2/ NOTE:

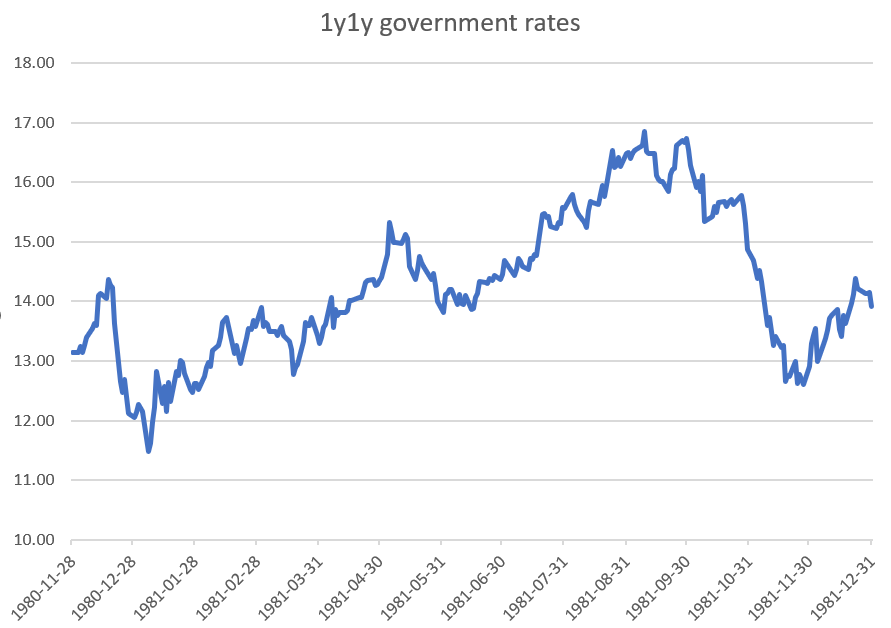

This analysis is on the 1y1y forward rate, i.e. you are taking a position in the expected 1 year rate in 1 years time.

This is roughly equivalent to buying the 2 year bond now, and selling it in 1 year's time.

DON'T do analysis just on the 2 year yield.

Here we go...

This analysis is on the 1y1y forward rate, i.e. you are taking a position in the expected 1 year rate in 1 years time.

This is roughly equivalent to buying the 2 year bond now, and selling it in 1 year's time.

DON'T do analysis just on the 2 year yield.

Here we go...

