It's hard to know where any economy is going.

But if you want to start predicting where the macro economy will go in the next 3-6m, here are the 13 key indicators to track that will give you a head start. 👇

But if you want to start predicting where the macro economy will go in the next 3-6m, here are the 13 key indicators to track that will give you a head start. 👇

To understand how any economy will play out in the future, it is important to consider where it is in its:

a) business cycle

b) long-term debt cycle

c) long-term productivity

Let’s take a look at what indicators are best to look at along these dimensions using the US today.

a) business cycle

b) long-term debt cycle

c) long-term productivity

Let’s take a look at what indicators are best to look at along these dimensions using the US today.

Business cycles are the normal expansion and contraction of economic activity typically driven by monetary policy.

To visualize forward you have to know where you are in the cycle, the momentum, and what pressure policy/financial conditions are putting on the economy.

To visualize forward you have to know where you are in the cycle, the momentum, and what pressure policy/financial conditions are putting on the economy.

The two best indicators to understand where an economy stands in the business cycle are

1/ unemployment rate

2/ core inflation

The combination of these two factors tell you whether the economy is running hot, neutral, or cold.

1/ unemployment rate

2/ core inflation

The combination of these two factors tell you whether the economy is running hot, neutral, or cold.

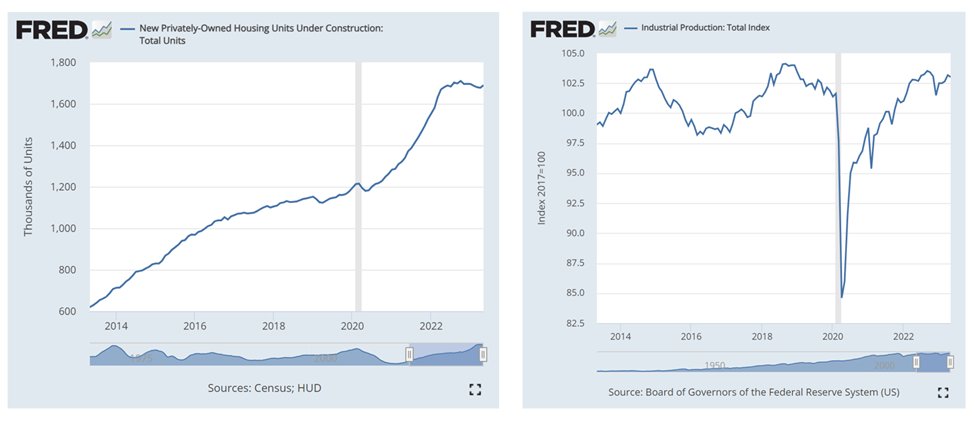

Next it's important to understand the momentum of the economy. That is best done by tracking the most cyclically sensitive sectors of the economy because those typically lead the rest of the economy.

Those best sectors to track are:

3/ Housing

4/ Manufacturing

Those best sectors to track are:

3/ Housing

4/ Manufacturing

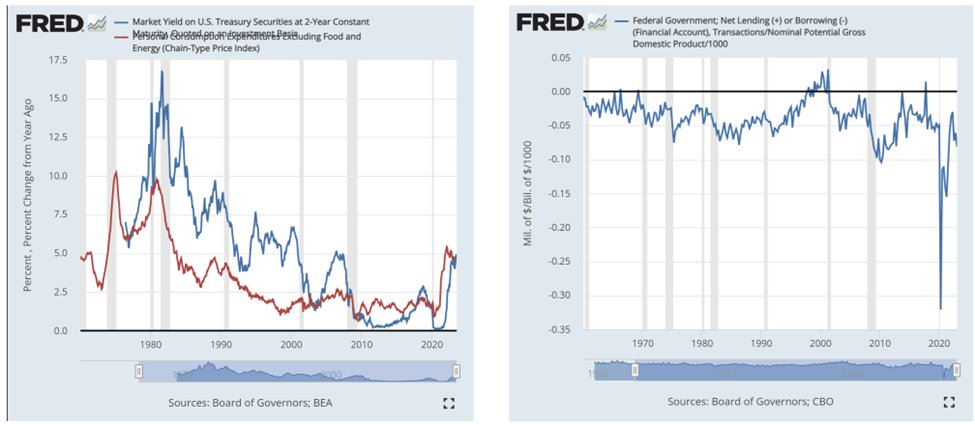

The final step is to understand policy & financial conditions because these dynamics can push an economy faster or slower.

The best measures of policy conditions are:

5/ Short-term real interest rates

6/ Change in fiscal deficit

The best measures of policy conditions are:

5/ Short-term real interest rates

6/ Change in fiscal deficit

The best measures of financial conditions are:

7/ Stocks

8/ Credit spreads

7/ Stocks

8/ Credit spreads

Put together cyclical dynamics in the US today are:

- Late cycle

- Neutral cyclical momentum

- Modestly tightening policy

- Slightly stimulative fin conditions

Typically this set of conditions normally leads to continued expansion at near potential GDP on a 3-6m fwd basis.

