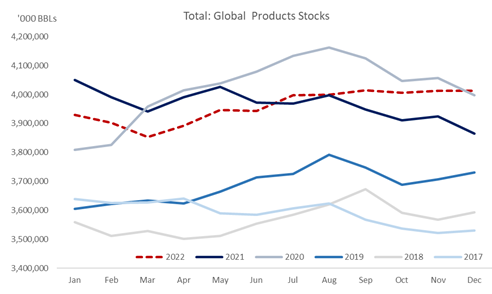

Meanwhile, global stocks are ticking up.

Lakshmi’s read-through: hoarding/picture-painting ahead of EU product embargoes.

Caveat emptor. 🐻

Meanwhile, global stocks are ticking up.

Lakshmi’s read-through: hoarding/picture-painting ahead of EU product embargoes.

Caveat emptor. 🐻

For whatever it’s worth, Lakshmi thinks worst-case Russian losses will be ~400kbpd with 0 as a possibility vs. markets likely still pricing in ~1 mmbpd of losses.

OFAC language is more porous than Swiss cheese too. Lakshmi sums it up nicely:

“GOAL for the US (not so much for the EU) is FIRST to keep Russian volumes flowing and SECOND to reduce Russian revenues.”

“GOAL for the US (not so much for the EU) is FIRST to keep Russian volumes flowing and SECOND to reduce Russian revenues.”

Will be interesting to see how long this can keep up. As my good friend @BurggrabenH points out, India has de minimus storage capabilities.

Loading suggestions...