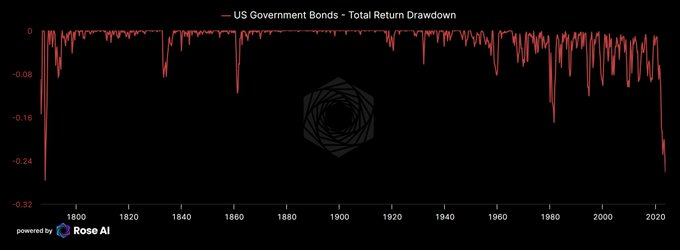

With the most recent leg down, this US bond selloff is on par with the largest ever in history.

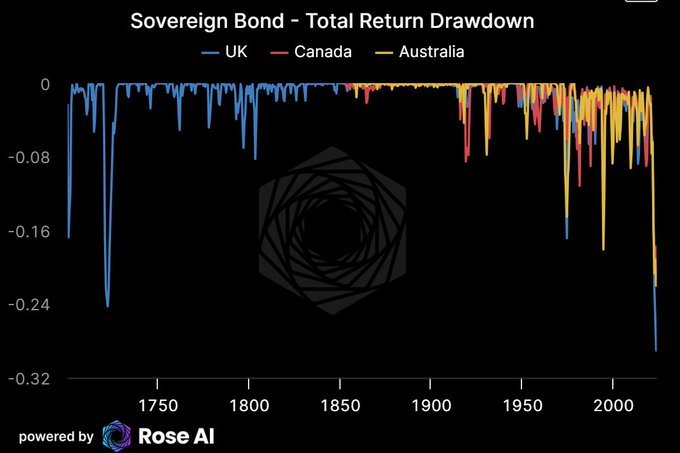

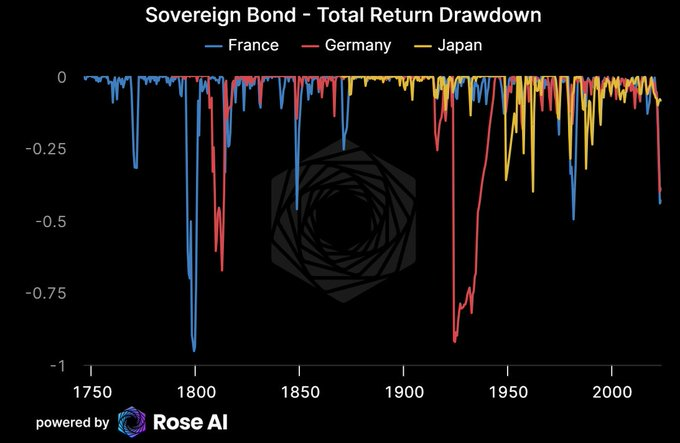

As shown next, it's also in line the largest falls for major countries that didn't lose a world war or have hyperinflation. Some perspective from my friend @abcampbell on the selloff:

As shown next, it's also in line the largest falls for major countries that didn't lose a world war or have hyperinflation. Some perspective from my friend @abcampbell on the selloff:

Some larger declines have happened in history, but have been very rare and mostly been caused by hyperinflation / domestic revolution.

And as @abcampbell reminds us, these are in local currency, so losses in purchasing power / global currency / gold terms were much larger.

And as @abcampbell reminds us, these are in local currency, so losses in purchasing power / global currency / gold terms were much larger.

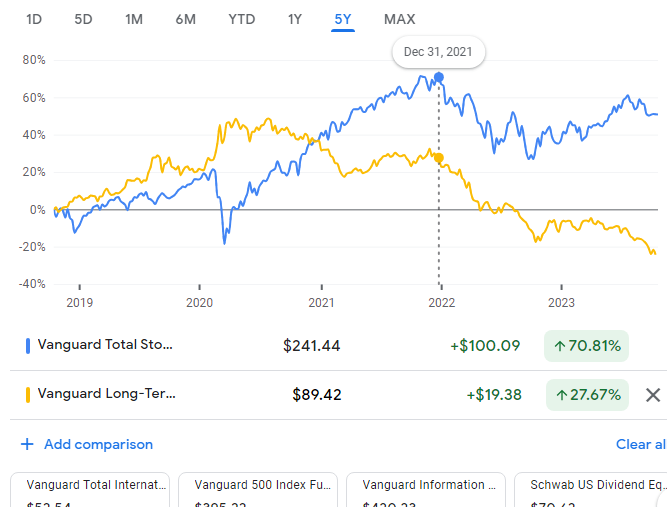

There is of course the old adage that just because an asset is cheap doesn't mean that it can't get cheaper. Those that have been around markets long enough viscerally know the truth in that perspective.

But it is worth appreciating what you are betting on for further shorts.

But it is worth appreciating what you are betting on for further shorts.

Bond declines by their nature are self correcting as higher yields limit private sector borrowing and entice yield sensitive investors.

Equity declines are the exact opposite as declines create worse economic conditions and cause buyers to demand higher risk premiums.

Equity declines are the exact opposite as declines create worse economic conditions and cause buyers to demand higher risk premiums.

So if you are in the market to short something, bonds probably aren't the most obvious choice at this point. It's stocks.

And every day that we see further yield rises, it only makes the trade more compelling from a valuation and economic momentum perspective.

And every day that we see further yield rises, it only makes the trade more compelling from a valuation and economic momentum perspective.

Loading suggestions...