- Late cycle

- Neutral cyclical momentum

- Modestly tightening policy

- Slightly stimulative fin conditions

Typically this set of conditions normally leads to continued expansion at near potential GDP on a 3-6m fwd basis.

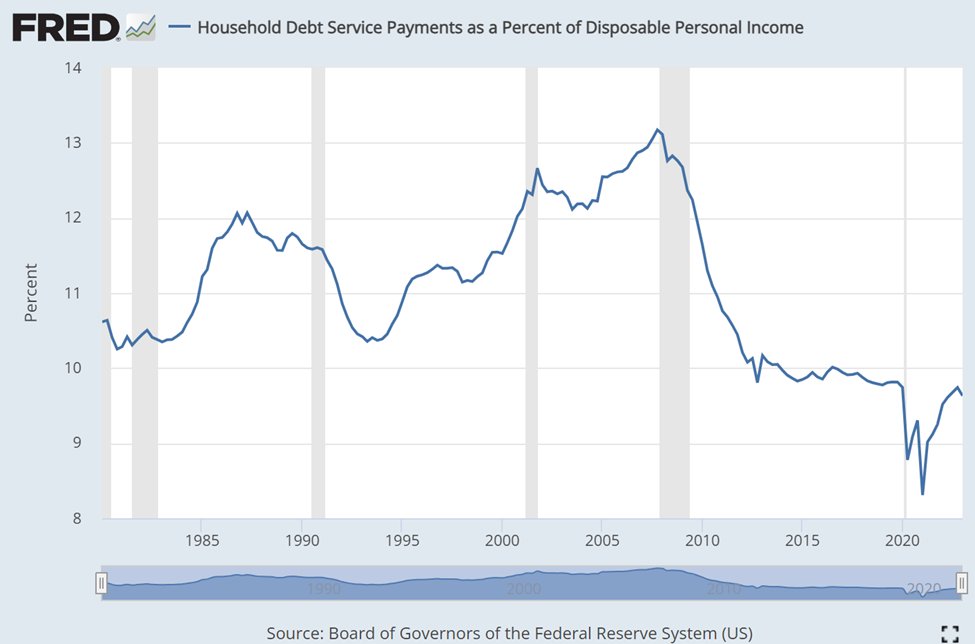

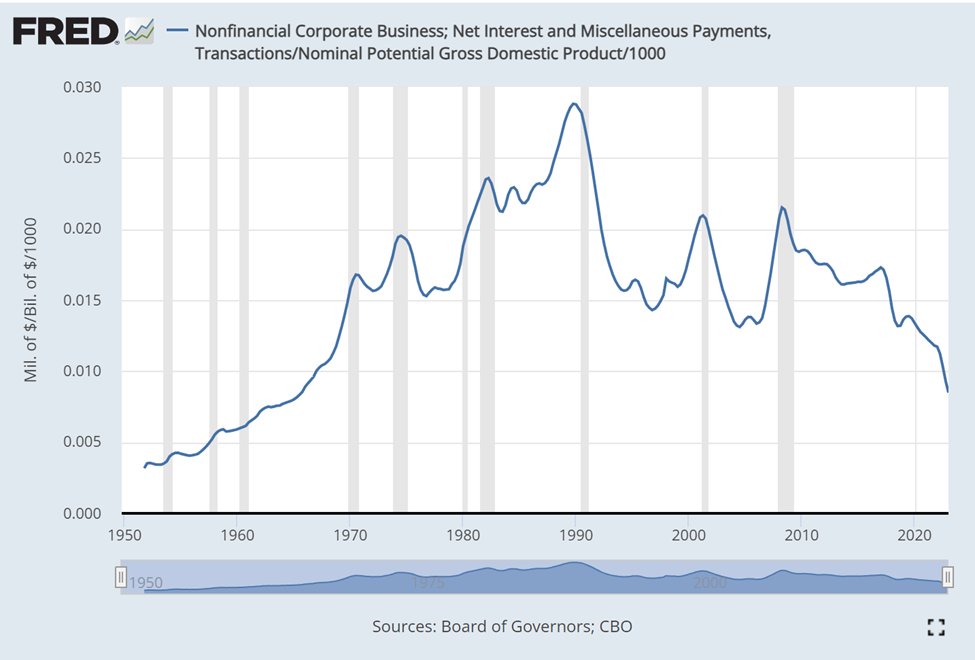

The Long-term debt cycle can be either a consistent drag or lift to economic activity that is somewhat independent of the cyclical dynamics at play.