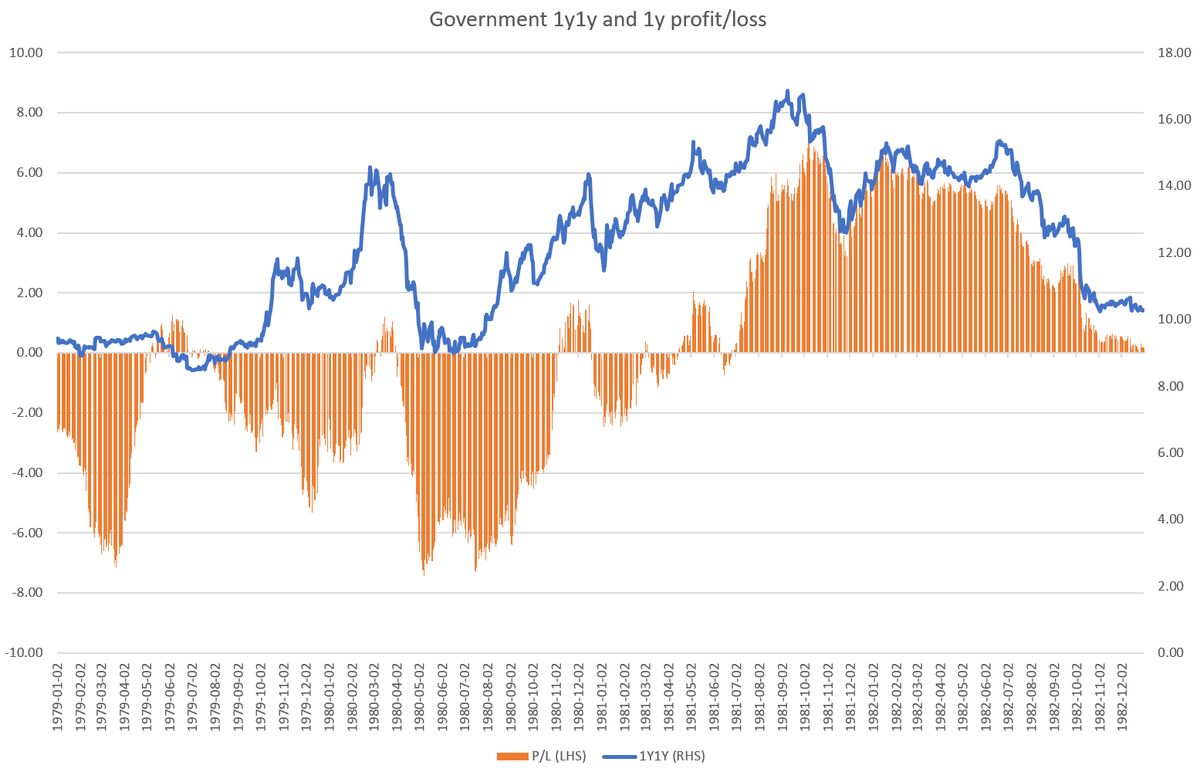

3/ Late 70s and 80s. Many hikes and cuts. Tough to call second to last hike each time, but if you did, these are results (better than you think, I was quite surprised).

Date is second to last hike date. You receive 1y1y at the end of the next session (the levels are on this day)

Date is second to last hike date. You receive 1y1y at the end of the next session (the levels are on this day)

4/

8-Oct-79

Fed funds: 13% hiked from 11.5%

1y1y rate at 9.97%, 3.03% (!!!) lower than FF

A trade buying bonds would LOSE 1.23% on this trade. ❌

Not that bad considering inversion. Note that fed funds was much lower at 11% at the end of this trade, and it still lost.

8-Oct-79

Fed funds: 13% hiked from 11.5%

1y1y rate at 9.97%, 3.03% (!!!) lower than FF

A trade buying bonds would LOSE 1.23% on this trade. ❌

Not that bad considering inversion. Note that fed funds was much lower at 11% at the end of this trade, and it still lost.

5/

15-Feb-1980

Fed funds: 15% hiked from 14%

1y1y rate at 13.54%, 1.46% lower than FF

A trade buying bonds would PROFIT 0.43% on this trade. ✅

Fed funds was to 20% (!!!!!) 1 year later, and yet this trade profits. Incredible.

15-Feb-1980

Fed funds: 15% hiked from 14%

1y1y rate at 13.54%, 1.46% lower than FF

A trade buying bonds would PROFIT 0.43% on this trade. ✅

Fed funds was to 20% (!!!!!) 1 year later, and yet this trade profits. Incredible.

6/

21-Nov-1980

Fed funds: 18% hiked from 12% (!)

1y1y rate at 13.22%, 4.88% (!!!) lower than FF

A trade buying bonds would PROFIT 0.23% on this trade. ✅

Again, crazy that this still profited, despite incredible inversion and a Fed funds at 20% the next year!

21-Nov-1980

Fed funds: 18% hiked from 12% (!)

1y1y rate at 13.22%, 4.88% (!!!) lower than FF

A trade buying bonds would PROFIT 0.23% on this trade. ✅

Again, crazy that this still profited, despite incredible inversion and a Fed funds at 20% the next year!

9/

28-Apr-1981

Fed funds: 16% hiked from 12% (!)

1y1y rate at 13.22%, 4.88% (!!!) lower than FF

A trade buying bonds would PROFIT 0.23% on this trade. ✅

Not big, and with a massive drawdown...but it still worked through another 2 oscillations up to 20%.

28-Apr-1981

Fed funds: 16% hiked from 12% (!)

1y1y rate at 13.22%, 4.88% (!!!) lower than FF

A trade buying bonds would PROFIT 0.23% on this trade. ✅

Not big, and with a massive drawdown...but it still worked through another 2 oscillations up to 20%.