If debts are low then HH, Biz, or the Gov can borrow more which in turn helps economic activity, or the opposite.

If debts are low then HH, Biz, or the Gov can borrow more which in turn helps economic activity, or the opposite.

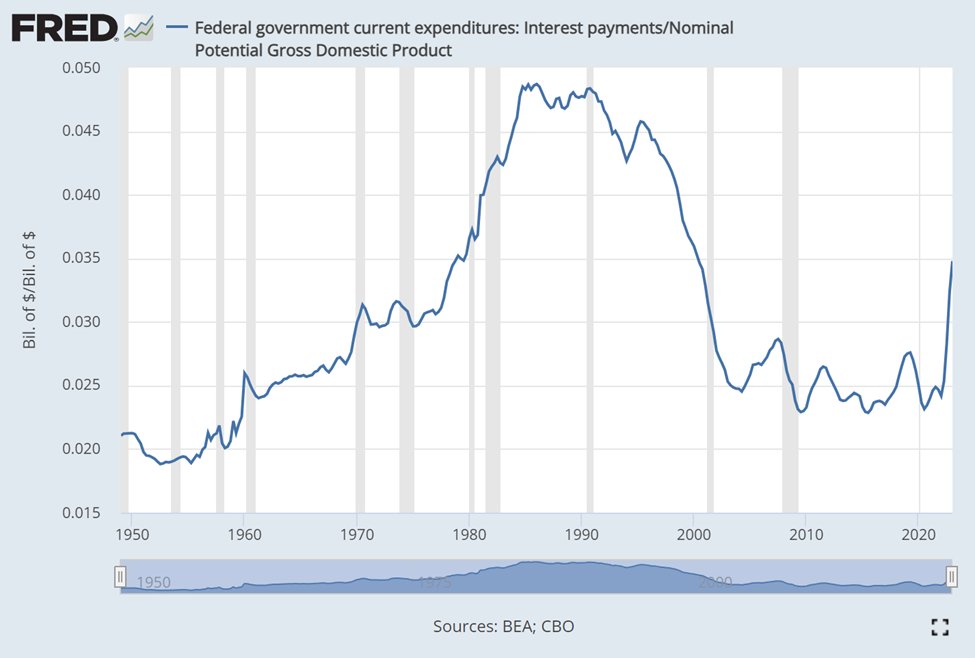

But its not just about looking at the *level* of debt. What matters is if the debt can be serviced. So it's best to look at *debt service* relative to the ability to pay.

9/ HH debt svc to income

10/ Biz debt svc relative to GDP

11/ Government interest expense to GDP

9/ HH debt svc to income

10/ Biz debt svc relative to GDP

11/ Government interest expense to GDP

Put together the long term debt picture in the US looks

- HH is a modest support

- Corp is a modest support

- Gov is a modest drag

Typically countries with this composition the long-term debt cycle wouldn't have a big impact on growth outcomes in the near term.

- HH is a modest support

- Corp is a modest support

- Gov is a modest drag

Typically countries with this composition the long-term debt cycle wouldn't have a big impact on growth outcomes in the near term.

Finally both the cyclical dynamics and the long-term debt cycle dynamics drive an economy around a central growth rate (often called “potential”). This long-term economic trend is determined by:

12/ Working age population growth

13/ Productivity growth

12/ Working age population growth

13/ Productivity growth

In the US the long-term potential growth rate is *low* at about 1-1.5%.

Working age population growth is close to zero and productivity growth has been about 1% in the post-GFC period. Much more noted here:

Working age population growth is close to zero and productivity growth has been about 1% in the post-GFC period. Much more noted here:

When we put this all together for the US economy it looks like:

- Cyclically late cycle with roughly neutral momentum to maybe slightly weaker

- Long-term debt cycle with neutral pressure on cyclical conditions

- Long-term potential growth that is low vs history

- Cyclically late cycle with roughly neutral momentum to maybe slightly weaker

- Long-term debt cycle with neutral pressure on cyclical conditions

- Long-term potential growth that is low vs history

This adds up to a US economy that would typically grow roughly at potential to a tad softer than that over the next 3-6m given these indicators.

But because of the secular dynamics that modest growth may feel slow vs previous cycles.

But because of the secular dynamics that modest growth may feel slow vs previous cycles.

Of course any economy is more complex than the 13 indicators I've listed above.

This isn't intended to reflect all the things to think about or the important idiosyncratic dynamics that exist in individual economies.

This isn't intended to reflect all the things to think about or the important idiosyncratic dynamics that exist in individual economies.

Instead think of this as the starting point. 13 indicators that can be applied to any country in any time frame to get a head start on what might play out in the future.

And from there start to ask the important questions of what else may drive the future.

And from there start to ask the important questions of what else may drive the future.

In future posts we will apply the same framework to other countries to see how they might progress.

Loading suggestions...