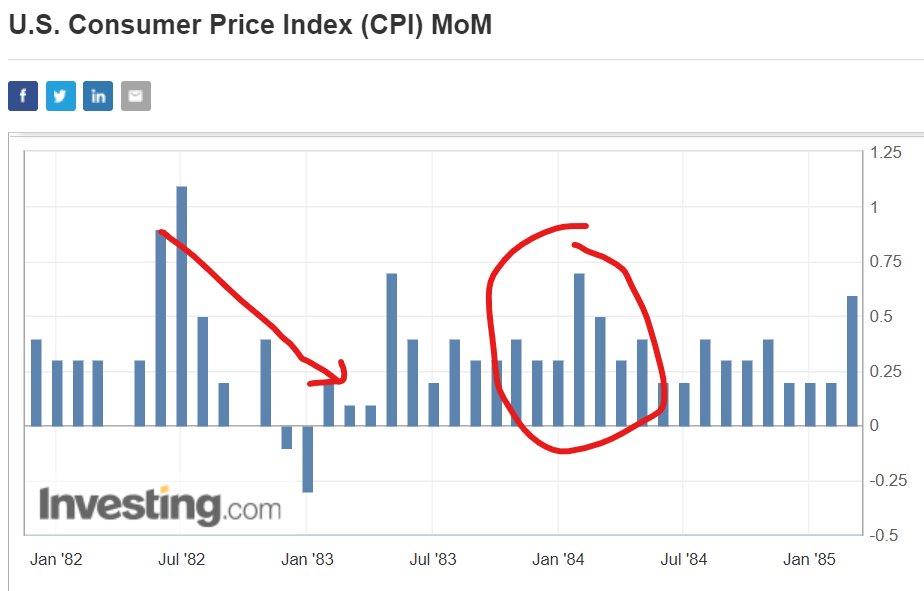

10/

24-May-1983

Fed funds: 8.63% hiked from 8.5%

1y1y rate at 10.31%, 1.82% higher than FF

A trade buying bonds would LOSE 1.76% on this trade. ❌

Pretty big loss here. Inflation moved from low 3% to high 4% over this time, causing hikes in late '83, and losses on the trade.

24-May-1983

Fed funds: 8.63% hiked from 8.5%

1y1y rate at 10.31%, 1.82% higher than FF

A trade buying bonds would LOSE 1.76% on this trade. ❌

Pretty big loss here. Inflation moved from low 3% to high 4% over this time, causing hikes in late '83, and losses on the trade.

11/

17-Jul-1984

Fed funds: 11% hiked from 10.5%

1y1y rate at 13.78%, 2.78% higher than FF

A trade buying bonds would PROFIT 4.13% on this trade. ✅

Massive profit here. This one has nailed the end of the hiking cycle.

NOTE that the 1y1y rate was WAY higher than fed funds.

17-Jul-1984

Fed funds: 11% hiked from 10.5%

1y1y rate at 13.78%, 2.78% higher than FF

A trade buying bonds would PROFIT 4.13% on this trade. ✅

Massive profit here. This one has nailed the end of the hiking cycle.

NOTE that the 1y1y rate was WAY higher than fed funds.

12/

19-May-1987

Fed funds: 6.5% hiked from 5.88%

1y1y rate at 8.88%, 3.33% higher than FF

A trade buying bonds would PROFIT 1.43% on this trade. ✅

Steep yield curve makes profits big again.

19-May-1987

Fed funds: 6.5% hiked from 5.88%

1y1y rate at 8.88%, 3.33% higher than FF

A trade buying bonds would PROFIT 1.43% on this trade. ✅

Steep yield curve makes profits big again.

13/

14-Dec-1988

Fed funds: 8.38% hiked from 8.13%

1y1y rate at 9.22%, 0.86% higher than FF

A trade buying bonds would PROFIT 1.57% on this trade. ✅

Another good one, but once again a positive slope yield curve.

14-Dec-1988

Fed funds: 8.38% hiked from 8.13%

1y1y rate at 9.22%, 0.86% higher than FF

A trade buying bonds would PROFIT 1.57% on this trade. ✅

Another good one, but once again a positive slope yield curve.

14/

21-Mar-2000

Fed funds: 6% hiked from 5.75%

1y1y rate at 6.79%, 0.79% higher than FF

A trade buying bonds would PROFIT 2.69% on this trade. ✅

Big profit, but positive sloped yield curve again.

21-Mar-2000

Fed funds: 6% hiked from 5.75%

1y1y rate at 6.79%, 0.79% higher than FF

A trade buying bonds would PROFIT 2.69% on this trade. ✅

Big profit, but positive sloped yield curve again.

15/

10-May-2006

Fed funds: 5% hiked from 4.75%

1y1y rate at 4.99%, flat to FF

A trade buying bonds would PROFIT 0.13% on this trade. ✅

Not so good, given what was coming. GFC didn't take hold until much later.

10-May-2006

Fed funds: 5% hiked from 4.75%

1y1y rate at 4.99%, flat to FF

A trade buying bonds would PROFIT 0.13% on this trade. ✅

Not so good, given what was coming. GFC didn't take hold until much later.

16/

27-Sep-2018

Fed funds: 2.25% hiked from 2%

1y1y rate at 3.03%, 0.78% higher than FF

A trade buying bonds would PROFIT 1.36% on this trade. ✅

Solid gain, helped by the Fed switching to cutting very quickly. Another positively sloped curve.

27-Sep-2018

Fed funds: 2.25% hiked from 2%

1y1y rate at 3.03%, 0.78% higher than FF

A trade buying bonds would PROFIT 1.36% on this trade. ✅

Solid gain, helped by the Fed switching to cutting very quickly. Another positively sloped curve.

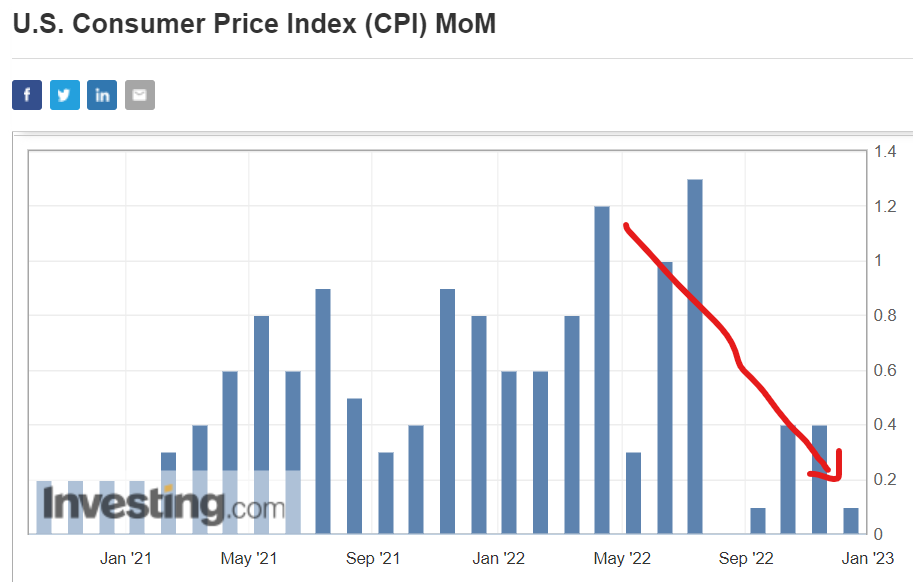

17/ How does this compare to today?

1-Feb-2023

Fed funds: 4.75% hiked from 4.5% (?)

1y1y rate at 3.53% (now), 1.22% LOWER than FF

Which period does this compare to best?

1-Feb-2023

Fed funds: 4.75% hiked from 4.5% (?)

1y1y rate at 3.53% (now), 1.22% LOWER than FF

Which period does this compare to best?

18/ I think we have to ignore the more recent examples from the 2000s, as they all occurred with a positive sloped yield curve, providing a lot of insurance against getting it wrong.

19/ So that leaves the '80s.

Out of 8 trades, 2 lost money. They were split evenly between inverted and positively sloped.

An interesting take away is that the winners were evenly split between being inverted and positive sloped.

Out of 8 trades, 2 lost money. They were split evenly between inverted and positively sloped.

An interesting take away is that the winners were evenly split between being inverted and positive sloped.

20/ The inverted cases are roughly equivalent to what we have today (2 times the yield = 2 times the inversion), so it is consistent.

21/ CONCLUSION

* The inversion of the curve shouldn't bother you, something that surprised me and went against my post 2005 trader training.

* Whether the trade makes money or not will depend on where monthly inflation rate is in a years' time. Obvious, but important.

* The inversion of the curve shouldn't bother you, something that surprised me and went against my post 2005 trader training.

* Whether the trade makes money or not will depend on where monthly inflation rate is in a years' time. Obvious, but important.

24/ TRADE:

Buying short-maturity bonds (or forwards) after the next Fed hike has a high chance of winning, BUT the heavy inversion means that there is ZERO insurance against CPI picking up again.

This is the historical experience, with the best analogue being the '80s.

Buying short-maturity bonds (or forwards) after the next Fed hike has a high chance of winning, BUT the heavy inversion means that there is ZERO insurance against CPI picking up again.

This is the historical experience, with the best analogue being the '80s.

A guide to (inflationary) money printing

Learn how CB can create debasement (and it's not QE that does it)

macroisdead.com

Learn how CB can create debasement (and it's not QE that does it)

macroisdead.com

Loading suggestions...